Nuthawut Somsuk/Getty Images

When do Roth conversions make sense for your retirement funds?

Paying federal taxes now may be better for you in the long run, explains one financial advisor.

Updated 1:32 p.m. ET on Jan. 4

One of the most common questions high-earning federal employees have as they near retirement is how to save money on their taxes.

There are a few strategies that can be used to avoid taxes over your lifetime, but one of the most common is to carry out Roth conversions.

One important note before you read further is that Roth conversions cannot be done within the Thrift Savings Plan. To convert money in your TSP to Roth, you would first need to roll it into a Traditional IRA, which can be done at age 59.5 or after you separate from service. Money can, however, be contributed to the Roth side of the TSP, and the logic below will apply to that decision as well.

A Roth conversion is when you “convert” some or all of your Traditional (pre-tax) assets – typically in a Traditional IRA – to a Roth (after-tax) account – typically a Roth IRA.

The basic idea is that you’re choosing to pay tax now on whatever amount that you convert, in order to move that money into an account where it will grow tax-free from this point forward.

In its simplest form, the decision in favor or against a Roth Conversion can be boiled down to one question: Are you paying a lower tax rate now than you will be in retirement?

If yes, there’s a good chance that conversions make sense.

If not, a conversion likely does not make sense.

But how do you know what your tax rate will be now vs in retirement? Many people assume that their rate will be lower in the future because they won’t have their employment income. But that’s a dangerous assumption to make, especially for federal employees.

Once you add up your pension, Social Security, and distributions from your TSP (required or not), many feds end up with an income very similar to – if not higher than – what it was during their working years.

Let’s start by listing a few generalizations, specific to federal employees.

Many feds in the FERS retirement system fit into the following scenario:

- Their income is higher during their working years than in retirement (but maybe not by much)

- In retirement, they have multiple streams of guaranteed income – FERS pension & Social Security (and maybe a military pension or disability payments as well)

- On top of their guaranteed income, they have distributions from the Traditional side of the TSP, which are taxable as regular income.

- Typically between the FERS pension and Social Security, most of their spending needs are met, so…

- When Required Minimum Distributions start (age 73 or 75 depending on when you were born), and they’re required to take money from the TSP, their taxable income increases to a level that’s higher than what they actually require for living expenses.

- This extra income may push them into a higher tax bracket and they get upset that they’re required to pay taxes on money they don’t actually need.

Does that sound like an accurate representation of your financial picture? If so, you may be a good candidate for Roth conversions.

Consideration 1: Current Tax Environment vs Future

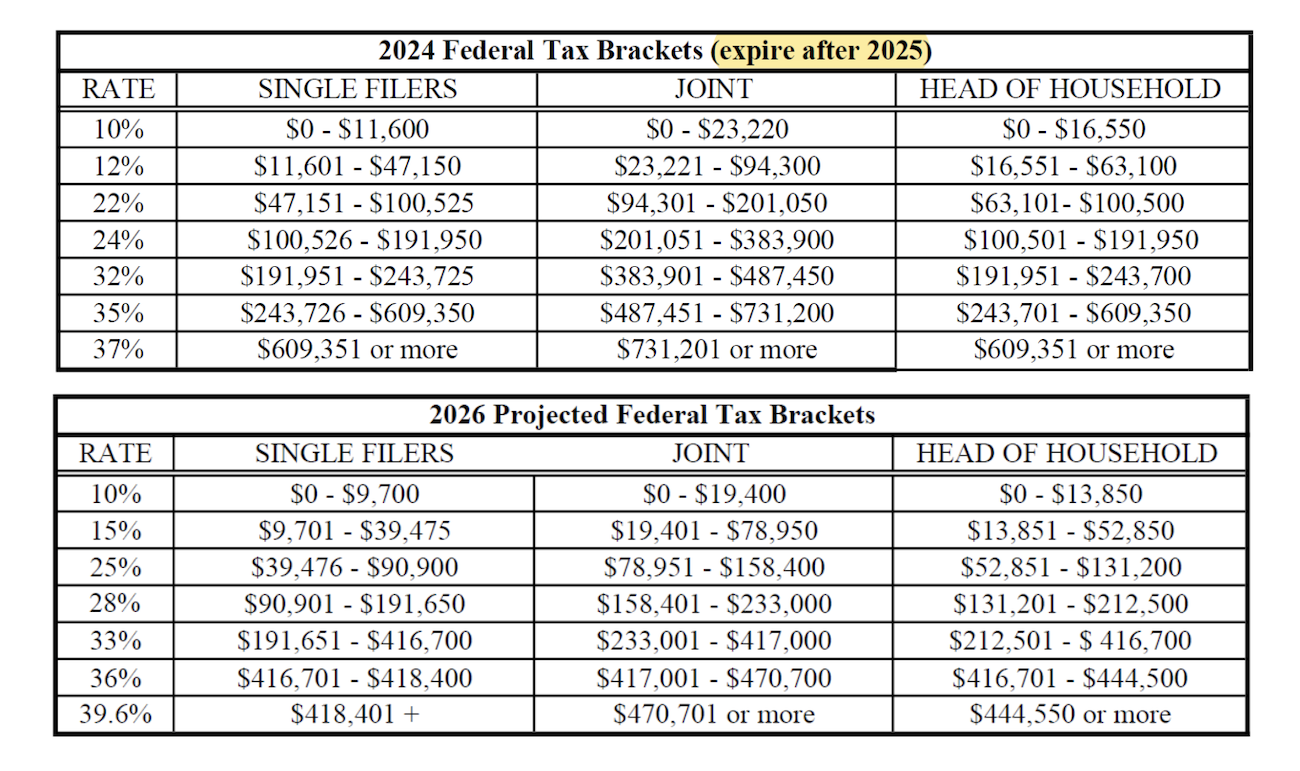

Right now our tax tables are defined by the Tax Cuts and Jobs Act which passed in 2018. This act effectively lowered each tax bracket from where they were previously. However, the thing that many people don’t know is that the Act has an expiration date.

Unless Congress is able to pass a law upholding the TCJA, or passes a new tax code completely, the Act will sunset after 2025. This means that if nothing happens (a likely scenario) our tax rates will go up in 2026.

Here’s what that looks like:

As you can see, the rates in 2026 are in some cases substantially higher than current rates.

For example, if you’re a couple who makes $250k combined right now, your marginal tax rate could jump from 24% to 33%. That’s a big difference.

So how does that impact your decision on whether or not to do a Roth Conversion?

Well, let’s come back to that first question: “Will my tax rate be higher or lower in retirement?”

Let’s say you’re a married couple that brings in $200k combined taxable income. Right now, your marginal tax bracket is 24% and the top of that bracket is $383,900.

If you chose to do a Roth Conversion you would pay 24% federal income tax as long as you kept your total taxable income under $383,900. Since converting to Roth adds to your taxable income, that means you could convert a maximum of $183,900 (the difference between your $200k current taxable income and the top of the 24% bracket).

But why would you CHOOSE to pay 24% federal tax now when you don’t have to?

Well, even if your income dropped to $100k in retirement, look at where that puts you in the 2026+ tax table: 25% federal taxes.

So even though your retirement income is HALF of what it is now, your tax rate will likely still be HIGHER down the road.

Converting, and paying 24% now allows you to avoid paying 25%+ when you withdraw the money in retirement.

Consideration 2: Required Minimum Distributions

OK, so in the example above, the person was able to save 1% on their tax rate. That’s great, but maybe not good enough to convince you that a conversion is worth it.

conversions get much more beneficial for people who have large Traditional TSP balances and relatively low spending.

Here’s an example to demonstrate why:

Let’s say there’s a single filer with an employment income of $100k. This puts them in the 24% bracket.

When they retire from their 30-year federal career, they have a $30k/year FERS pension and $3k/month ($36,000/year) Social Security payments. This gives them an annual guaranteed income of $66,000. This would be the 25% bracket in 2026+.

This person lives a fairly frugal lifestyle so that $66k covers most of their living expenses, and they don’t need to make regular withdrawals from the TSP.

Because this person is frugal, they’ve been a great saver for their whole career, and when they retire they have a $1 million Traditional TSP balance. Since they’re not using it for their living expenses, by the time they turn 75 (Required Minimum Distribution age), they have $1.5 million in the TSP.

For your first RMD, you’re required to take 3.65% from your Traditional TSP. 3.65% of $1.5 million is $54,750.

Now, with almost $55k in additional income that they don’t need, this person has a total income of $121k, putting them in the 28% bracket. Not to mention, the RMD rate goes up each year.

If this person would have taken the opportunity to convert some of their Traditional assets while they were paying a 24% rate, they would have lowered the amount of RMDs that they had to take, and saved themselves from paying tax at 28%.

Conclusion

These are just two examples of how a federal employee’s tax rate can be higher in retirement than it is now. In both of these scenarios, Roth conversions likely could have saved them money on their taxes.

In order to decide if conversions make sense for you, use the examples that we included above and plug in your own numbers.

Map out your income from now through retirement and determine if there are any years where you’ll be paying a lower tax rate. Oftentimes there’s a lower income period between the year someone retires and the year they start social security. These are great years for Roth conversions.

Austin Costello is a certified financial planner with Capital Financial Planners. If you’d like help deciding if/when you should be doing Roth conversions, you can register for a complimentary check up.