Why the U.S. Government Never, Ever Has to Pay Back All Its Debt

Governments really can, and do, borrow forever.

How will our children, grandchildren, and sundry other friends and relatives too young to see an R-rated movie unaccompanied ever pay back the entire debt the government is piling up now? Easy. They won't. The U.S. government is never completely debt-free (except for that one time it sold land seized from Native Americans).

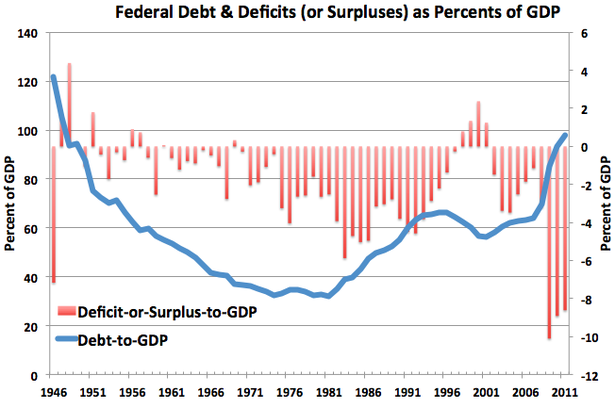

There's only one thing you need to know about the government. It's not a household. The government, unlike us, doesn't need to pay back its debts before it dies, because it doesn't die (barring secession or a sneak attack from across the world's longest unprotected border -- a most unworthwhile initiative). In other words, the government can just roll over its debts in perpetuity. That's the point Michael Kinsley misses when he says we "can't borrow forever," in an otherwise fine column trying to convince unemployment and deficit hawks that they actually agree on a "barbell" approach -- stimulus now, austerity later -- to fiscal policy. We can, and in fact have, borrowed forever. And that doesn't mean our debt burden will go up forever either. As you can see in the chart below, the government dramatically decreased its debt-to-GDP ratio in the three decades following World War II, despite mostly running deficits during the time.

(Note: This chart shows gross debt, which includes debt the government owes to itself, such as the Social Security trust fund. Debt-to-GDP is on the left axis; deficit-or-surplus-to-GDP on the right).

Here's the budget math. Between 1946 and 1974, debt-to-GDP fell from 121 to 32 percent, even though the government only ran surpluses in eight of those years (and the surpluses were generally much smaller than the deficits). That's because nominal GDP -- just the cash size of the economy -- grew much faster than debt did. As Greg Ip of The Economist points out, fast nominal GDP growth, and the easy monetary policy that requires, is the only way governments have ever successfully reduced debt ratios in the past. Austerity alone will fail. (See Europe).

Read more at The Atlantic.