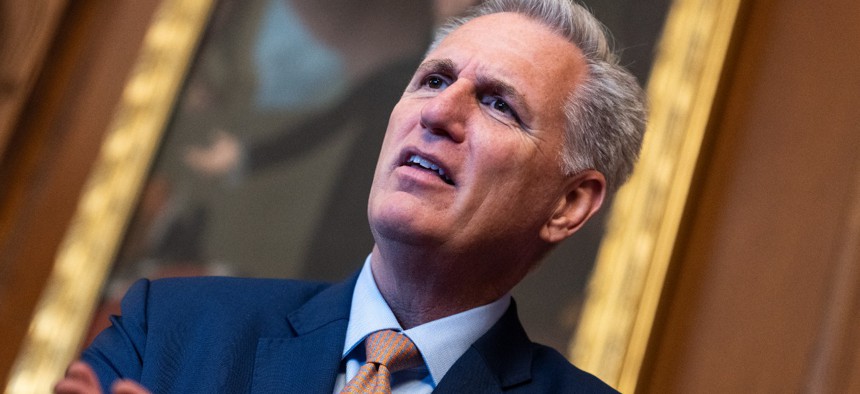

House Speaker Kevin McCarthy, R-Calif., is seen in the U.S. Capitol on April 20. Tom Williams/CQ-Roll Call, Inc via Getty Images

The TSP Wouldn’t Be Affected By McCarthy’s Plan to Raise the Debt Ceiling and Cut Spending

The House could vote on the plan later this week.

House Speaker Kevin McCarthy’s plan to couple raising the debt ceiling with dramatic cuts of more than 20% to discretionary domestic spending would not affect the Thrift Savings Plan, the director of the retirement savings program’s Office of External Affairs said Tuesday.

Nothing in the plan–which the House could vote on later this week–would directly impact the TSP, said Kim Weaver, during the monthly meeting of the Federal Retirement Thrift Investment Board. McCarthy’s proposal is Republicans’ opening salvo in negotiations to raise the debt ceiling and avoid what would be the United States’ first ever default on its financial obligations. It is unlikely to pass the Democratic-controlled Senate, and President Biden has said he supports a “clean” bill to raise or suspend the debt ceiling.

A recent estimate from Moody’s Analytics placed the deadline for raising the debt ceiling at Aug. 18, and a top economist at Moody’s said failure to do so would have “cataclysmic” consequences for the U.S. economy in general. Weaver said it is too early to discuss whether or how TSP is preparing for the possibility of a default, in response to a follow-up question after Tuesday’s meeting.

One indirect effect of the debt ceiling situation on the TSP so far is that reinvestments of the government securities (G) fund were suspended in January, as part of “extraordinary measures” the Treasury took to buy more time until a default. This is a standard response when the United States gets close to the debt limit and the fund is made whole after the debt ceiling is raised, meaning there is no lasting harm to TSP participants.

It is unclear what would happen to federal employees in the scenario of a default, but analysts have said that either the Treasury would delay all payments until it had enough money to make them, or it would prioritize which bills got paid. Both situations raise the prospect of federal employees either being furloughed or required to work with a delayed paycheck.