There are some new choices for 2023. Peter Dazeley/Getty Images

An Open Season Checklist for Federal Annuitants

For starters, make sure you check if your premium is increasing, so you’re not caught off guard next year.

Now that it’s Federal Employees Health Benefits Open Season, annuitants should weigh their options. There are some new choices for 2023, and we’ll give you some reasons for and against enrolling in Medicare Part B as well as take a closer look at what may be the least expensive plan option: FEHB Medicare Advantage plans.

What’s New for 2023

After a record Medicare Part B premium increase in 2022, retirees breathed a sigh of relief when the Centers for Medicare & Medicaid Services announced standard Part B premiums were decreasing $5.20 to $164.90 in 2023. For high-income earners, the adjusted gross income threshold for paying higher Part B premiums (IRMAA) next year will be: $97,000 for individuals and $194,000 for married couples.

FEHB plan premiums, however, increased with the enrollee share going up 8.7% on average. Keep in mind that the increase is not uniform. Some FEHB plan premiums will be less, some have stayed the same, and some have increased above the average. Make sure you check this for-sure expense so you’re not caught off guard next year.

Couples also need to be aware that self-plus-one isn’t always the least expensive enrollment choice. There are 86 FEHB plans in 2023 where enrolling in self & family is less expensive than self-plus-one.

Depending on the plan, the difference between the two enrollment choices is significant. For example, with Kaiser High Option in the Washington, D.C., area you can save $1,323 next year enrolling in self and family instead of self-plus-one. The benefits you receive from the plan are the same regardless of enrollment choice, so choose the less expensive option.

Reasons to Enroll in Part B

The most common question we get every Open Season is whether to enroll in Part B. Remember: You must make this decision after you retire and also reach age 65 because there’s a premium penalty of 10% a year if you delay enrollment unless you or your spouse is still working and you are covered by either’s employer insurance plan.

If you have Part B or are wondering whether to enroll, here are some ways to get the most out of paying the Part B premium.

First, you want to be in a plan that coordinates well with Medicare. Many FEHB plans will waive medical deductibles, copays, and coinsurance charges when you have Medicare Parts A & B. This is often called “wraparound” coverage. The Checkbook Guide calculates how well FEHB plans coordinate with Medicare by comparing the plan with Part A only and with Parts A & B. FEHB plans that score well on this comparison include Aetna Direct CDHP, GEHA High, and Blue Cross Basic all of which waive doctor, hospital, and any deductible charges when you have Part B.

Some FEHB plans also provide a partial Part B premium reimbursement. BCBS Basic and GEHA High are two national plans that offer these reimbursements. While some CDHP and High Deductible plans will allow you to use a savings account for Part B premium reimbursement, this reduces the savings account balance (whether HSA or HRA) dollar for dollar and doesn’t produce any additional benefit.

You also have a broader selection of providers to choose from with Part B coverage. By using your Part B benefit, you can go outside your FEHB plan’s provider network to see anyone who accepts Medicare and pay just the 20% coinsurance cost after the $233 Part B Deductible. This is especially beneficial for FEHB plans without out-of-network coverage like BCBS Basic.

But by far the strongest reason to enroll and stay enrolled in Part B is to be eligible for an FEHB Medicare Advantage plan, which for almost all annuitants will be the least expensive plan choice in 2023.

FEHB Medicare Advantage Plans

Over the last few years more FEHB plans have added FEHB-specific Medicare Advantage (MA) plans. Most of these MA plans have $0 out-of-pocket costs for approved healthcare services from providers that accept Medicare, except for prescription drugs. All reimburse some or all the Medicare Part B premium. The benefit structure of these plans produces major cost savings compared to other popular FEHB plans.

Checkbook’s Guide to Health Plans ranks all FEHB plan options, including these special MA options, based on a total cost estimate that’s a combination of for-sure expense (premium) plus likely out-of-pocket costs you’ll face based on age, family size, and expected healthcare usage.

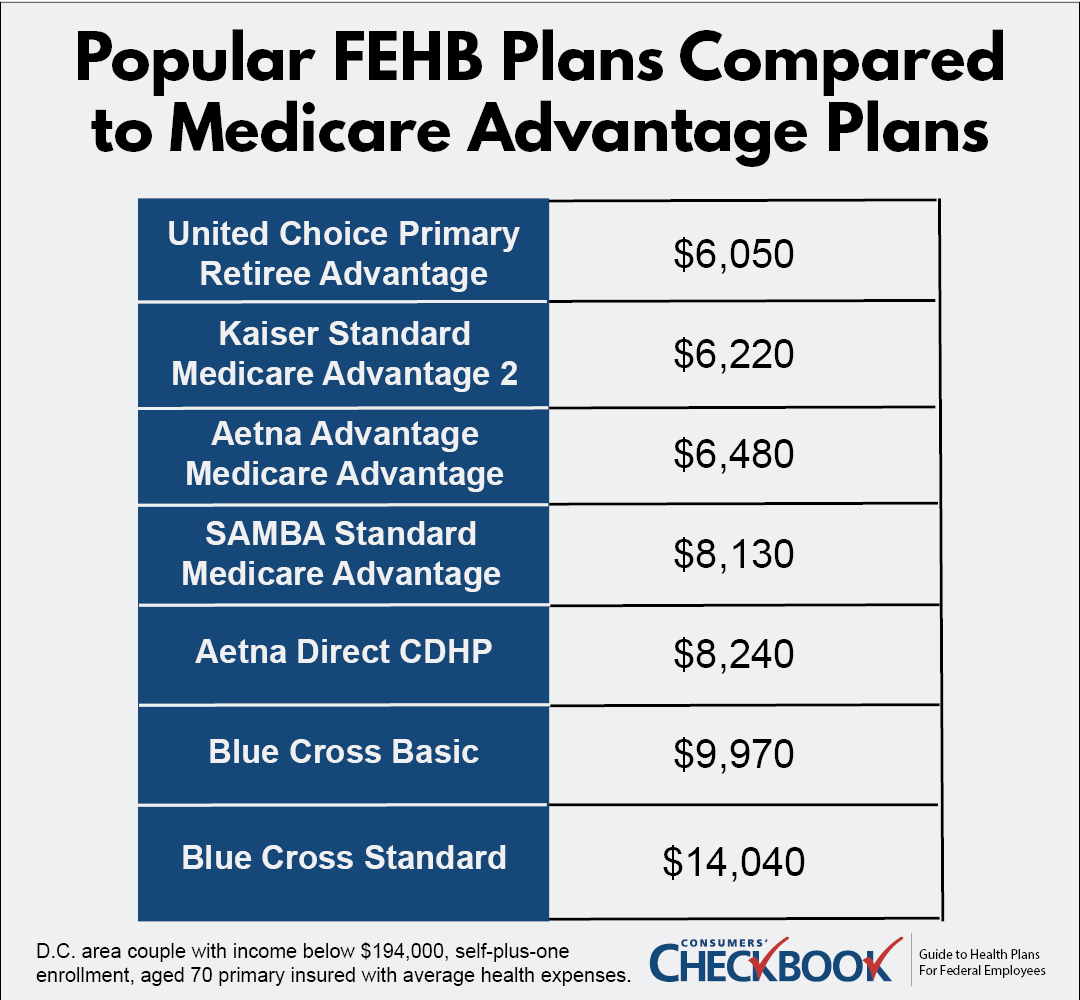

For example, we estimate that a D.C. area couple enrolled in Medicare Parts A & B could save $7,990 in estimated total costs next year by switching from BCBS Standard to United Choice Primary Retiree Advantage.

The FEHB MA plans available to you depend on where you live. Aetna Advantage Medicare Advantage is a PPO plan available nationwide, United Choice Retiree Advantage plans are in about half the country, and Kaiser Medicare Advantage plans are available on the West Coast, Hawaii, Colorado, Georgia, and Mid-Atlantic states. There are also MA plans offered nationwide by APWU and MHBP, and restricted enrollment MA plans offered by Rural Carrier and Compass Rose.

There are additional FEHB MA plans for annuitants to consider in 2023. SAMBA High and Standard, NALC High, and Foreign Service are national PPO options, and UPMC Standard, Kaiser Standard Mid-Atlantic, and Kaiser Standard Georgia are HMOs.

Enrollment in MA plans requires three steps that should be completed in the following order:

- If you’re not already enrolled in Medicare Part B, apply at Medicare.gov. You won’t be able to join an MA plan without first being enrolled in Part B. That takes the longest, so start here.

- Enroll with OPM in the FEHB plan that corresponds to the MA plan you want to join.

- The final step is enrolling in the MA plan. After you’ve enrolled in the FEHB plan with OPM, wait a few days for OPM to update the insurance plan and then you’ll need to call the MA plan directly to enroll.

These FEHB MA plans offer advantages because you have dual FEHB/MA enrollment. For example, a married couple with one spouse below age 65 could join one of the plans and rely on FEHB benefits for the younger spouse until he or she turns 65, with the older spouse enjoying the enhanced MA benefits from the beginning of the new plan year.

One word on overseas coverage. Since you stay enrolled in an FEHB plan with these MA plans, you always have emergency overseas care that is provided by all FEHB plans. However, except for UnitedHealthcare, routine care overseas is not covered by any MA plan. UnitedHealthcare added reimbursement for overseas routine care as a new plan benefit in 2023.

Reasons Not to Enroll in Part B

If you fall into one of the high-income categories—more than $97,000 for individuals or $194,000 for couples—Part B is of limited financial value due to the higher premium. There are less expensive FEHB plans without Part B compared to the least expensive MA plan with a higher Part B premium.

Also, if you’re with an FEHB plan that doesn’t coordinate well with Medicare, you’ll be better off financially not enrolling in Part B. For example, there are some FEHB plans that do not waive doctor and hospital charges when you have Parts A and B. As a result, the extra cost of Part B is equal to the full premium. Under these plans you receive very little benefit and you should consider either changing plans or not enrolling in Part B.

The Final Word

The Part B premium decrease is good news for annuitants, but higher FEHB premiums mean most will be paying more in overall premiums next year. Couples need to check whether self-plus-one or self & family is less expensive. The least expensivqe enrollment option can change every year.

Unless you’re subject to higher Part B premiums, enrolling in Part B will be the best decision for most annuitants. You’ll have greater access to providers and be eligible to join MA plans.

The savings available to annuitants who join low-cost FEHB MA plans is so substantial that it cannot be ignored. Even if you’re relatively satisfied with your existing FEHB plan, for your own financial protection you should consider whether joining an MA plan can offer you better benefits than you’re currently receiving at a much lower cost.

The FEHB Open Season began Nov. 14 and ends Dec. 12.

Kevin Moss is a senior editor with Consumers’ Checkbook. Checkbook’s 2023 Guide to Health Plans for Federal Employees is available to many federal employees for free. Check here to see if your agency provides access. The Guide is also available for purchase and Government Executive readers can save 20% by entering the promo code GOVEXEC at checkout.