Mixing Civilian and Military Retirement

A guide to calculating the financial impact of combining civilian and military retirement benefits versus leaving them separate.

What comes after a career in the military services? Sometimes, a second career in the civilian service is the next logical step. But as the second career nears completion, an important decision needs to be made between two retirement options:

- 1. Combine military and civilian careers into one civilian retirement and forfeit military retirement. This decision also requires making a military service credit deposit of 3 percent of military base pay (Federal Employees Retirement System) or 7 percent of military base pay (Civil Service Retirement System) plus interest, as described in my Feb. 24 column on military service credit deposits.

- 2. Retire from CSRS or FERS using only civilian federal service and continue receiving a separate military retirement benefit.

The decision depends on the financial impact of keeping the careers separate or combining them. A decision to use military service toward a civilian retirement would not affect Social Security retirement benefits. The decision to combine careers into one retirement also would not alter other military retirement perks such as health care and commissary privileges.

Generally, an employee must waive military retired pay in order to receive credit for military service in the computation of the CSRS or FERS annuity, unless he or she is:

- 1. Retired from civilian service after Sept. 30, 1982, and has military service that was not used in the computation of military retired pay -- for example, four years at one of the service academies such as West Point or the Naval Academy in Annapolis.

- 2. Receiving military retired pay awarded:

- On account of a service-connected disability incurred in combat with an enemy of the United States;

- On account of a service-connected disability caused by an instrumentality of war and incurred in the line of duty during a period of war; or

- Under provisions of 10 U.S.C. 12731-12739 (retired pay under Chapter 1223 for members of the reserves).

Sample Decision Processes

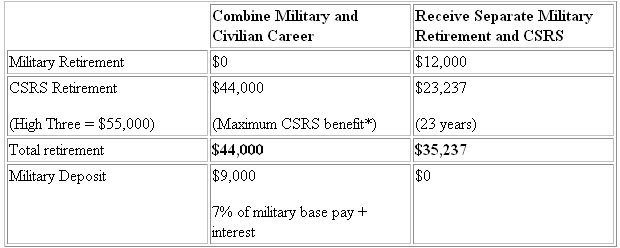

Steve: Steve completed 20 years of military service in 1973 and is receiving a military retirement benefit of $12,000 per year. He has been employed as a civilian employee with the Defense Department since his military retirement and now has 23 years of civilian service. He is covered by CSRS.

* By combining his careers, Steve has 43 years of service. CSRS provides a maximum benefit after 41 years and 11 months of 80 percent of the high-three. Steve will be entitled to a refund of excess retirement contributions of $4,200 since retirement contributions continue to be withheld until he retires, even though his last year of service is not being used to compute his retirement benefit.

Things to consider :

- By combining military and civilian careers, Steve's retirement payments will increase by $8,763 per year.

- Steve must pay a $9,000 deposit in order to combine his careers, but this will be offset to $4,800 since he will also be entitled to a refund of excess CSRS contributions. He will recover this investment within less than one year of receiving the higher retirement.

- Cost of living adjustments are the same for CSRS and military retirement benefits.

- Spousal survivor benefits are computed at 55 percent of the retirement under both CSRS and military retirement.

- Steve will continue to receive his military retirement until he begins receiving his combined military and civilian career retirement. He doesn't need to apply to waive his military retirement until shortly before his civilian retirement begins.

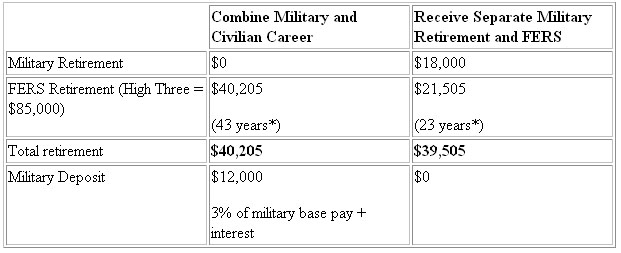

Stan: Stan completed 20 years of military service in 1985 and is receiving a military retirement benefit of $18,000 per year. He has been employed as a civilian employee with the Defense Department since his military retirement and will have 23 years of civilian service by the time he retires in 2008. He is covered by FERS.

*Stan will be 62 years old by the time he retires. His FERS benefit will be computed at 1.1 percent of his high-three for his years and months of service. FERS provides this computation for employees who retire at age 62 or later and who have at least 20 years of creditable service.

Things to consider :

- By combining military and civilian careers, Stan's retirement will increase by $700 per year.

- Cost of living adjustments are about 1 percent less under FERS.

- Spousal survivor benefits are computed at 55 percent of the retirement under military retirement but at only 50 percent of the FERS retirement benefit.

- If part of Stan's military retirement is coming from the Veterans Administration due to a service-connected disability, he would not have to waive that benefit. This could swing the decision toward combining the careers after considering the differences in COLA, survivor benefits and military deposit.

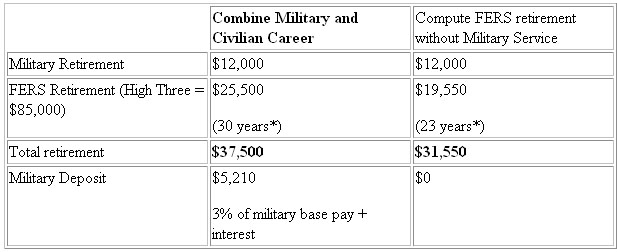

Sarah: Sarah completed 20 years of military service in 1985 as a member of the Naval Reserves. She has been employed as a civilian employee with the Defense Department since 1985 and will have 23 years of civilian service by the time she retires in 2008. She is covered by FERS.

*Sarah will not need to waive her retirement from the Reserves (see the exception above). She will receive credit for 7 years of active duty performed while serving as a member of the Naval Reserves.

Things to consider :

- By paying the military service deposit, Sarah has 30 years of service credit that will be used to compute her FERS retirement benefit.

- Sarah doesn't have to waive her retirement and she has increased her FERS retirement benefit by $5,950 (7 percent of $85,000) by completing the military service credit deposit for her seven years of active service.

- Sarah will recover a return on her $5,210 military deposit within less than a year of retiring under FERS.

To Do

- Human Resources, Retirement Benefits Office: Request two retirement benefit estimates. The first will show your retirement without using your military service credit. The second estimate will show your retirement with a combined civilian and military service credit.

- Military Finance Center: Request an estimate of your base pay during military service.

- Human Resources, Retirement Benefits Office: Request a computation of your military service credit deposit. You will need this information to evaluate the cost of combining your military and civilian careers.

- At home: Consider the difference in your retirement income by reviewing your military retirement and civilian retirement benefit options.

Resources

- Military Service Credit Under the Civil Service Retirement System

- Chapter 22, CSRS and FERS Handbook, Creditable Military Service

- CSRS and FERS Handbook , Service Credit Payments for Post-1956 Military Service

- Form RI 20-97 , Estimated Earning During Military Service

Tammy Flanagan is the senior benefits director for the National Institute of Transition Planning Inc. , which conducts federal retirement planning workshops and seminars. She has spent 25 years helping federal employees take charge of their retirement by understanding their benefits.

NEXT STORY: Reverse Pay Parity