OMB says it's working with agencies to decrease improper payments as well as carry out its oversight duties. lemono/Getty Images

The Latest Improper Payment Numbers Are Here, But What Do They Mean?

The Office of Management and Budget published its annual governmentwide report on improper payments, but a fraud expert says they aren’t entirely reliable.

Improper payments, which put taxpayer dollars at risk, have been a long-term issue for the federal government, but they declined over the past year. However, there is more than meets the eye on this, according to a fraud risk expert.

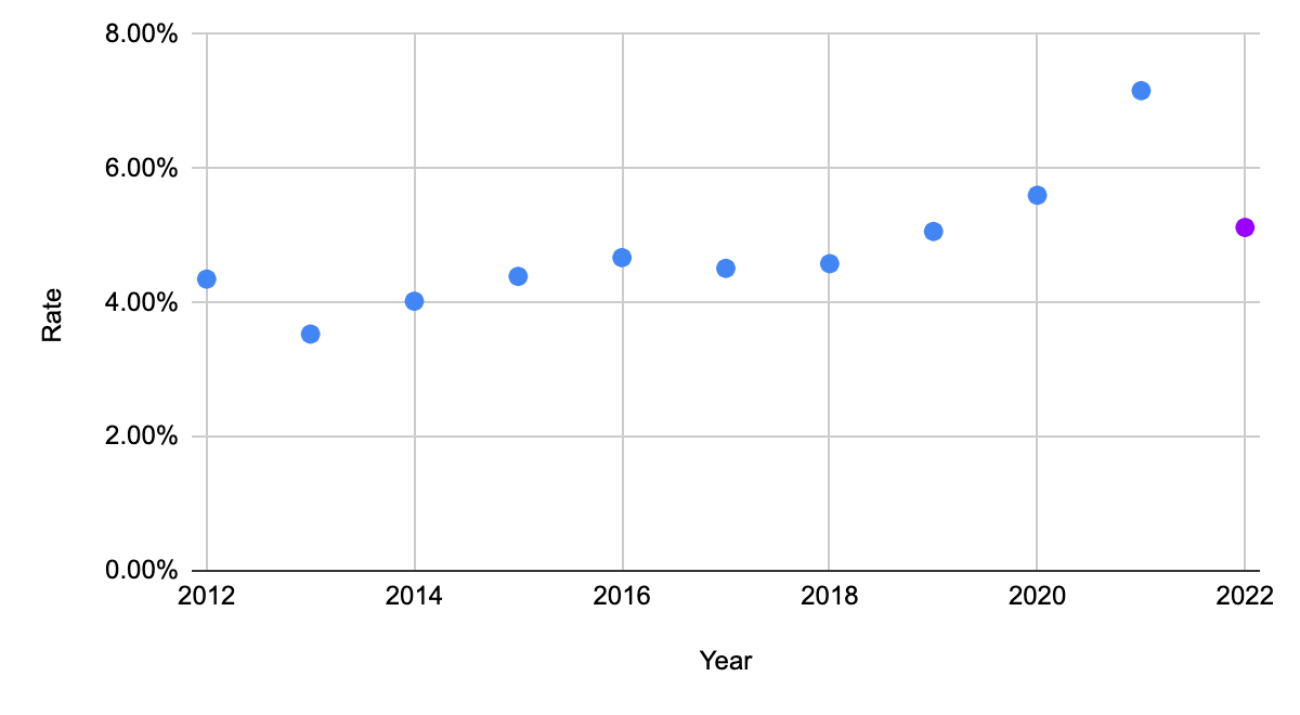

Last Wednesday, the Office of Management and Budget published its annual governmentwide report on improper payments, which says the rate decreased from 7.2% in fiscal 2021 to 5.1% in fiscal 2022. According to OMB, most of these payments are not fraudulent; many are overpayments, underpayments, and/or payments made to the correct recipient in the correct amount, but not according to policies and procedures and unknown payments. The office lauded its efforts along with the federal agencies, but acknowledged it still has more work to do.

“Overall, the improper payment rates are of questionable reliability generally and that is born out by many years, as in like 15 or 20 years of [Government Accountability Office] reports that have gone into detail about why agencies struggle to accurately estimate improper payments," Linda Miller, a partner at Guidehouse who is an expert in fraud risk and previously served as deputy director of the Pandemic Response Accountability Committee, told Government Executive on Monday. The data, housed on www.paymentaccuracy.gov, is on federal programs, many of which fund state ones.

“While it seems like a good news story that the improper payment rate has declined, it's more of a factor of the radical increase in improper payments in 2021,” she continued. “We are seeing now that some of those improper payment rates are going down relative to 2021, which is an improvement, but if you look at years before 2021 you can see that many of these programs still have higher improper payment rates than they did before the pandemic." Examples of this are the Children's Health Insurance Program and Medicaid.

Miller also said that OMB’s line that the majority of improper payments are not fraudulent is “misleading” because no one actually knows how many payments are fraudulent.

However, there are some “good news stories” looking at the data, such as after years of issues, there has been a steady decline in improper payments in the lifeline program (which provides discounted phone service to qualifying low-income consumers), which the Federal Communications Commission designated the nonprofit Universal Service Administrative Company to run, she said.

“While it’s encouraging that the improper payment rate declined, there is much more work to do. We need to further reduce the improper payment rate and find more opportunities to safeguard taxpayer dollars,” Rep. Abigail Spanberger, D-Va., who sent a letter to the president earlier this month calling on him to bring back the “Campaign to Cut Government Waste” he led when he was vice president. “That’s why I’ve called on President Biden to initiate another [campaign].”

In its post last week, OMB says it's working with agencies to decrease improper payments as well as carry out its oversight duties, such as by being a liaison to the inspector general community and GAO.

For example, OMB has issued guidance on being effective stewards of taxpayer resources for implementation of the American Rescue Plan, Infrastructure and Investments Jobs Act and Inflation Reduction Act; provided guidance and technical help to agencies, so they can get to the root cause of their issues; and worked to improve the accuracy of agencies improper payments data.

“Additionally, OMB is continuing to identify lessons learned from [Infrastructure and Investments Jobs Act and American Rescue Plan] implementation and is laser focused on ensuring the right financial controls are in place; providing clear government-wide guidance and training to agencies; and working with the oversight community to identify cross-cutting issues,” said the blog post.

Miller agreed that these are effective efforts and noted there has been been more of a recognition by the White House and agencies that oversight and controls are needed.

In an update published in July on OMB’s implementation of GAO’s open priority recommendations, Comptroller General Gene Dodaro acknowledge that OMB issued guidance on implementation the requirements of the 2019 Payment Integrity Information Act, but also said “reducing government-wide improper payments, including fraud” is one of the eight areas that some of the remaining 44 open priority recommendations fall into.