In May, the IRS announced higher HSA contribution limits for plan year 2024. Individuals can contribute up to $4,150 and those with family coverage can contribute up to $8,300. zimmytws/Getty Images

Why Every Federal Employee Should Consider a Health Savings Account

The annual HSA contribution limit is increasing in 2024. Here are some of the benefits of having one.

High Deductible Health Plans , which include Health Savings Accounts , are one of the cheapest health plan options available to federal employees. With an increase in HSA contributions for plan year 2024, HDHPs will offer additional value going forward. If you haven’t considered an HDHP in the past, now is a good time to review whether it could help you save money on your current and future healthcare expenses or be an additional stream of income in retirement.

HDHP and HSA Basics

HDHPs encourage enrollees to be mindful healthcare consumers by having a high deductible in place. Here’s how it works: Before the deductible, you’ll pay the full amount allowed by the plan for health services. After the deductible, you’ll generally pay a percentage of billed expenses, or coinsurance, that varies by plan and typically ranges between 5% to 20%. In some cases, depending on the health service, it can be higher.

To help you out before the deductible is met, all HDHPs provide free in-network preventive care including annual physicals, well-child visits, mammograms, and immunizations.

Additionally, all FEHB HDHPs fund an HSA that you can use to pay for out-of-pocket expenses. The plan-funded amount ranges between $750 to $1,200 for self-only enrollments and from $1,500 to $2,400 for self-plus-one and self-and-family enrollments. Plan contributions to the HSA are deposited monthly.

You can also make voluntary contributions to an HSA that are triple tax advantaged—they go in tax-free (either as a pre-tax payroll deduction or as a deduction when you file your taxes if you make a lump-sum contribution), grow tax-free, and exit tax-free if used for qualified healthcare expenses.

The HSA is managed by a financial services company, and you’ll be able to choose how to invest your funds with investment options similar to an Individual Retirement Account (IRA) with greater choice than what is available through a Thrift Savings Plan. Any unused funds will roll over to the following year, and there is no roll-over cap. Your HSA is owned by you, the enrollee, which means it’s fully portable if you leave federal service or switch FEHB plans.

How Much Can You Save Switching Plans?

Depending on your current FEHB plan, you could save thousands of dollars by switching to an HDHP. Keep in mind that HDHPs tend to have lower premiums than many popular non-HDHPs and have the added benefit of plan HSA contributions.

Checkbook’s Guide to Health Plans ranks all FEHB plans based on a total cost estimate that’s a combination of for-sure expense (premium) plus likely out-of-pocket costs you’ll face based on age, family size, and expected healthcare usage.

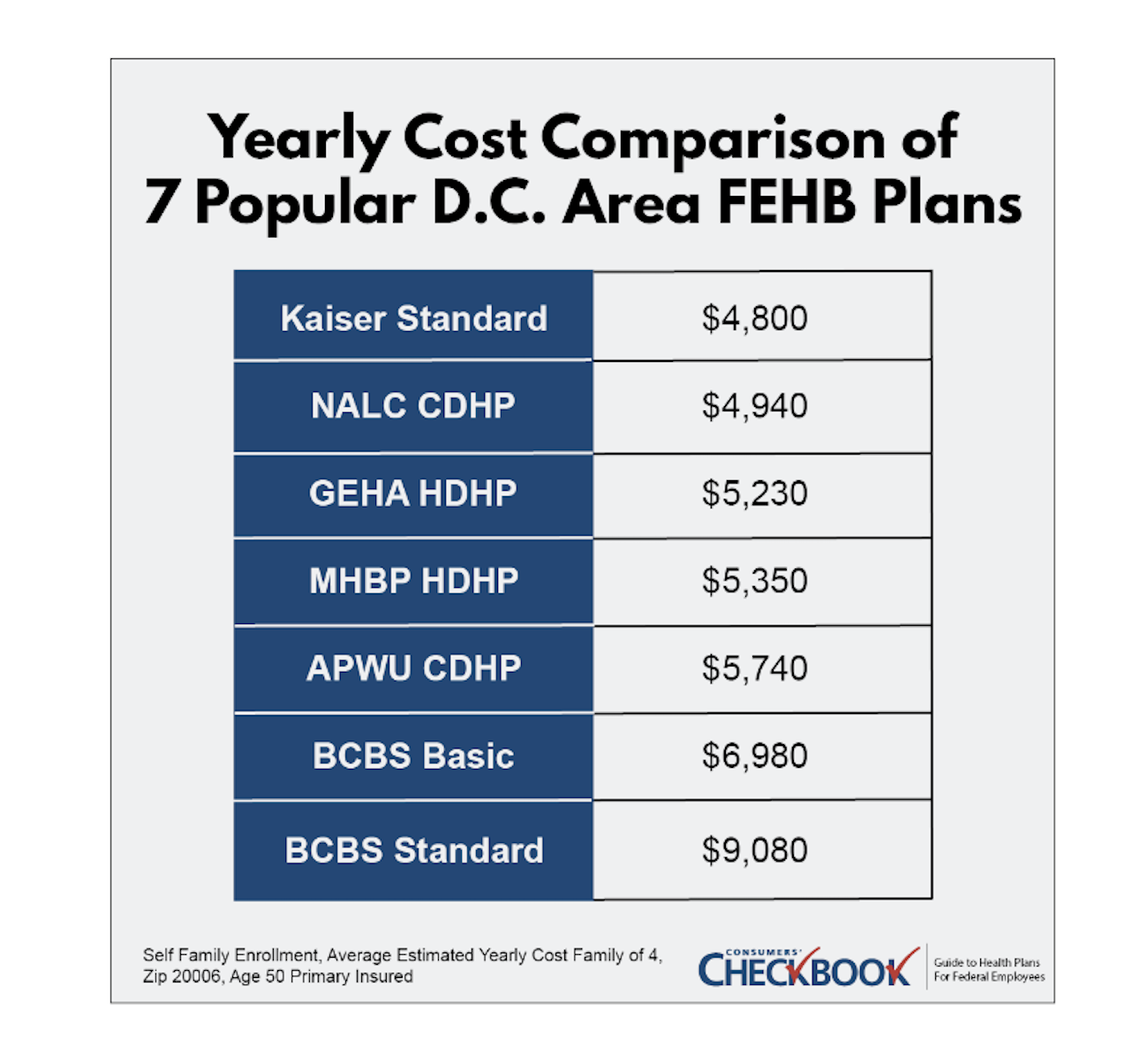

For 2023 coverage, we calculate that a Washington, D.C.-area family of four could have saved $3,850 in estimated total costs this year by switching from BCBS Standard to GEHA HDHP, or $1,750 in estimated total costs by switching from BCBS Basic to GEHA HDHP.

Retirement Super Weapon

As you approach retirement, you have an opportunity to contribute even more to your HSA. Once you turn 55, you’ll be able to contribute an additional $1,000 per year as a “catch-up” contribution on top of the normal contribution maximum.

Once you turn 65, a big change with your HSA takes place: You’re allowed to make non-medical distributions and only pay your regular tax obligations. Prior to age 65, non-medical distributions would create a 20% income-tax penalty on top of your normal taxes. This change gives you more flexibility on how to use your HSA funds, including as supplemental retirement income.

There are other healthcare-related qualified expenses that you can choose to use your HSA for in retirement and pay no taxes on. The premium for long-term care insurance, which pays for nursing homes and assisted living centers, is a qualified expense, as are Medicare Part B and D premiums both for you and a spouse.

What’s New For 2024

In May, the IRS announced higher HSA contribution limits for plan year 2024. For self-only enrollments, the combined HSA contribution between enrollee and plan will increase by $300 from $3,850 to $4,150. Self-plus-one and self-and-family enrollments will see HSA contributions rise $550 from $7,750 to $8,300.

Additionally, the minimum HDHP deductible will rise slightly next year to $1,600 for self-only enrollments and $3,200 for self-plus-one and self-and-family enrollments. Also, the maximum out-of-pocket expense (deductible, copayments, coinsurance, not premiums) will increase to $8,050 for self-only enrollments and $16,100 for self-plus-one and self-and-family enrollments. Finally, HSA catch-up contributions are unchanged in 2024 and remain $1,000.

Reasons to Not Join an HDHP

While an HDHP with an HSA will be the cheapest plan option for many, it may not be the best choice for all.

If you have an accident or unplanned hospitalization at the start of a plan year, you would be responsible for paying the entire deductible and possibly a portion of expenses above the deductible depending upon the service’s cost. This event could produce an unexpected health bill of a few thousand dollars. If that would cause financial distress, you would be better served with a non-HDHP that has either no deductible or a low deductible with fixed co-pays for healthcare services.

Additionally, any employees that have significant prescription drug expenses will probably be better served by a non-HDHP. You’ll be paying the allowed charge for most prescription drugs before you reach the deductible in an HDHP. A non-HDHP that covers your prescription and that has a fixed co-pay will be less expensive for most.

The Final Word

For most federal employees, an HDHP will be the least costly plan option available especially when considered as a long-term option. If you’re able to preserve the plan contribution and make additional contributions into the account, the HSA can grow very fast. We’ve heard from many federal employees that have HSAs with a balance of $50,000 or more because they’ve been enrolled in an HDHP for many years and have contributed the max every year. And, when you turn 65, the HSA becomes a multi-purpose super weapon that can either help pay for almost every healthcare expense you’ll face or be used as an extra source of income.

However, federal employees are on borrowed time to maximize an HSA’s tax-preferred benefits. Once you retire and are on Medicare, you no longer qualify to receive an HSA from an HDHP and you can no longer make voluntary contributions to your HSA.

With increased contribution limits, you’ll be able to sock away even more money into an HSA next year. Give HDHPs a look this fall during Open Season to see if this plan type can help you save money now and in the future.

Kevin Moss is a senior editor with Consumers’ Checkbook. Checkbook’s Guide to Health Plans for Federal Employees is available to many federal employees for free; check here to see if your agency provides access. The Guide is also available for purchase and GovExec readers can save 20% by entering promo code GovExec at checkout.

NEXT STORY: TSP Portfolios Report a Mixed Bag of May Returns