The Inflation Reduction Act of 2022 contained major Part D reforms, and some have already been adopted. designer491/Getty Images

What federal annuitants need to know about Medicare Part D for 2024

This upcoming Open Season will be one of the most important in recent years for annuitants to evaluate their existing plan against those that offer Part D coverage.

Federal annuitants will have higher healthcare costs in 2024. The enrollee share for Federal Employees Health Benefits Program premiums is rising 7.7%, and the standard Medicare Part B premium is increasing 5.9%, or $9.80, to $174.70/month.

Medicare Part D reforms that passed in 2022 are being implemented and offer annuitants an opportunity to save money next year in two ways—lower out-of-pocket prescription drug costs and protection against high out-of-pocket prescription drug costs.

We’ll discuss Part D reform and the two plan options available to annuitants next year—Part D Prescription Drug Plans and FEHB Medicare Advantage Plans.

Part D Reform

The Inflation Reduction Act of 2022 contained major Part D reforms, and some have already been adopted. This year, Part D plans began offering insulin at no more than $35/month. In 2024, there will no longer be any enrollee cost share over the catastrophic coverage limit, and Part D premiums are not allowed to increase more than 6% per year. In 2025, Part D plans will have a $2,000 out-of-pocket spending cap.

Earlier this year, the Office of Personnel Management encouraged FEHB plans to offer more Part D options so that federal annuitants could benefit from improved prescription drug coverage. In a letter to FEHB carriers, OPM offered two ways for FEHB plans to provide Part D coverage—Part D Prescription Drug Plans, which had never been offered to annuitants before, and FEHB Medicare Advantage Plans, which have been available over the last few years.

New Part D Prescription Drug Plans

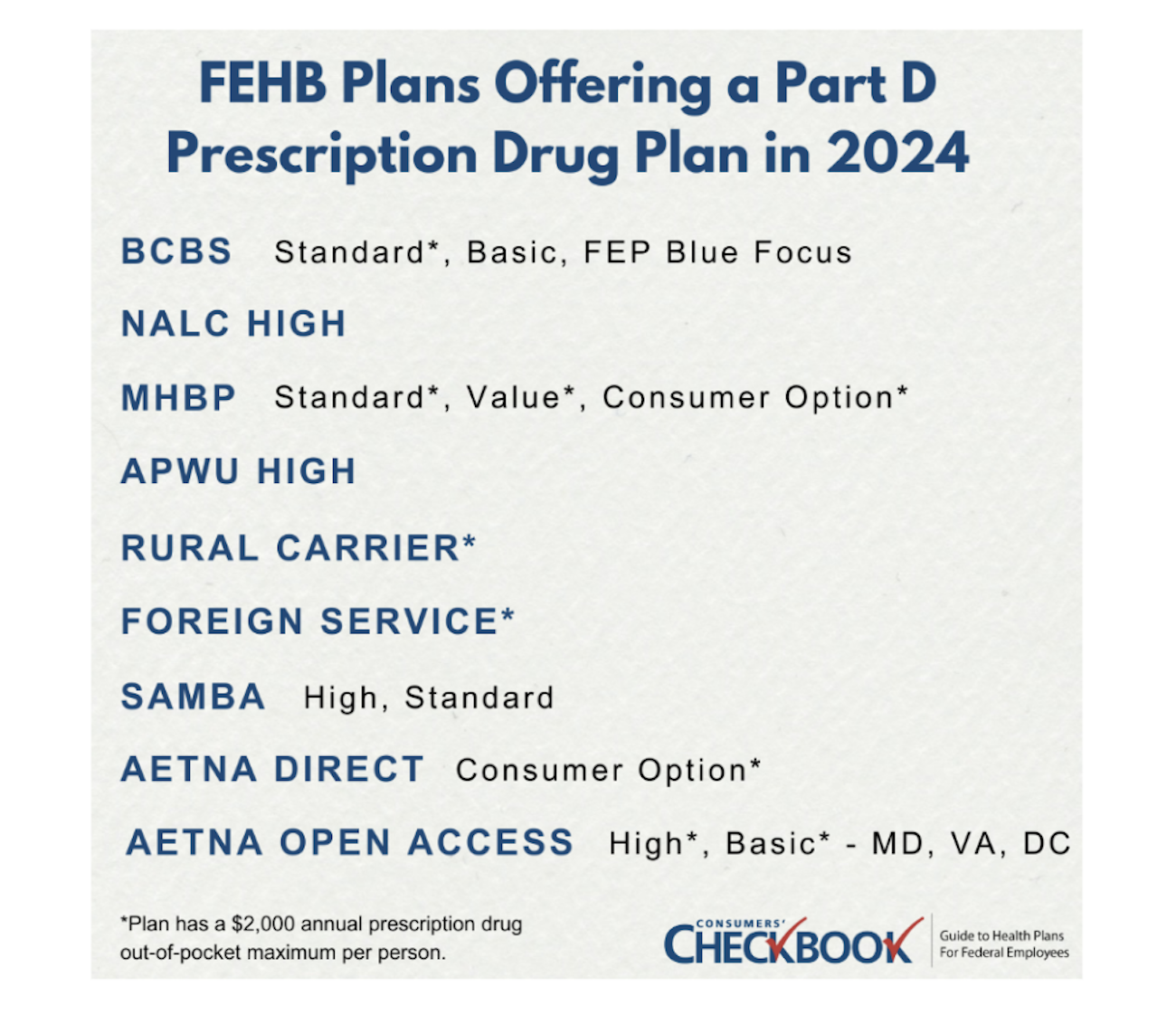

The following 17 FEHB plans will offer a Part D Prescription Drug Plan next year, with no additional premium:

To receive OPM approval, the PDP must provide as good or better prescription drug benefits than the FEHB plan, at no additional cost. After our review of the 2024 PDP benefits, we concur with OPM’s assessment. The PDP benefits are as advertised and are at least as good as the FEHB prescription benefits, in some cases with even lower out-of-pocket prescription drug costs. This is especially true for the PDPs, marked above, that provide the $2,000 prescription drug maximum out-of-pocket, a year earlier than what is required by law. Annuitants with moderate to high prescription drug costs will benefit greatly from enrolling in one of those plans next year.

If you are a member of an FEHB plan offering a PDP and are enrolled in either Medicare Part A or Medicare Parts A & B, you’ll be auto-enrolled in the PDP plan for prescription drug coverage. BCBS plans are the exception to the rule; they will only auto-enroll when you have both Parts A & B. Your plan will send you written notification of the auto-enrollment, and you’ll have 30 days to opt out of the PDP. After the 30 days, you’ll receive a new prescription drug insurance card, and your Part D coverage will begin 1/1/2024.

If you aren’t in one of the 17 FEHB plans that offer a PDP and are interested in enrolling, you can visit the website of a plan offering a PDP to find enrollment instructions. Most plans will have an online and telephone enrollment option.

Annuitants filing individually with income above $103,000, or filing jointly with income above $206,000, will be subject to an Income Related Monthly Adjustment Amount with Part D enrollment. Keep in mind that Part D IRMAA is far less than Part B IRMAA: The first income tier is $12.90/month per person compared to Part B IRMAA which is $69.90/per month per person. With lower out-of-pocket prescription drug costs and catastrophic protections in some plans, the PDP benefits will outweigh IRMAA for many annuitants.

If you decide to opt out of PDP coverage because of IRMAA or any other reason, you can enroll into a PDP in the future, without penalty, as FEHB prescription drug is considered creditable coverage by OPM.

Make sure to check that any existing prescription drugs will remain covered in the PDP. This drug formulary is managed by CMS, not OPM, and there could be differences in how they’re classified in the PDP compared to the FEHB plan. The official FEHB plan brochure of the 17 plans offering a PDP will discuss coverage either in Section 9 or Section 5(f). Most of the plan websites have additional information including a formulary lookup and pharmacy pricing tool.

FEHB Medicare Advantage Plans

MA plans, or Medicare Part C, package original Medicare with a Part D plan. These plans have been around for the last few years, and there are even more MA plans available to annuitants next year.

National plans offering an MA plan: GEHA High & Standard (new for 2024), NALC High, MHBP Standard, APWU High, Rural Carrier, Foreign Service, SAMBA High & Standard, Compass Rose High, and Aetna Advantage.

Local plans offering an MA plan: United Healthcare, Kaiser, MDIPA, CDPHP, Health Alliance HMO (new for 2024), Healthnet of California, and UPMC Standard.

Many of the MA plans offer a Part B premium reimbursement ranging between $75 to $150 per month. However, there are some Kaiser plans that will reimburse up to $250/month for individuals that pay a higher Part B premium because of IRMAA or a late enrollment penalty.

Also, many, but not all, of the MA plans have $0 out-of-pocket costs for approved healthcare services from providers that accept Medicare and the plan, besides prescription drugs. You can also find special benefits from some of the MA plans such as a gym membership through Silver Sneakers, hearing aid coverage, dental care, and a quarterly over-the-counter pharmacy item allowance.

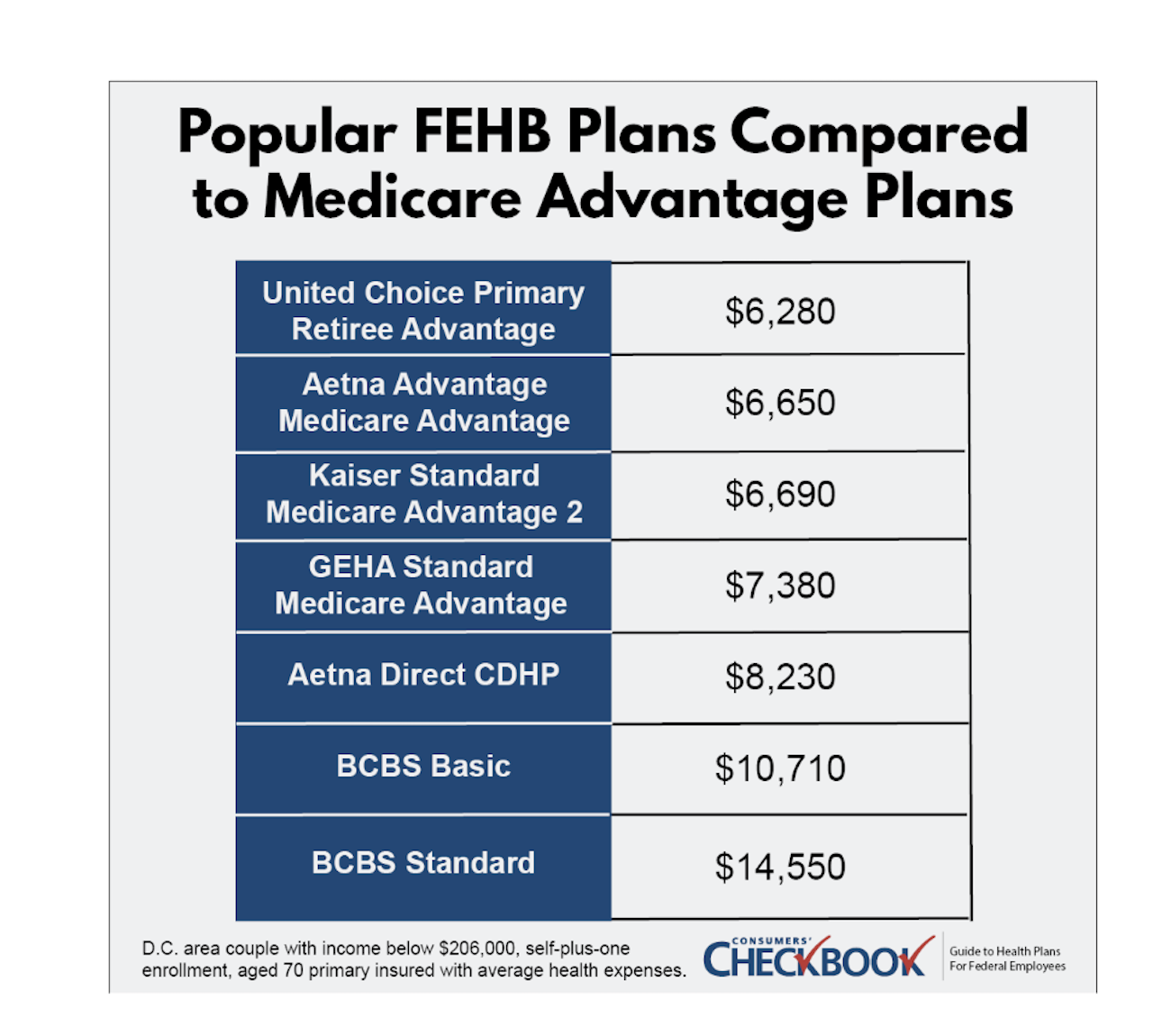

The combination of a significant reduction in Part B premiums plus $0 out-of-pocket healthcare costs outside of prescription drugs provides annuitants massive healthcare savings. For every FEHB and FEHB MA plan, Checkbook’s Guide to Health Plans for Federal Employees provides a yearly cost estimate, which is a combination of the for-sure expense of premium (both FEHB and Part B in this case) and the likely out-of-pocket costs you’ll face based on age, family size, and expected healthcare usage.

A D.C.-area couple with a 70-year-old primary insured, average healthcare expenses, income below $206,000, and self-plus-one enrollment could save $8,270 next year in likely healthcare expenses switching from BCBS Standard to United Choice Primary Retiree Advantage.

You must have Medicare Parts A & B to enroll in an FEHB MA Plan. To sign up, first enroll with OPM in the corresponding FEHB plan and wait a business day or two for OPM to update the plan with a new member roster. The final step is enrolling in the MA plan, which must be done directly with the plan either through its website or through a special MA enrollment phone number. To find out more information about the MA plan benefits, go to section 9 of the official FEHB plan brochure or to the plan website.

While an FEHB MA plan will be the least costly choice for most federal annuitants, it might not be the best option for everyone. If you have Part B but pay more than the standard Part B premium, through IRMAA or a late enrollment penalty, the higher Part B premium will erode the financial value that the MA plans provide. However, if you are only in the first tier of IRMAA, the Part B reimbursement and zero cost share besides prescription drugs will likely still result in MA plans as the cheapest plan choice.

If you spend considerable time abroad, most of the FEHB MA plans will not cover routine care overseas. Only UnitedHealthcare has some routine overseas coverage.

Pay attention to the FEHB MA plan’s provider network. The plans state that you can see any provider that accepts Medicare, but the provider must also accept the plan. Make sure to check the FEHB MA online provider directory to see that both your existing providers and any providers you might want to see in the future will be covered.

The Final Word

Federal annuitants will face greater healthcare costs in 2024, with both higher FEHB and Medicare Part B premiums. For annuitants that face moderate to high prescription drug costs, new Part D prescription drug coverage will be an important way to save money next year.

This upcoming Open Season will be one of the most important in recent years for annuitants to evaluate their existing plan against those that offer Part D coverage. If your current FEHB plan doesn’t have new Part D coverage, you’ll want to review those with a PDP to see if one would be a better fit than your existing plan.

FEHB MA plans offer federal annuitants an opportunity to save some serious money on all your healthcare costs, not just prescription drugs. How much you’ll save depends on your current FEHB plan and which FEHB MA plan you choose to enroll in for next year.

Kevin Moss is a senior editor with Consumers’ Checkbook. Checkbook’s 2024 Guide to Health Plans for Federal Employees will be available on the first day of Open Season, Nov. 13. Check here to see if your agency provides free access. The Guide is also available for purchase and Government Executive readers can save 20% by entering promo code GOVEXEC at checkout.