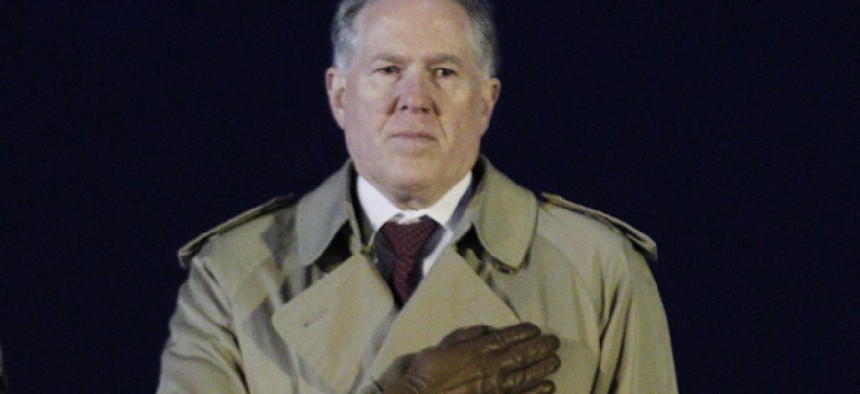

Frank Kendall is acting Defense undersecretary for acquisitions. AP photo

Pentagon defends approach to tax-delinquent contractors

Acquisition chief Kendall responds to senators on Leonie Industries.

The Defense Department’s current procedures for deciding whether to crack down on contractors that owe back taxes is working as intended, Frank Kendall, acting Defense undersecretary for acquisitions, logistics and technology, said in a newly released response to inquiries from lawmakers.

Sens. Tom Carper, D-Del., and Tom Coburn, R-Okla., wrote to Kendall asking if the Pentagon was withholding any payments from Leonie Industries -- the largest U.S. contractor working in Afghanistan- - after USAToday reported in February that the firm owed about $4 million in back taxes.

Leonie Industries, thorough its attorney, said it’s already working with the Internal Revenue Service to resolve the cash-flow issues.

In a letter dated April 4, Kendall wrote “while the department has a robust and effective process of collecting contractor tax debt, it can only be executed when the Department of the Treasury, through the Internal Revenue Service, notifies the Defense Finance and Accounting Service of a valid debt for which DFAS can offset against payments due the company. IRS has not notified DFAS of a tax delinquency on the part of Leonie Industries or its owners.” Hence no payments due to the company have been withheld.

Kendall also confirmed that the Army had ascertained that Leonie Industries had entered into an agreement with the IRS on a payment plan.

Carper said in a statement on Monday: “While I welcome the news that the IRS and the contractor have established a plan for the contractor to repay their delinquent taxes, there is still much work to be done when it comes to overseeing government contractors and holding them accountable for tax delinquency.”

Carper said the IRS must work more closely with Defense to examine the tax status of government contractors.