Unlike Medicare Part A, which is free at age 65 and covers major medical expenses like hospital visits, Part B carries a monthly premium. designer491/Getty Images

Will your future income rocket your Medicare premiums?

As a federal employee with FEHB, should you also take Medicare Part B at age 65? Here are a few things to consider before making the decision.

Medicare Part B can play a crucial role in providing essential healthcare coverage for individuals aged 65 and older. It covers outpatient care, preventive services, and durable medical equipment – like an FEHB plan.

But unlike Medicare Part A, which is free at age 65 and covers major medical expenses like hospital visits, Part B carries a monthly premium.

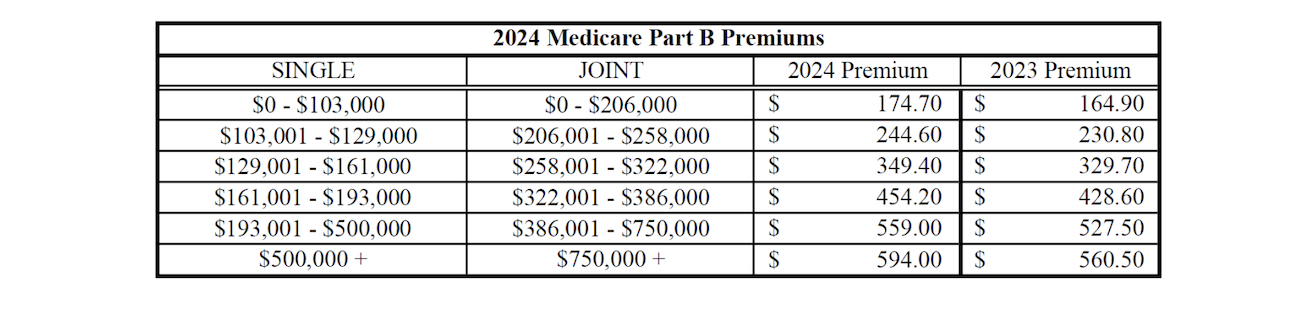

And here’s the part that catches a lot of retirees off guard: The monthly premium for Medicare Part B is dependent on your income.

At certain income levels, the government adds an “income-related monthly adjustment amount” to the base premium. And, while Part B premiums start out relatively affordable, they can become far more expensive for higher income earners.

Who is Eligible?

Individuals can file for Medicare Part B up to three months before turning 65 and no later than three months after reaching age 65.

Individuals who are 65 or older and still covered under an employer’s healthcare plan (or a spouse’s plan), are not required to enroll for Medicare Part B until they have retired. After retirement, you have eight months to enroll without penalty.

The penalties for filing late can be quite harsh, as they are permanent increases to all future premiums. So, you’ll want to be sure you’ve done your homework and know what’s best for you ahead of time.

How do Premiums Work?

Medicare Part B premiums are based upon someone(s) Modified Adjusted Gross Income or their income before deductions. As you can see in the chart below, premiums can increase significantly at higher income levels:

How Does the Future Income Affect My Decision?

One of the most important retirement planning considerations, and one that’s often forgotten, is how future income, including pensions, Social Security, and required minimum distributions, can influence tax obligations and Medicare costs.

For private sector retirees, retirement income is typically limited to Social Security plus withdrawals from their retirement accounts. Because of that, it’s relatively easy to stay within one of the first Medicare Part B premium brackets.

Federal employees, on the other hand, typically have a nice pension which, when combined with Social Security and TSP withdrawals, can land them in the same tax bracket as when they were working.

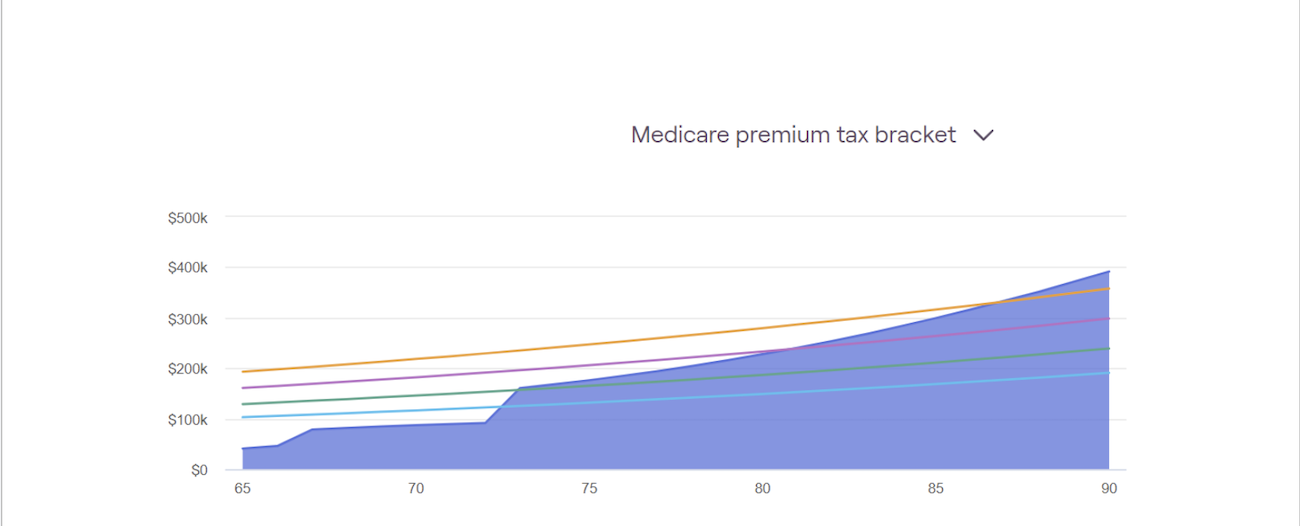

If a federal retiree’s pension is high enough, they may decide to delay Social Security until they’re 65 or 70. In that scenario, they may be in the first Medicare premium bracket at retirement but may face higher IRMAA and increased Medicare Part B premiums once Social Security benefits have begun.

Finally, the most overlooked (and often largest) income stream that can impact your future retirement income are RMDs, a required withdrawal from your retirement account that is mandatory for any tax-deferred (traditional) account.

In short, Uncle Sam lets you defer paying taxes on these funds while you were working, and now, it’s time to pay up.

Accounts like your TSP, previous employer plans, and Traditional IRAs are all considered in this formula. It is a mandatory withdrawal that boasts a staggering 25% penalty if it is missed (down from 50% prior to the Secure Act 2.0 passed in 2022).

These distributions count as taxable income and contribute to your MAGI. They begin at age 73 (75 for those who are not age 73 by Dec. 31, 2033) and are approximately 4% of your traditional balance year one. As you age, your IRS Divisor, a nice way of saying life expectancy, decreases and the proportion of your account that needs to be withdrawn increases.

Typically, you can assume your RMD will be larger than the prior year unless you have a negative year in your investments. Retirees who underestimate the impact of RMDs on their overall income may find themselves in a higher IRMAA tier, leading to increased Medicare premiums that could cost them thousands of dollars.

Have a Plan

So, what should you do if you think Social Security and RMDs could spike your retirement income?

First, run your numbers to assess your risk.

If you’re at risk of higher premiums, the good news is that there are strategies to mitigate the risks mentioned above. This can be achieved by engaging in strategic tax planning to minimize overall taxable income.

Tax planning strategies could include:

- Spreading retirement account distributions over several years.

- Taking advantage of tax-efficient investment tactics.

- Being intentional with the timing of things like your retirement age/date as well as when to draw Social Security.

Finally, potentially the most impactful strategy is Roth contributions and conversions. While this incurs taxes in the short term, it can reduce taxable income in the future and potentially lower future income and Medicare premiums.

I it’s important to take steps NOW to prepare yourself for a decision on Medicare Part B.

By proactively considering pension benefits, Social Security filing age/amount, and forecasting future RMDs in your financial planning, you can make informed decisions that not only optimize your healthcare coverage but also mitigate the impact on taxes and premiums.

Taking a proactive approach to these considerations can contribute to a more financially secure and stress-free retirement.

David Setia is a chartered mutual fund counselor with Capital Financial Planners as well as federal benefits trainer for RETFED Seminars. If you don’t feel confident in your Medicare, Social Security, and retirement plans, register for a complimentary checkup. For federal topics covered in even greater depth, see our recorded webinars.

NEXT STORY: Most TSP funds gained ground in February