While the average enrollee share of premium is increasing 7.7%, not all plans reflect this trend. Foremniakowski/Getty Images

A closer look at 2024 Federal Employee Health Benefits premiums

Wondering how the increase might impact your FEHB plan choice? We’ll walk you through it.

Last week, OPM released the first batch of information for the 2024 Federal Employee Health Benefits Open Season. Federal employees and annuitants will, on average, pay 7.7% more in FEHB premiums next year. OPM cites increased cost and use of prescription drugs, emergency room care, and outpatient care as the primary reasons for the increase in premiums.

How will higher premiums impact your FEHB plan choice for the upcoming open season? We’ll walk you through changes in popular plans, discuss which ones saw their premiums increase above and below the average, provide enrollment advice for two-person families, and discuss FEDVIP dental and vision plan premium changes.

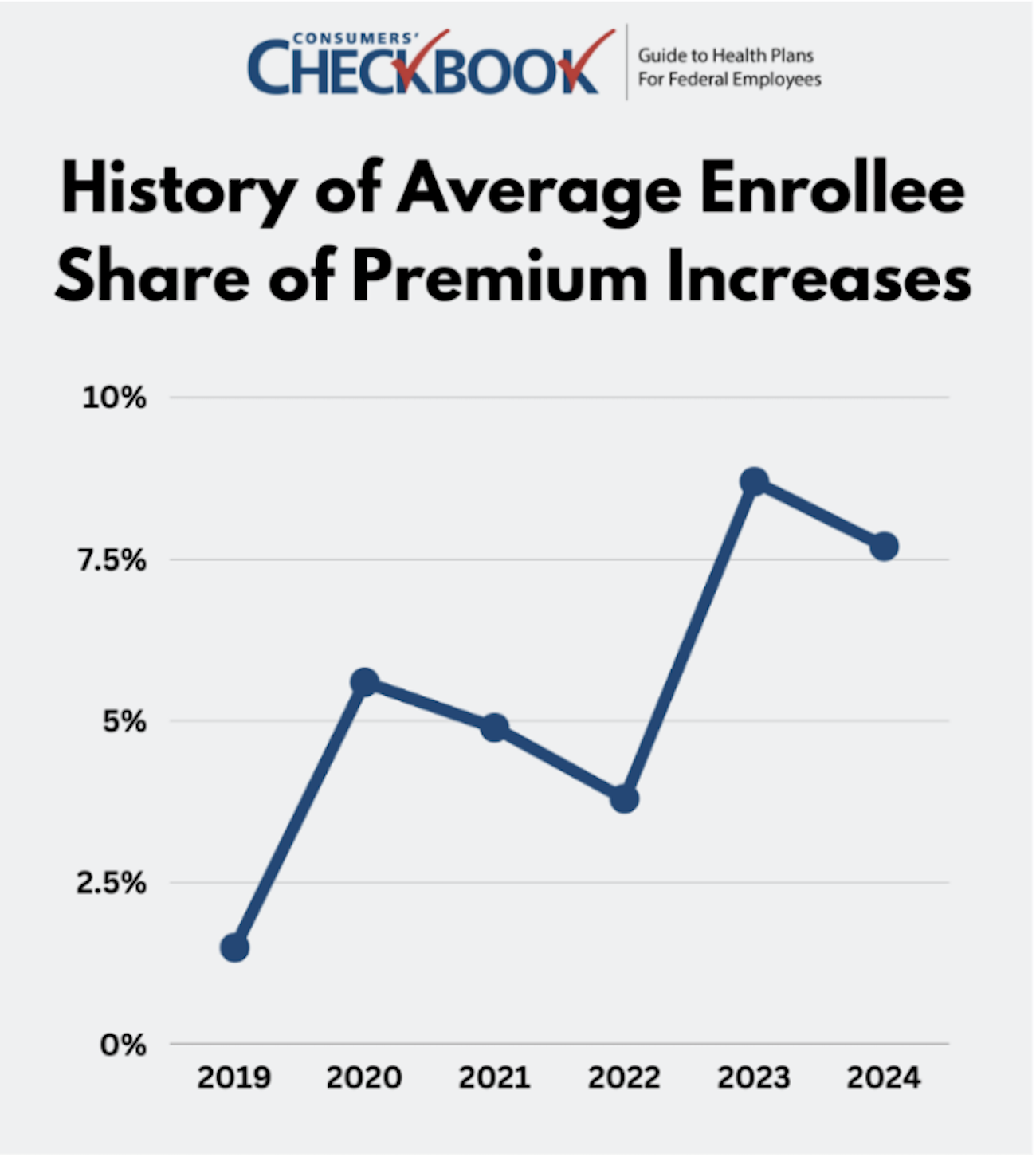

Recent History of FEHB Premium Increases

Next years 7.7% premium increase is less than the 8.7% increase of 2023, but it’s still much higher than previous years. In 2022, the average enrollee increase was only 3.8%. While no one can predict the future, federal employees and annuitants should prepare to pay higher premiums and a higher rate of increase going forward.

How Premiums are Changing in 2024

While the average enrollee share of premium is going up 7.7%, not all plans reflect that trend. For the 156 FEHB plans available in 2023 and 2024, premiums will decrease in 28 plans, stay the same in 15 plans, increase below the 7.7% average in 64 plans, and increase above the 7.7% average in 49 plans.

Some of the changes are striking. For example, the largest decrease in enrollee share of premium is from the Baylor Scott & White Standard Health Plan (A8), available in Central Texas, which costs 54% less in 2024, saving self-only enrollees around $1,500 next year. Aetna Advantage, a national PPO plan, has the same premium in 2024 as 2023. The largest increase in enrollee share of premium is from Kaiser Permanente High (F8) in the Atlanta region, which is 22% more in 2024 and will cost self-only enrollees around $1,100 more next year.

How is your plan’s premium changing next year? Even if you’re happy with your existing FEHB plan, it will most likely be more expensive in 2024. Not all premiums rose at the same rate, and there may be new plan bargains available to you, which is why it’s important to know how this for-sure expense will impact your budget in 2024.

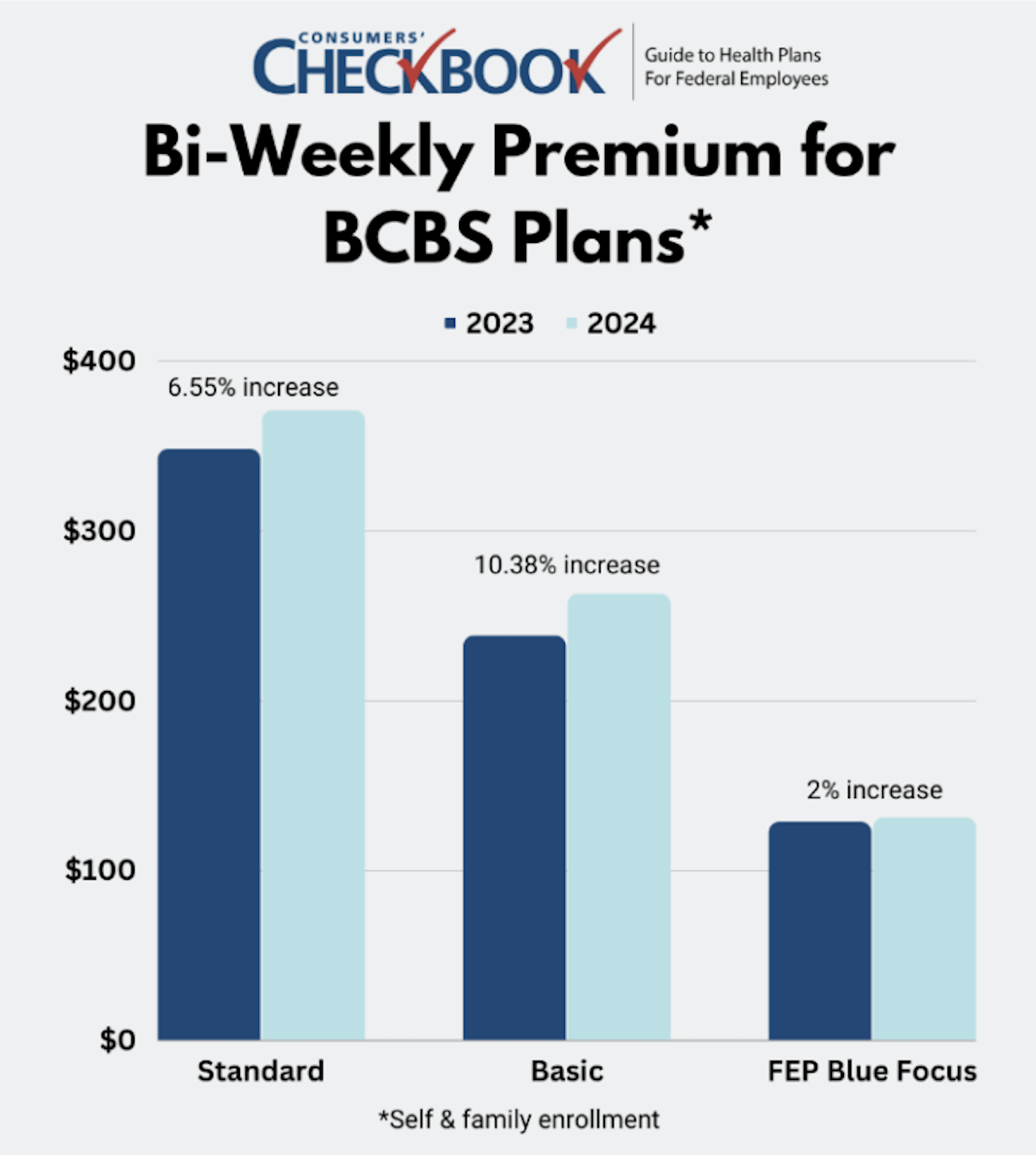

Blue Cross Blue Shield

Almost two-thirds of federal employees are enrolled in one of the Blue Cross Blue Shield plans—Standard, Basic, or FEP Blue Focus. How did the BCBS plan premiums change?

Basic increased above the all-plan average, Standard increased just below the average, and FEP Blue Focus increased well below the average.

This upcoming Open Season is a good opportunity to assess whether your current plan is still the best fit for your needs. For Basic and Standard plan members, are you enrolled in the right BCBS plan? Now might be the opportunity for you to save one or two thousand dollars a year in premium by switching to FEP Blue Focus.

Of course, there are many differences between the Standard, Basic, and FEP Blue Focus plans, but three of the most important are Standard is the only one where:

- You can see out-of-network providers,

- Receive mail-order prescription drugs (Basic has mail-order prescription drug coverage only for annuitants with Part B),

- And receive fertility coverage, including assisted reproductive technology (ART) coverage up to $25,000 annually (a new benefit for 2024).

If you’re enrolled in Standard and don’t use those benefits, you’ll save money switching to Basic or FEP Blue Focus and you’ll get to keep your existing BCBS in-network providers.

Self-Plus-One vs Self & Family Enrollment

Married couples and two-person families can enroll as self-plus-one or self-and-family. Most of the time, self-plus-one is the cheaper enrollment choice, but not always. In 2024, there are 49 FEHB plans where self-&-family enrollment is less expensive than self-plus-one, and 11 plans where the premiums are the same.

There is a sizable amount of money at stake that you could save, or waste, based on your enrollment decision. For example, a two-person family considering the D.C.-area Kaiser High (E3) plan can save $59.68 bi-weekly enrolling as self-&-family compared to self-plus-one. That adds up to $1,552 annually.

You can find premiums by enrollment type on the last page of any FEHB brochure (found on the OPM plan comparison tool and Checkbook’s Guide to Health Plans) once they are released in November, just before the start of Open Season. Look for the enrollee share of premium and choose the enrollment option that is cheaper. You receive the same plan benefits regardless of enrollment type.

FEDVIP Premiums

FEDVIP premiums have historically increased at a much lower rate compared to FEHB plans. For 2024, FEDVIP dental plan premiums will increase 1.4% on average and FEDVIP vision plan premiums will increase by 1.1%.

The Final Word

Your FEHB premium will most likely go up in 2024, and possibly by quite a bit. The 7.7% increase is only an average, and many plans will cost more. While only one factor in your overall plan selection decision, the premium is important because it’s a for-sure expense. You absolutely must check to see how yours is changing for 2024 and consider whether another plan is a better value for you and your family. The 2024 FEHB Open Season starts Nov. 13 and ends Dec. 11.

Kevin Moss is a senior editor with Consumers’ Checkbook. Checkbook’s 2024 Guide to Health Plans for Federal Employees will be available on the first day of Open Season, Nov.13. Check here to see if your agency provides free access. The Guide is also available for purchase and Government Executive readers can save 20% by entering promo code GOVEXEC at checkout.