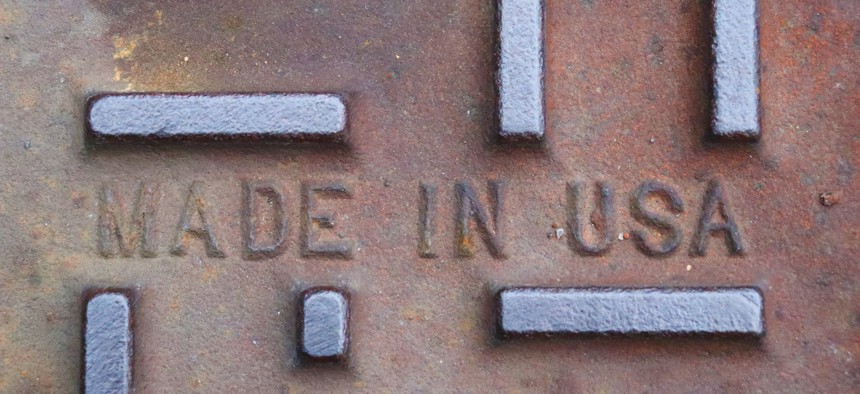

Shutterstock.com

How Biden’s ‘Made in America’ Executive Order Could Impact Federal Contractors

Among other things, the EO creates a new White House office to review waiver requests.

The full impact of President Biden’s “Made in America” executive order compelling federal contractors and agencies to purchase more U.S.-manufactured products won’t be clear for some time, according to experts.

Five days after taking office, Biden issued an executive order on January 25 to push federal agencies to buy more products made in the United States. It builds on current laws—the Buy American and Buy America statutes, passed in 1933 and 1982, respectively. The federal government spends about $600 billion annually in contracting and current laws giving preference to American companies are not always followed and haven’t been “substantially updated since 1954,” said a fact-sheet from the White House.

“The [executive order] directs the [Federal Acquisition Regulatory Council] to consider proposing rules to tighten up the [Buy American Acts] requirements,” so “there are no immediate changes,” said Adelicia Cliffe, partner at the law firm Crowell and Moring, who is part of the firm’s government contracts and international trade group. This is because any new rules will have to go through the formal rulemaking process.

Specifically, the executive order said that within 180 days, the FAR Council should consider: replacing the “component test” (which says that over 50% of a product’s cost must have a domestic origin), increasing the numerical threshold for domestic content requirements for construction materials and end products, and increasing the price preferences for domestic construction materials and end products.

“At this point it’s very hard for contractors to predict and make any supply chain adjustments because we just don’t know what this test is going to look like,” said Clifee.

Alan Chvotkin, partner at Nichols Liu, LLP, a government contracts law firm, who was previously executive vice president and counsel at the Professional Services Council, told Government Executive, “in many respects, the Trump administration had already laid significant groundwork for a lot of the activities” due to a similar final rule issued on January 19, the day before Inauguration Day, which implemented a July 2019 executive order issued by then-President Trump.

That final rule increased the domestic content threshold from 50% to more than 55% for most products (this is higher for products mainly made of iron and steel) and the price preference from 6% to 20% for large businesses, and from 12% to 30% for small businesses, excluding Defense Department procurements. Biden’s order said that the July executive order is “superseded to the extent [it’s] inconsistent” with the July 2019 executive order.

The final rule issued by the Trump administration was published the day before Inauguration Day and was set to take effect on January 21, which would make it subject to the Biden administration’s regulatory freeze issued on January 20. However, the FAR Council issued a correction to Biden’s executive order, which was posted in the Federal Register on February 5, saying the rule actually took effect on January 19. There are various interpretations as to whether or not the rule is still subject to the freeze.

The White House Office of Management and Budget and FAR Council did not respond to a request for comment on the situation.

Regardless, the final rule does several of the things the executive order asks the FAR Counsel to consider, so it is yet to be seen what the actual numerical changes will be.

The order also asks the FAR council to review long-standing exceptions to commercial information technology “from application of the Buy America Act,” said Chvotkin. “The information technology community ought to be paying close attention to how the FAR Council develops its recommendations and rulemaking around that area.”

Kelly Kroll, partner at the law firm Morris, Manning & Martin LLP who specializes in government procurement, noted a caveat to the executive order is that it only applies to contracts under the 1933 Buy American Act, which “does not apply to a lot of things because of the Trade Agreements Act,” that is a “waiver itself of the BAA and applies to procurements over $180,000 for commodities and over [about] $6 million for construction.”

An aspect of the order that could have a “fairly immediate impact,” according to Cliffe, is the creation of the Made in America office within OMB to review waivers to purchase goods from outside the United States. The order mandates a list of actions within 45 days of the appointment of the office’s director.

The office could lead to “significant ramifications with respect to the impact on government contractors to the extent that there will be fewer waivers in the future,” said Robert Burton, partner with Crowell & Moring and former deputy administrator and acting administrator of the Office of Federal Procurement Policy. “I think that’s where we’re headed.”

Lastly, the order directs the General Services Administration to create a public website for proposed waivers and justifications to be publically available. Requests for waivers will now be subject to “public scrutiny and you would expect competitors to be weighing in and commenting and resisting the issuance of waivers under certain circumstances,” Cliffe stated.

She also noted that the fact sheet accompanying the executive order “suggests that we need to be thinking about the interplay between changes to domestic preferences, along with environmental requirements in the procurement regulations, supply chain security restrictions, diversity, affirmative action requirements … as contractors think about their sourcing strategy.”

Biden has also issued executive orders on using federal procurement to advance racial equity and support for underserved communities, tackle the climate crisis and to order a review of the U.S. supply chain.

Update: This article has been updated to clarify how the January 19 final rule impacts iron and steel end products as well as the price preferences it impacts.