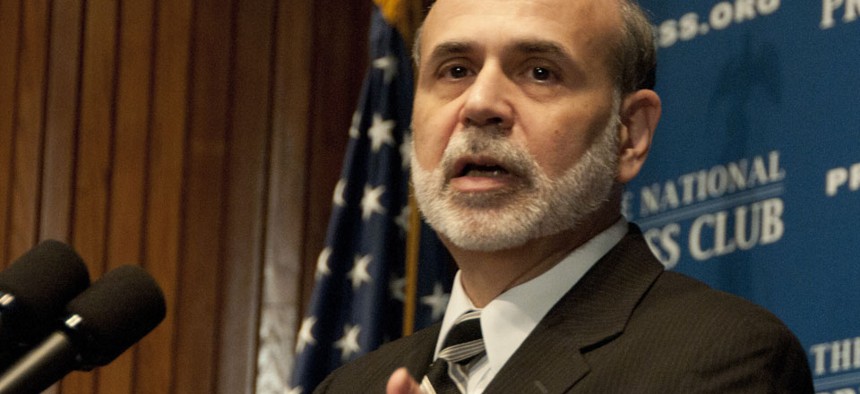

Federal Reserve Chairman Ben Bernanke arguably wields the nation's last policy lever in his central bank's monetary policy. Albert H. Teich/Shutterstock.com file photo

How Syria, a Hurricane, or Ben Bernanke Could Move the Debt Ceiling Deadline

Four possible paths to an early default.

Deadlocked over a deal to raise the debt ceiling, Congress and the White House are flirting with federal default. But that's not the worst of it: as the exact date of default is uncertain, any number of unforeseen events could push our federal finances over the edge.

Treasury Secretary Jack Lew told Congress Monday that the government is likely to default on its debts by mid-October unless the debt limit is raised. But mid-October could just as easily be early October. Or it could be late-September. Or Treasury's extraordinary measures may, as some analysts are still predicting, stave off default until November.

Setting an exact default date is difficult, if not impossible, because the government's day-to-day finances are dictated by a wildly unpredictable cocktail of political, economic and natural forces. Here are a few hypotheticals that could buy Congress more time—or bring on default more quickly than anyone saw coming.

Syria

Few events wreak more havoc than military interventions. Federal budgets, of course, do not come away unscathed. And right now, it's looking like there's a decent chance there will be some form of U.S. intervention in Syria.

Such an intervention, even if its just a targeted missile strike, could cost the U.S. billions, and alter the debt-limit timeline. In July, Joint Chiefs Chairman Gen. Martin Dempsey told Congress that the cost of targeted strikes against Bashar al-Assad's military "would be in the billions," and that just instituting a no-fly zone over the country would cost about a billion dollars a month.

One other way of thinking about the possible cost of targeted strikes is to look back to the 1999 NATO strikes in response to ethnic cleansing in Kosovo, which the Obama administration is reportedly using as a "precedent" for a possible Syria campaign. NATO conducted strikes on Serbia for 78 days starting in March, at a cost to the U.S. of about $5 billion (not adjusted for inflation) through September of 1999.

Act of God

By late November of last year, New Jersey Governor Chris Christie estimated that Superstorm Sandy had cost his state $36.8 billion after making landfall in October. Around the same time, New York Governor Andrew Cuomo was asking for $41 billion in federal aid for his state, with $15 billion going to New York City alone.

After months of arguing, Congress approved of a $50.5 billion aid package in January. That's a bit more than the amount of money the Treasury expects to have on hand come mid-October. And we're only about to hit peak hurricane and tropical storm season.

A massive storm or hurricane isn't likely to drastically (or quickly) alter the Treasury's debt-ceiling estimate, and Sandy is surely something of an outlier. It would have to be a "pretty big" storm to make a sizable difference, says the Bipartisan Policy Center's Steve Bell, and Sandy was one of the biggest ever. But when every billion counts, an unexpected act of God could make the deadline rush up just a bit quicker.

Act of Bernanke

It's the economy, stupid. The strength of the U.S. economy largely dictates how much tax revenue hits Treasury's coffers, and if the recovery takes flight this fall, it could buy the government more time, says Bill Frenzel, a guest scholar at the Brookings Institution.

Economic growth, however, is a double-edged sword—as any number of shocks could blow a hole in the recovery, sending tax revenue crashing and accelerating the default date. Think back to 2008, when the U.S. government was expecting the economy to keep chugging along and provide a steady revenue stream. But by mid-October, financial firms were collapsing, the economy was contracting, and a series of confident revenue expectations ended up being wildly off.

And then there's Federal Reserve Chairman Ben Bernanke, who—with fiscal policy locked in a perpetual stalemate—arguably wields the nation's last policy lever in his central bank's monetary policy. But after years of unprecedented stimulus, Bernanke has been sending signs that the bank may soon back off.

That tapering could send shockwaves through a stock market that many have long argued is overdue for a contraction. Given that stocks shuddered in June when Bernanke said the Fed would eventually, provided the economy stayed strong, peel back on some—but not all—of its stimulus efforts, signs that the taper was actually beginning would likely set back the economy and move up default.

The Debt Ceiling Debate Itself

The very possibility of default could accelerate the debt ceiling's arrival. In 2011, investors got jittery as the due date drew near and the White House and Congressional Republicans were mired in stalemate. The Dow dropped nearly 2,000 points in late-July to mid-August of that year, a plunge the market would not undo until 2012.

At a time when Treasury is scraping for every tax dollar, a similar market run could be enough to tip the needle.

There are signs, however, that the market has been inoculated against D.C.'s drama. When Congress took the country to the edge of the fiscal cliff in late 2012, markets didn't budge, prompting many to speculate that investors no longer buy hardliner bluster and assume a last-minute deal is coming.

Either way, Congress' day of reckoning of coming, as—absent legislation extending the ceiling—no upcoming event will long delay default, says Frenzel.

"I think we've taken it just about as far as we can go," he said. "I wouldn't expect any miracles."

(Image via Albert H. Teich / Shutterstock.com)