The government securities of the G Fund, grow at a statutorily mandated rate. Anton Petrus/Getty Images

TSP’s G Fund and The Debt Ceiling

When the government suspends reinvestments in the G Fund while it shores up its finances, one expert argues they should account for the missed payments separately from actual returns.

The G Fund is quite possibly the most boring investment vehicle available to any group of investors in the United States. The fund was the first to open to participants when the TSP launched in April 1987. According to the law establishing the TSP, the G Fund is technically called the "Government Securities Investment Fund,” and it invests in “special interest-bearing obligations of the United States" issued by the Treasury Department. Because Treasury issues the “special” “obligations” directly to the fund, they are not tradeable outside of the TSP. The fund is so obscure that it receives essentially zero coverage in popular media.

While boring, the fund is not inconsequential: Millions of TSP participants held almost $300 billion in investments in the G Fund in January this year, either directly or in the Lifecycle Funds. The Lifecycle or “L Funds” hold a portion of their investments in the G Fund in addition to the four other main TSP funds.

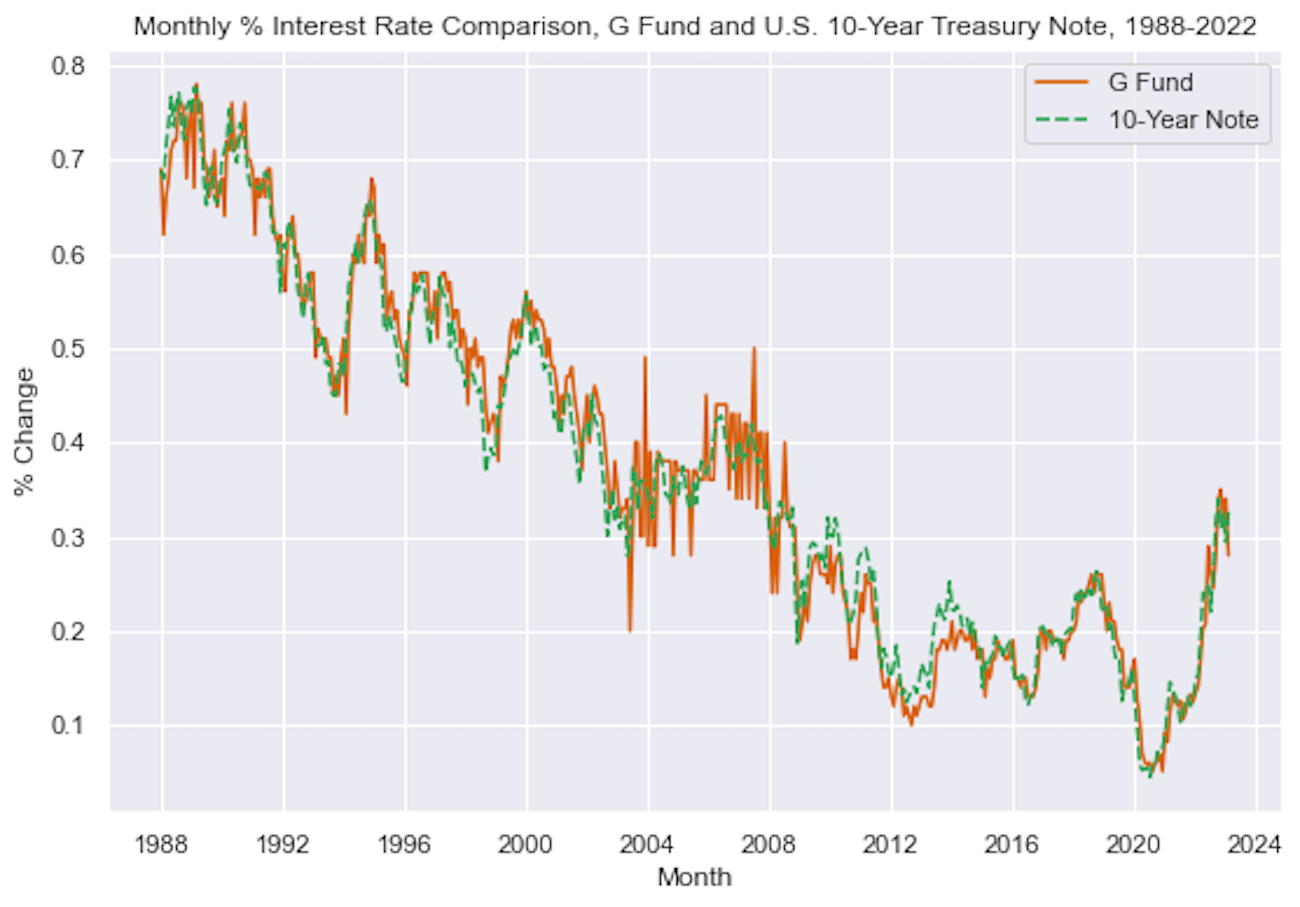

The G Fund receives an interest rate “equal to the average market yield...on all marketable interest-bearing obligations of the United States then forming a part of the public debt which are not due or callable earlier than 4 years." In practice, monthly returns have closely matched the percentage rate for the 10-year U.S. Treasury Note almost perfectly. The G Fund and 10-year are 98.4% correlated since 1988, the first full year of the G Fund’s operation, through February this year. Here is a chart comparing the monthly percentage rates for the two since 1988:

Also built into the law is the ability for Treasury to enact what is called a "debt issuance suspension period." The law states that “Treasury may suspend the issuance of additional amounts of obligations of the United States, if such issuances could not be made without causing the public debt of the United States to exceed the public debt limit.”

Once we hit the current debt limit of $31.4 trillion, on Jan. 23, the Treasury Department announced several measures, one of which was "suspending reinvestment of the Government Securities Investment Fund (G Fund) of the Federal Employees Retirement System Thrift Savings Plan." After the "debt limit impasse" ends, according to the statement, the "G Fund will be made whole."

The TSP website too issued a short statement noting the lapse in funding, adding that “G Fund account balances will continue to accrue earnings and will be updated each business day, and loans and withdrawals will be unaffected.”

Thus it was business as usual despite the announced suspension of funding: The G Fund rose on Jan. 24 by .0019 cents, from $17.2784 to $17.2803. The day after that it rose again by a similar amount, and the day after that it rose again.

By April 21, three months after the discontinuation of payment of interest, the G Fund share price had risen by more than 15 cents to $17.4395, or approximately .9324 percent. While the increase might not seem like much on a per-share basis, it represents about $2.797 billion in missed interest payments for the approximately $300 billion G Fund as of the end of January. But as stated in its press release, Treasury hasn’t actually made these payments yet, and it won’t until after the debt ceiling impasse is resolved.

The rationale for continuing the business-as-usual accounting has historically been straightforward. For one, since these are specially issued obligations, there is no counterparty to sell them to, so the only accounting as such is for TSP participants. Indeed, in the first fifteen years of the fund’s existence there was essentially no reporting of G Fund returns except in paper statements sent to TSP participants. Back then, participants could only request one interfund transfer a month - by the 15th - for the transfer to be completed by the end of the month. It was only in the early 2000s that each of the funds began to report daily returns on the TSP’s then-rudimentary web presence. Accounting simply wasn’t an issue in the fund’s first decades of existence, even as it gradually grew to $78 billion by the end of 2007. (The national debt at the time was approaching $10 trillion.)

Moreover, Treasury is required by law to repay all “interest that would have been earned by the Government Securities Investment Fund from obligations of the United States during such debt issuance suspension period.” Thus long-term, there is absolutely no threat of default. In this context, the regular accounting has been convenient when thousands of transactions are taking place into and out of the fund daily.

And practically speaking, the chance of TSP participants withdrawing significant amounts from their G Fund holdings – a “run” on the G Fund – during a debt ceiling impasse has been utterly inconceivable, because participants have had very limited options as to where to transfer their funds. The stock funds (C, S, and I Funds) are often in decline during times of market stress, and the total bond fund (F Fund) isn’t necessarily a safe haven either. Otherwise, there have been no other options, and TSP participants often transferred funds into the G Fund despite the debt ceiling impasse judging by past fund movements.

Yet, given the size of the fund and structural changes to the TSP, the fact that the G Fund has not received any interest payments for over 90 days might pose some underlying challenges during this or future extended budget ceiling impasses.

First and foremost, the continued business-as-usual accounting masks the question of the constitutionality of the law itself. The 14th Amendment, Section 4, of the U.S. Constitution states that “[t]he validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions…shall not be questioned.” The law authorizing suspension of interest payments on U.S. Government debt, coupled with the business-as-usual accounting as if interest was being paid on time, sets precedent at odds with this constitutional requirement. Could this same approach be used in other scenarios? Could, for example, a time come when interest payments on U.S. debt held in the F Fund are withheld during a “suspension period,” but have the accounting continue as if the interest was still being paid, citing the original law as basis? Are there other ways interest payments might be suspended but still be accounted for, as in the case of the G Fund?

No private sector fiduciary would allow the non-payment of interest on US government debt without legal challenge. Private financial institutions such as Blackrock or State Street – which each manage portions of the other four TSP funds – would almost certainly proactively seek timely repayment if interest on government debt they manage were withheld.

The Federal Retirement Thrift Investment Board (FRTIB) – the fiduciary entity that oversees the TSP – states unequivocally that TSP participants “have property rights under the law” to their TSP holdings. The press release for the creation of the Mutual Fund Window (MFW), for example, forcefully states that “[t]he funds that a federal employee or member of the uniformed services uses to invest in the TSP or the MFW are personal property, not federal funds,” and further affirms that TSP holdings are “personal property”: TSP participants “have property rights under the law.” Yet the law allowing a “debt issuance suspension period” dispossesses TSP participants of their property rights, particularly in light of the 14th Amendment.

Moreover, the MFW now means TSP participants are no longer tied solely to TSP funds – such as the G Fund – for their investments. Participants can elect to invest up to (the arbitrarily set) 25% of their holdings in non-TSP investment options, based on certain account minimums. Whereas a sudden sell-off of the G Fund was essentially impossible previously, now it is merely highly improbable. Because the G Fund is not tradeable, the only counterparty is the U.S. government itself, meaning that in any sort of sell-off the U.S. government would have to buy back G Fund securities directly at the now-increased share price due to continued accounting practices.

The question in this scenario becomes: how much of the G Fund can Treasury afford to redeem should some TSP investors elect to withdraw their funds, potentially during the height of a debt ceiling impasse and market turmoil? Can it afford $1 billion in outflows, $3 billion, $10 billion or more? With the business-as-usual accounting, Treasury would have to redeem G Fund holdings at higher values even though Treasury has elected to stop paying interest to the G Fund. But if the debt ceiling has already been reached, would Treasury be able to redeem inflated G Fund securities? This illustrates the additional moral hazard of continuing to account for interest payments even though they have not been received.

While this author and G Fund investor has for over a decade expressed complete confidence in the G Fund, in this era of meme investing and heightened rhetoric, it is no longer inconceivable or impossible that some TSP investors would actively seek alternatives for their investments at critical times.

A more forthright approach would be to account for the government’s missed payments separately from actual returns (which during the debt issuance suspension period is 0% for the G Fund), to provide more transparency to TSP participants and the public of the increasing impact of the law, given that overall G Fund holdings have grown significantly over the years. Forthright accounting removes the risk of surprise redemptions of elevated share values – interest that is accounted for but not yet paid by Treasury into holders’ accounts – should TSP participants choose to sell their G Fund holdings during debt ceiling impasses. It also presents an opportunity to center discussion on TSP participants’ property rights and the constitutionality of Treasury withholding payments to the G Fund during any debt ceiling impasse. Ultimately, TSP investors should be afforded the same rights as all other investors in U.S. government securities, and not treated as second-class investors who are disenfranchised by current law.

Lee Radcliffe is a U.S. Army veteran with over 20 years of federal government and data analytics experience who has written extensively about Investing in the Thrift Savings Plan for Government Executive, Federal News Network, Federal Times, and other publications. His most recent book is TSP Investing Strategies: Building Wealth While Working for Uncle Sam, 2nd Edition (Thrift Strategies LLC, 2020). Follow Lee online at tspstrategies.com, and @TSPstrategies on Facebook, Twitter, and Instagram.

NEXT STORY: OPM Tests Chatbot For Retirement Services