Why It Pays to Keep Your Own Records

A cautionary tale about documenting your service, and doing some pre-retirement tax planning.

I recently received the following email from “Maria”:

As a fairly recent retiree, I wanted to alert you to an issue I had with the Office of Personnel Management when finalizing my annuity.

Many years ago a wise mentor of mine told me to save the last leave and earnings statement from every agency I worked for as proof of my retirement contributions should there be an error. I had followed this advice and saved this information, so I checked my total retirement contributions against the amount that OPM computed (retirees are provided with this information after the Civil Service Retirement System or Federal Employees Retirement System claim is finalized). I noticed there was a discrepancy in my retirement contributions. As you know, this information is used to determine the tax-free portion of my retirement benefit. (It is also used to determine the maximum contribution that CSRS and CSRS Offset employees may contribute to a Voluntary Contributions account). Fortunately for me, it was the agency prior to the one I retired from that was the root of the error and I was able to get it corrected by contacting that payroll provider. (I also involved my congressional representative.) Total time to make this correction: 18 months!

The total discrepancy was $327 so there was not much of a tax implication, thankfully. It could have been far worse. The taxable portion of my annuity was reduced $10.92 in tax year 2015. (In 2014 it was even less, as it was for a nine-month period – $7.28.)

My other surprise was the state tax liability – not only was it over $3,000, but I got hit with a $185 penalty for under-paying my state income tax. Had someone mentioned it, I could have filed estimated taxes. Unfortunately for me, I found that out too late. Hopefully this will help out someone else down the road as they retire.

There are a few lessons to be learned from Maria’s experience:

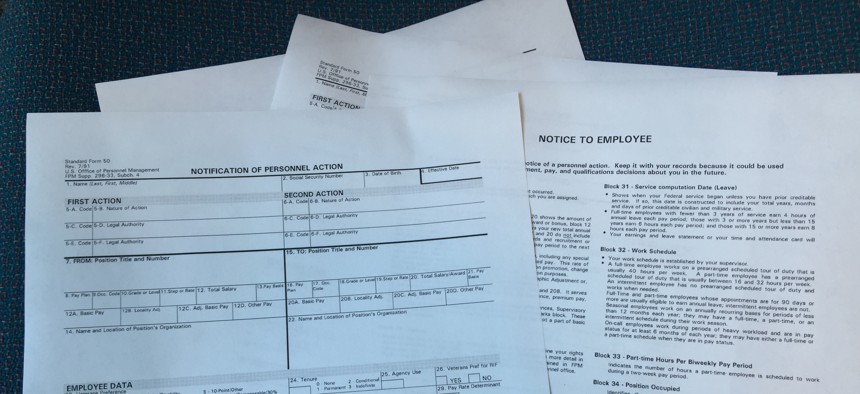

Keep copies of your records. These include the last pay statement from each agency you’ve worked for; SF-50’s (Notification of Personnel Action Statements) documenting your retirement coverage, beginning and ending dates of federal service, salary changes during your high-three average salary period and work schedule; insurance documentation showing level of coverage and required five years of coverage under the Federal Employees Health Benefits Program and Federal Employees Group Life Insurance, coverage and enrollment in long-term care insurance, and coverage under dental and vision insurance; beneficiary designation forms (CSRS, FERS, FEGLI, Thrift Savings Plan and unpaid compensation); records of deposits or redeposits for civilian or military service credit; divorce decrees; marriage certificates; and your completed retirement application.

Understand what you are entitled to. At the very least, you should know how much creditable service you have, the salary rates used for your high-three, how much life insurance coverage you have at the start of your retirement and how much you will maintain afterwards; your survivor benefit election and the value it has to your surviving spouse (or insurable interest) and any entitlement your former spouse may have to survivor benefits or your retirement benefit. For tax planning, it is also important to know how much money you have contributed to the retirement fund. This information is shown on your leave and earnings statements. If you change agencies or payroll offices, the amount of your contributions are forwarded to OPM and the new payroll office starts at zero dollars, which is why Maria was advised to keep her last statement from each appointment.

Do some tax planning when you are getting ready to retire. This includes computing the amount ot tax withholding from your CSRS or FERS retirement as well as Social Security retirement and TSP withdrawals. You must make choices about withholding from these benefits. (There are some required tax withholdings from payments taken from the TSP.) Remember, OPM will not withhold state income tax from your interim retirement payments while your retirement claim is being finalized. This can last for several months or more, depending on OPM’s work load and the complexity of your retirement claim.

Although the error involving Maria’s contributions was small, it illustrates the importance of keeping track of your retirement records and understanding the importance of retirement tax planning. Next week, we’ll look at that in a little more depth.