- PreviousWhat's Out There? DoD Retirement Resources, ExploredPrevious:What's Out There? DoD Retirement Resources, Explored

- Next The Federal Long Term Care Insurance Program Perspective—Preparing for the UnexpectedNext: The Federal Long Term Care Insurance Program Perspective—Preparing for the Unexpected

Safeguarding Your Future: Comprehensive Retirement Planning in the DoD

StartRetirement planning may seem like a daunting task, but there are a host of resources federal employees and active duty military personnel can use to stay informed.

Through secondary research, first-hand interviews, and a survey of nearly 300 members of the defense community, Government Business Council (GBC) was able to visualize the state of retirement and long-term care across defense branches and agencies. Click through this GBC insight card stack to see what we learned and what steps you can take to prepare for the road ahead.

Contents

- Federal and Survey Retirement Statistics

- Federal and Survey Retirement Statistics (pt. 2)

- What's Out There? DoD Retirement Resources, Explored

- Retirement in the Department of Defense

- Sponsored: The Federal Long Term Care Insurance Program Perspective—Preparing for the Unexpected

- You’ve Considered Savings, But How About Care?

- Known and Unknown Benefits of Insurance

- Providing for One’s Self and Loved Ones

- Looking Ahead

1/9

Federal and Survey Retirement Statistics

As the average age of retirement rises, we must pay attention to some of the reasons behind this trend. In “Executive Branch Retirement Statistics: Fiscal Years 2007 - 2016,” the Office of Personnel Management (OPM) reports that the average retirement age in the Executive Branch rose from 59.5 to 61.8 years between during fiscal years 2007 - 2016.

Source: "Executive Branch Retirement Statistics: Fiscal Years 2007 – 2016," Office of Personnel management. February 2017. So, why are people retiring? To find out, GBC conducted a survey of active duty military members and Department of Defense (DoD) civilians on retirement planning and long-term care considerations in the defense community. We discovered that the top three reasons for retirement among respondents are intuitive yet salient—expecting retirees want to:

- Take time off for leisure/new interests,

- Spend more time with family/friends, and

- Have confidence in the knowledge that they have saved enough for retirement.

Additionally, a plurality (45%) of respondents are more concerned about financial preparedness than mental preparedness—much larger than the share of active duty military and DoD civilians indicating the opposite concern (8%). This may be underlying federal employees’ decisions to retire later in their careers—they will not retire until they are confident about their finances and investments.

2/9

Federal and Survey Retirement Statistics (pt. 2)

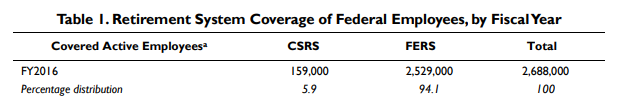

In the same survey of DoD employees, GBC learned that more than three-quarters (79%) of respondents feel at least somewhat prepared for retirement. A greater majority of so-called ‘pre-retirement’ DoD employees (i.e., active duty military or DoD civilians five years or fewer away from retirement) feel at least somewhat prepared (87%). Conversely, nearly one-fifth (19%) of respondents reported feeling unprepared for retirement—the lion’s share of these individuals were in the early or middle stages of their federal government careers, with 10 years or more until retirement.

Source: "Charting the Course: Evaluating Retirement Preparedness in the DoD," Government Business Council. June 2018. In a 2017 study of retirement readiness that drew from a sample of thousands of individuals, nationally representative findings show that most Americans do not have high confidence in their retirement plans or savings: Only thirty percent of Americans feel that their retirement plans are “very well developed”, and slightly more than one-quarter feel that that they have already saved enough for retirement.

There is evidence that trepidation about prospects about financial and emotional preparedness dissipate as individuals advance in their careers—for example, senior-level members of both the active duty military and DoD civilian workforce report greater levels of resource access than less-tenured counterparts—but it’s also possible that some of this information comes a bit too late to be useful.

3/9

What's Out There? DoD Retirement Resources, Explored

The Department of Defense (DoD) offers a variety of informational resources and events for retirees. The Defense Finance and Accounting Services (DFAS) provides information on retirement planning as well as a retirement application checklist for military retirees through Retired Military and Annuitant Pay. Collectively, the defense community celebrates Retiree Appreciation Day during which veterans, retirees, and their families can receive retirement information and medical checkups.

When asked about experience with agency resources, one retiree who participated in the GBC study shared, “[The intelligence community and DoD] have retirement seminars at mid-career and end-of-career points that are very excellent so I had lots of information available.” Still, other respondents were less enthusiastic: Less than one-quarter of those surveyed in GBC’s study reported receiving retirement resources outside retirement classes and workshops, while 11% indicated that they had received no preparation to date.

Despite feeling dissatisfied with the resources provided by their agency, members of the defense community can take other steps to prepare themselves for retirement. The survey respondent mentioned earlier provided insight into this process:

“I read constantly, subscribe to a lot of [publications], and religiously read Tammy Flanagan’s column. I used the information in her columns to do my calculations before I submitted anything for retirement to my agency, and they were spot on.”

So, what can members of the active duty military and DoD civilians do to provide for their own retirement preparation?

- Next The Federal Long Term Care Insurance Program Perspective—Preparing for the UnexpectedNext: The Federal Long Term Care Insurance Program Perspective—Preparing for the UnexpectedPreviousWhat's Out There? DoD Retirement Resources, ExploredPrevious:What's Out There? DoD Retirement Resources, Explored

4/9

Retirement in the Department of Defense

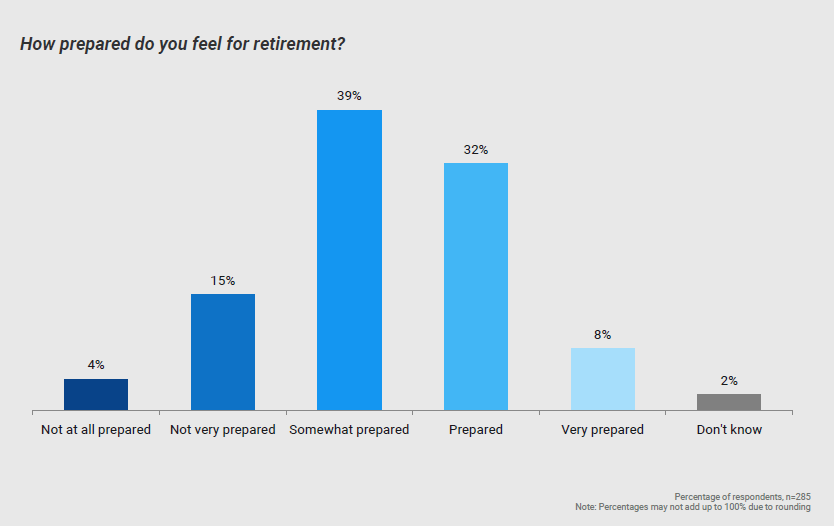

Due to the existence of numerous retirement plans, understanding the nuances of each can take a bit of effort. In a previous set of insight cards on retirement planning, GBC outlined the key points of the Federal Employees Retirement System (FERS) and the Civil Service Retirement System (CSRS), the two largest systems covering federal employees.

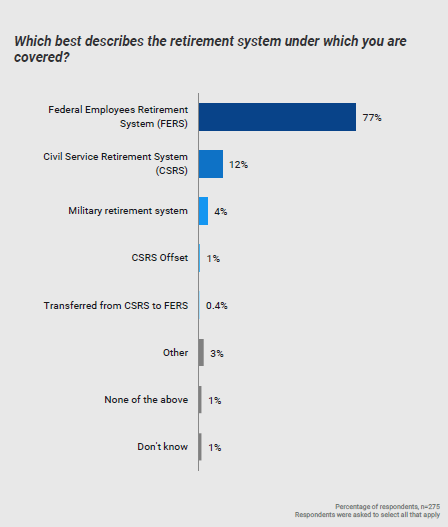

Source: "Charting the Course: Evaluating Retirement Preparedness in the DoD," Government Business Council. June 2018. Given that most of the respondents to GBC’s retirement and long term care survey were DoD civilians and a smaller share were active duty military, it’s not surprising that more than three quarters reported being covered under FERS and 12% indicated CSRS as their retirement system. Indeed, these findings are in line with a FY2016 report by the Congressional Research Service (CRS), which found that 94% of civilian federal employees were enrolled in FERS and 5% were enrolled in CSRS.

Source: "Federal Employees’ Retirement System: Summary of Recent Trends," Congressional Research Service. February 2018. The 2016 National Defense Authorization Act (NDAA) created a new retirement program for members of the armed forces and their families. Known as the Blended Retirement System or BRS, this system mixes a new legacy pension program with the Thrift Savings Plan (TSP). As of January 12, 2018, more than 70,000 service members had opted into the BRS.

Interestingly, GBC found that respondents enrolled in a military retirement system were more likely to have access to career fairs and professional financial planning assistance—an indication of cross-organizational collaboration opportunities within the DoD.

Next The Federal Long Term Care Insurance Program Perspective—Preparing for the UnexpectedNext: The Federal Long Term Care Insurance Program Perspective—Preparing for the UnexpectedPreviousWhat's Out There? DoD Retirement Resources, ExploredPrevious:What's Out There? DoD Retirement Resources, Explored Sponsor Content What's this?

5/9

The Federal Long Term Care Insurance Program Perspective—Preparing for the Unexpected

Even the most well-built retirement plans are subject to unforeseen surprises. While enhanced planning resources can certainly go a long way towards getting members of the active duty military and DoD civilians financially and emotionally prepared, they are just the start of a bigger effort.

As the GBC survey findings show, just about everyone adopts a ‘family first’ mentality as they near retirement. Still, few Americans have specific knowledge about the likelihood that they will need to shoulder long term care costs—fewer still know how they can prepare for these costs and avoid painful expenses.

The Federal Long Term Care Insurance Program (FLTCIP) has been helping individuals safeguard their savings and peace of mind for nearly two decades. With so little long term care coverage offered under existing federal, military, and VA plans, there is tremendous value in securing effective and affordable care through FLTCIP. Whether you are a few short years from retirement or are just getting started in your DoD employment, there is no better time to learn about your options.

Visit our website to learn how FLTCIP can deliver security and comfort, and to see how we can help build comprehensive retirement for you and your family.

6/9

You’ve Considered Savings, But How About Care?

.jpg)

When planning for retirement, one factor to consider is the need for long-term care (LTC) and how to handle its costs. According to the GBC survey, only 20% of respondents are currently enrolled in LTC insurance programs, with an additional 39% intending to enroll at some point in the future. Both figures are relatively low and have caused some worry in healthcare circles.

According to materials published by the U.S. Department of Health and Human Services in 2017, there is a nearly 70% chance that someone turning 65 will need LTC in their post-retirement years. It is estimated that approximately two-thirds of the average 65-year-old’s projected period of long-term care is expected to be spent at home, while the remaining third is typically spent in a nursing home or assisted living facility.

Given varying levels of awareness, some see LTC insurance programs as expensive and unnecessary—almost half of the respondents to GBC’s survey said that prohibitive costs or investing finances elsewhere influenced their decision to opt out of LTC insurance.

However, these values change as information levels increase: Although relatively few respondents to the GBC study report receiving long-term care education in the workplace, the overwhelming majority of those surveyed are concerned with the long-term well being of their families and report this as a major consideration in their retirement plans. Managing this reality for one’s self and loved ones is a tricky but not insurmountable challenge.

7/9

Known and Unknown Benefits of Insurance

Long-term care is the largest out-of-pocket expenditure risk for the elderly. According to “Long-Term Care Insurance Demand Limited By Beliefs About Needs, Concerns About Insurers, And Care Available From Family,” a study published in Health Affairs, long-term care insurance rates have historically been low due to retirees’ tendency to discount real risks to personal and financial well-being. Thus, there is a real risk to opting out of LTC insurance: Having to pay out of pocket or draw from savings can be devastating in a high-cost healthcare environment.

GBC’s recent study confirms at least part of this situation—one respondent shared insights about long-term care: “My brother [told me about] folks who did not invest in LTC insurance at a younger age and here they are, they need the assisted care but the family can’t afford it. There is value to [long-term care] but it’s a tough balance.”

When asked about his own experience with LTC planning resources in the DoD, the respondent confirmed GBC’s broader quantitative findings, stating, “Most of the stuff I’ve seen has been highlighting retirement… I haven’t heard anything about long-term care—I’ve only heard that from my brother.”

As important as family connections are for knowledge-sharing, employers bear at least some of the responsibility associated with informing their workforce.

8/9

Providing for One’s Self and Loved Ones

.jpg)

The percent of veterans enrolled in LTC policies is consistent with the general U.S. population. The veteran population, on average, is older than the general population, and the number of veterans who have disabilities that are highly service-connected has increased.

All DoD employees are required to enroll in Medicare, but Medicare only pays for LTC if an individual requires skilled services or rehabilitative care. Medicare does not pay for non-skilled assistance with Activities of Daily Living (ADL), which constitute the majority of long-term care services. Additionally, Medicare generally only pays for stays shorter than 90 days in length, involving rehabilitative care.

To supplement Medicare, the VA pays for service-related disabilities, as well as other programs such as nursing homes and at-home care. The VA also provides non-service related disability coverage for those unable to pay and offers programs to help veterans receive LTC in their homes.

Still, gaps in coverage arise, and individuals across job functions and pay grades can find themselves making difficult post-retirement decisions to finance personal care or the care of their loved ones.

- Start Over

9/9

Looking Ahead

Retirement planning can be exhausting and challenging, but military members on active duty and DoD civilian employees should not feel alone. The DoD offers various informational resources and seminars to help individuals plan responsibly for retirement, including the nuances of effective savings and the importance of mental preparation. A number of online publications and sources—some of which are mentioned in this card stack—can be helpful in plugging knowledge gaps. Additionally, individuals preparing for retirement may want to consider professional advice and guidance—a number of those interviewed by GBC have indicated benefiting from conversations with both financial preparedness and long term care experts.

While the fundamentals of financial preparation are covered at great length, lesser-mentioned aspects of retirement like mental preparedness and ensuring adequate long term care are key to success and happiness in life after work. Individuals looking to retire from DoD-based federal employment should fully utilize the opportunities available to them and seek additional information wherever it resides.