Air Force Photo

The Federal Employees Retirement System annuity supplement is a fairly simple concept: It’s a special payment for FERS employees who retire before age 62. The supplement is designed to act as a monetary bridge between retirement under FERS and the time a retiree qualifies for Social Security retirement. It is paid in addition to the monthly FERS annuity benefit, but unlike the annuity, it is not a lifetime benefit.

Since the FERS supplement was created in the 1980s, it has attracted its share of controversy. Indeed, it’s been on the chopping block in Congress and the White House many times, most recently in the Trump administration’s fiscal 2021 budget proposal. (That recommendation is a long way from becoming law, if it ever does.)

This week’s column is designed to clear up some of the confusion and provide a comprehensive overview of this valuable and sometimes misunderstood benefit.

What It Is

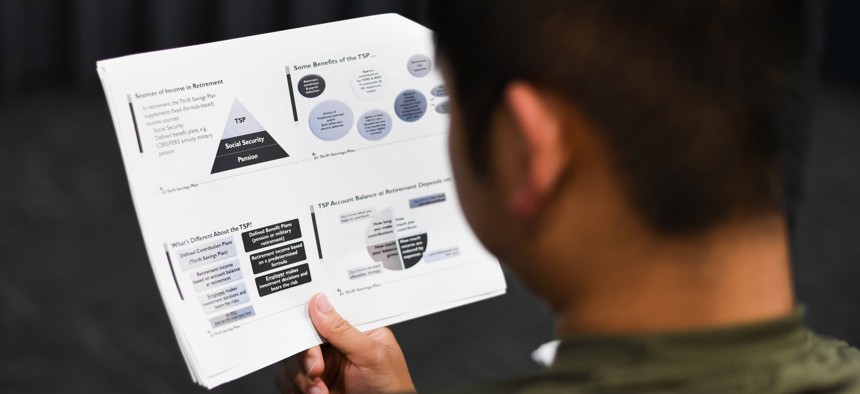

FERS was designed to provide benefits through Social Security, a defined benefit government pension, and the Thrift Savings Plan (an employer-sponsored savings plan like a 401(k) plan). FERS also was designed to allow federal employees to retire at an early age, like the older Civil Service Retirement System, which allowed regular retirement as early as age 55. FERS gradually increased the minimum retirement age to 57.

The FERS supplement represents what an employee would receive for their FERS civilian service from Social Security, and is calculated as if the employee were eligible to receive Social Security benefits on the day they retired. The supplement is subject to an earnings limit, which can cause it to be reduced or eliminated.

Who Gets It

The supplement is available immediately upon retirement to FERS employees who retire on a non-disability, immediate, unreduced retirement before age 62. An immediate annuity is one that is paid to employees who retire at the FERS minimum retirement age or later who have 30 or more years of creditable civilian service, or at age 60 with at least 20 years of service. Employees who retire at age 62 or later with at least five years of service will not be eligible for the supplement, because they are retiring when they are eligible for Social Security retirement.

This includes those who retire under special retirement provisions, such as law enforcement officers, firefighters and air traffic controllers, who typically are eligible to retire before the FERS MRA and are subject to mandatory retirement before age 62. You may also receive the supplement if you retired involuntarily before attaining your MRA or voluntarily because of a major reorganization, reduction in force, or an early retirement in the case of members of Congress. But in these three instances, you will not be eligible for the annuity supplement until you reach your MRA.

Those who transferred from CSRS to FERS can receive the supplement based on their civilian service subject to FERS if they were under FERS for at least a full calendar year.

Who Doesn’t Get It

Employees who are already 62 or older are obviously not entitled to the FERS supplement. Also ineligible are employees who retire under immediate or postponed MRA+10 retirement provisions. In addition, employees who resign before they are eligible for an immediate retirement will not receive the supplement, even if they claim their deferred retirement before age 62.

Here are a few examples of eligibility for the FERS supplement:

- John retires at 56 (his MRA) with 37 years of service. He will get the supplement immediately upon retirement.

- Jackie is a Border Patrol agent and will qualify to retire under FERS law enforcement provisions at age 48 with 25 years of law enforcement service. She will get the supplement immediately upon retirement.

- Louis entered federal service at age 38 and will resign at 58 with 20 years of federal service. Although he is eligible for a reduced, immediate retirement under the MRA+10 provision, he will postpone his retirement application to age 60 to avoid a 20 percent penalty on his retirement benefit. Regardless of when Louis applies for his retirement, he will not be eligible to receive the FERS supplement. However, if Louis decides to continue working to age 60—when he would be eligible for an immediate, unreduced retirement—then he would be entitled to receive the supplement from age 60 to age 62.

- Helen will retire at age 50, with an immediate retirement under an early out opportunity at her agency. She will not be entitled to the FERS supplement until she reaches her MRA.

How To Get It

This one’s easy, because the answer is you don’t have to do anything. If a retiree is entitled to the supplement, it will be included automatically in their FERS basic retirement benefit once their retirement claim has been finalized.

There is no specific application to receive the FERS supplement. In fact, there is no mention of the supplement on the FERS Application for Immediate Retirement. Nor is the supplement mentioned in the instructional pamphlet given to employees at retirement, Applying for Immediate Retirement under FERS.

You can read about the supplement in a pamphlet titled Information for FERS Annuitants. Your agency's retirement calculator software can compute the approximate value of the supplement in your FERS retirement estimate report.

Next week, we’ll look at how the supplement is computed, and how it can change over time.