PLG / iStock.com

Why a Health Savings Account is a Secret Weapon in Saving for Retirement

Many federal employees can save money by switching to a high deductible health insurance plan with an HSA when they have the chance.

Federal employment has an extra perk hiding in plain sight, but it’s often overlooked. The Federal Employees Health Benefits Program has many different plan types, but one gives federal employees an additional way to save money for retirement. Contributions to health savings accounts offered by high deductible health plans are not taxed initially, grow tax free and can be used for out-of-pocket medical expenses while you’re working as well as after retirement. They can also be used for non-medical expenses after age 65 without penalty, except for the same tax obligations that apply to withdrawals from other retirement accounts, such as those in the Thrift Savings Plan.

Here are the basics of high deductible health plans, the savings you can potentially realize by switching to one, and how to save for both your retirement and future health care expenses through an HSA.

How High Deductible Health Plans Work

HDHPs encourage plan enrollees to be mindful health care consumers because of their high deductibles. Before the deductible, you’ll pay the full amount allowed by the plan for health services, and after the deductible—like all health insurance plans—you’ll generally pay a percentage of billed expenses, usually 5%-20% depending on the plan.

To help you out before the deductible is met, all HDHPs provide free preventive care within the plan network, which includes annual physicals, mammograms, well child visits and immunizations.

All HDHPs for federal employees also fund an HSA to help with out-of-pocket expenses, either as they are incurred or to use for reimbursement in the future. The contribution amount varies by plan and enrollment type and ranges from $750 to $1,200 per year for self-only enrollment and from $1,500 to $2,400 annually for self-plus-one and self-family enrollments. The plan contributions to your HSA are spread out over the year and are deposited monthly into your HSA.

You may make additional voluntary contributions into your HSA, but there are Internal Revenue Service limits in place. In 2022, for self-only enrollment, the combined contributions from the plan and the enrollee cannot exceed $3,650. For self-plus-one and self-family enrollments, the combined contributions cannot exceed $7,300. These limits are set by the Treasury Department and are increased every year based on inflation. Voluntary contributions can be made as paycheck deductions or as a lump sum into the account.

The HSA will be managed by a financial services company, and you’ll have the same investment options as you would with an individual retirement account and many more options than you’d have for the Thrift Savings Plan. Any unused funds in your account will roll over to the following year, and there is no rollover cap. Your HSA is owned by you, the enrollee, which means it’s fully portable and if you leave federal service or switch FEHBP plans, you’ll always have access to your HSA.

Cost of Health Care Services in a High Deductible Health Plan

HDHPs do not provide cost information for health care services before the deductible in the official plan brochures or other marketing materials, leaving federal employees to wonder what a service’s full allowed amount is, and how to calculate a percentage of the amount after the deductible if the service does not have a fixed co-pay. Of course, this information gap ends when services are provided and you receive the bill. But advance information will often be very important for financial planning or even for deciding whether you want to incur the cost of a particular procedure.

While inconvenient, there are two workarounds that can reduce this problem: Call the plan or call the provider. If you call the plan and ask how much it costs for a primary care visit or urgent care visit, the plan will provide that information, allowing you to better predict the out-of-pocket expenses you’ll face. Also, the doctor, or staff, will presumably know what the charge will be and should know what other expenses may be required before or after the procedure (x-rays, drugs, follow-up visits, etc.).

High Deductible Health Plans Available to Federal Employees

There are a handful of high deductible health plans available nationwide—GEHA HDHP, MHBP HDHP and Aetna HealthFund HDHP. In the Washington, D.C. area you’ll also be able to enroll in CareFirst HDHP, HealthKeepers HDHP (VA only), and United HDHP. Outside of the D.C. area you’ll find the Humana HDHP available in many parts of the country.

The plan websites do an excellent job describing how the HDHPs work and you can learn more about available HDHPs at Consumer Checkbook’s Guide to Health Plans for Federal Employees and the Office of Personnel Management plan comparison tool.

How Much Money Can You Save By Switching to an HDHP?

Most federal employees will save money by switching from their current health insurance plan to an HDHP. Although they have high deductibles, HDHPs generally have lower premiums than non-HDHPs, plus they have the added benefit of plan HSA contributions.

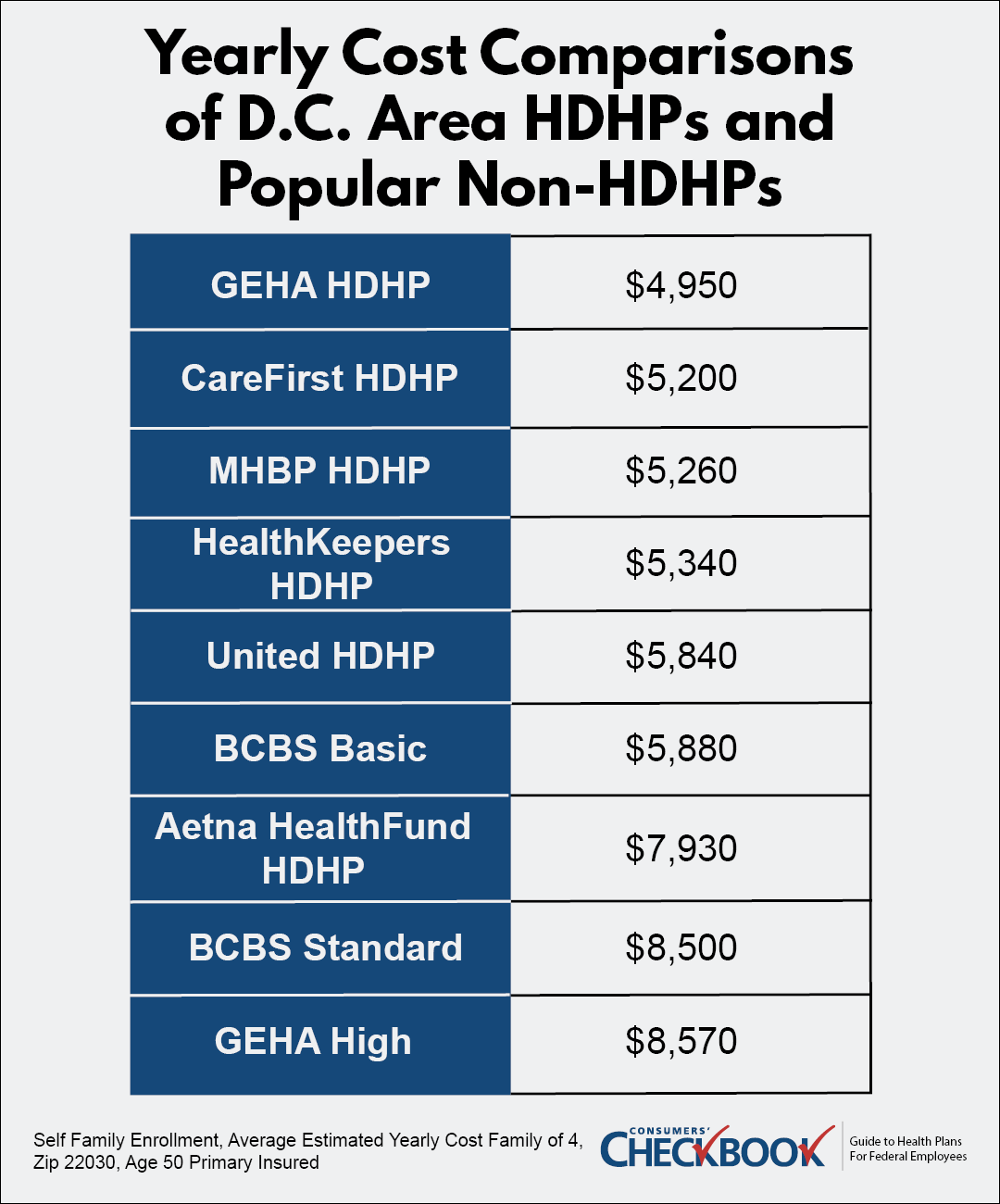

Checkbook’s Guide provides a total cost estimate for every FEHB plan, which is the combination of for-sure expenses (premiums) and the likely out-of-pocket expenses you’ll experience based on your age, family size and expected health care usage.

In 2022, a family of four in the Washington, D.C. area with average health care expenses could save about $3,500 a year by switching from Blue Cross Standard or GEHA High to GEHA HDHP.

The Full Potential of the HSA

To realize the full potential of your HSA, you’ll want to try to preserve the plan contribution and, if you can afford to, make additional voluntary contributions. Any additional contributions you make will be triple tax advantaged—they go in tax free, grow tax free and leave tax free if used for qualified medical expenses.

Here are two things you can do to help preserve the HSA plan contribution:

- If you’re switching to an HDHP from a more expensive plan, contribute the premium difference into your HSA. Since you’re already used to paying a higher premium, this move will be budget neutral. You’ll have extra funds in your HSA that can be used for out-of-pocket healthcare expenses, which will increase your chances of keeping the plan HSA contribution invested and growing over time.

- Consider taking out a limited expense flexible spending account (LEXHCFSA). The IRS does not allow for someone to have both an HSA and a general-purpose FSA. However, you are allowed to have a LEXHCFSA with an HSA, but it can only be used for qualified dental and vision expenses. With the LEXHCFSA you won’t have to use your HSA for those expenses, which will help you save it for other out-of-pocket medical expenses or keep the plan HSA contribution intact.

Save for Your Retirement with an HSA

As you approach retirement, you have an opportunity to contribute even more to your HSA. Once you turn 55, you’ll be able to contribute an additional $1,000 per year as a “catch-up” contribution on top of the normal contribution maximum.

Once you turn 65, a big change with your HSA takes place: You’re allowed to take non-medical distributions and only pay your normal tax obligations. Prior to age 65, non-medical distributions would create a 20% income-tax penalty on top of your normal taxes. This change gives you more flexibility on how to use your HSA funds, including as supplemental retirement income.

Of course there are other qualified expenses that you can choose to use your HSA for in retirement and pay no taxes on. The premium for long-term care insurance, which pays for nursing homes and assisted living centers, is a qualified expense, as are Medicare Part B and Part D premiums both for you and a spouse.

The Final Word

For most federal employees, an HDHP will be the least costly plan option available, especially when considered as a long-term option. The HSA that accompanies the plan helps to pay for out-of-pocket health expenses now and in the future. If you’re able to preserve the plan contribution and make additional contributions into the account, the HSA can grow very fast. We’ve heard from many federal employees that have HSAs with a balance of $50,000 or more because they’ve been enrolled in an HDHP for many years and have contributed the max every year. And, when you turn 65, the HSA becomes a multi-purpose super weapon that can help pay for almost every health care expense you’ll face or be used as an extra source of income.

However, federal employees are on borrowed time to maximize the tax-preferred benefits of an HSA. Once you retire and are on Medicare, you no longer qualify to receive an HSA from an HDHP and you can no longer make voluntary contributions to your HSA.

New employees and employees with qualifying life events that allow for switching plans outside of Open Season would be wise to consider an HDHP in 2022, and all federal employees should consider one during the 2023 Open Season at the end of the year.

Kevin Moss is a senior editor with Consumers’ Checkbook. Checkbook’s Guide to Health Plans for Federal Employees is available to many federal employees for free; check here to see if your agency provides access. The Guide is also available for purchase and Government Executive readers can save 20% by entering promo code GOVEXEC at checkout.