Flickr user Howard Lake

Has the IRS Become Gun-Shy on Regulating Nonprofits?

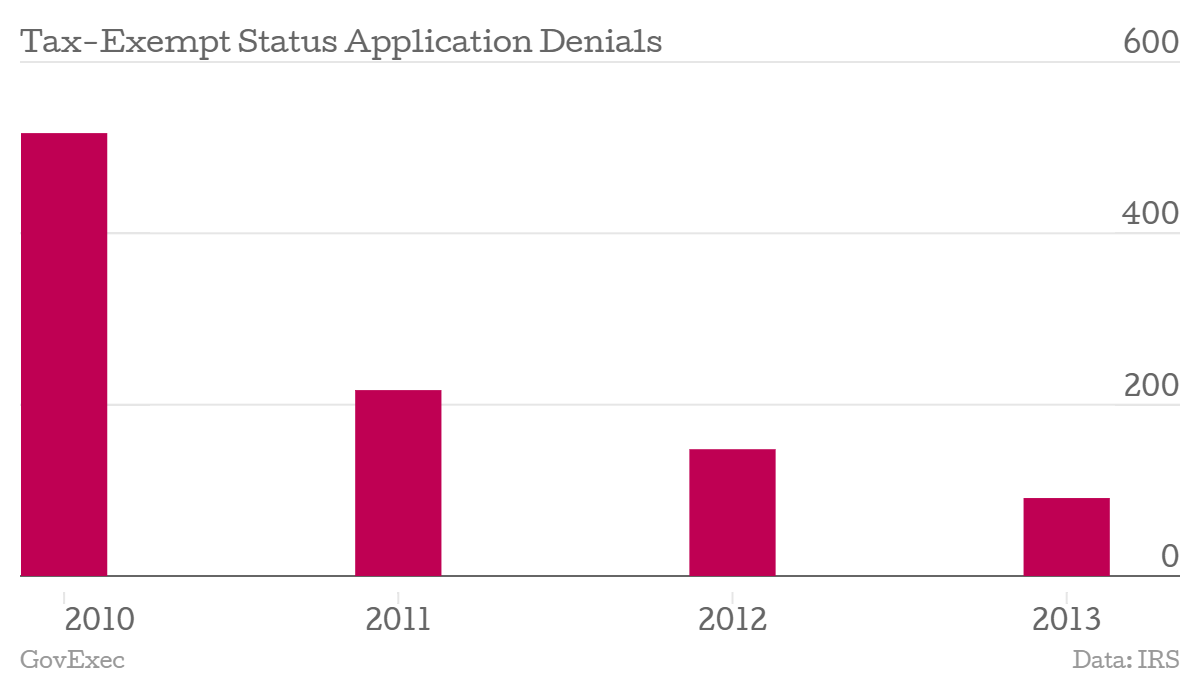

The number of organizations denied tax exempt status dropped precipitously between 2010 and 2013.

Tax-exempt status denied, said the July 25 form letter from the Internal Revenue Service.

The unnamed applicant for status as a charity appears to be a mind-control group, “dedicated to protecting the human rights of defenseless victims of involuntary microwave and mind control attacks,” according to an Aug. 18 report in Accounting Today .

The denial of status as a charitable or educational group—attributed to the group’s having advocated for legislation—might be a sign that the tax agency is functioning undeterred after 15 months of steady congressional hearings and multiple investigations into its alleged political targeting of conservative nonprofits.

But that’s not likely, according to some close observers. Marcus Owens, former director of the IRS Exempt Organizations division and now an attorney at Caplin and Drysdale, says his old division is “distracted” by congressional demands for records. “It takes up a huge amount of manpower with significant costs,” he said.

And because IRS management must allocate most of its scarce resources to collecting taxes, tax-exempt organizations are a lower priority, Owens added. “That division seems to particularly irritate senior members of Congress, so why poke a bear?”

Paul Streckfus, a tax attorney who edits a newsletter on exempt organizations, recently called the picture at the division “dismal,” adding that, despite some good new talent, “nothing has been been moving in the right direction, and it’s too easy to imitate House Republicans and blame it all on [resigned division chief] Lois Lerner.” Streckfus listed six important EO guidance projects “frozen in time,” among them proposed new rules for evaluating eligibility of social welfare groups for exemptions. Under the tax code, such groups may engage in limited political activity, which can make it especially tricky to determine their eligibility for tax-exempt status.

In July, the nonprofit Center for Public Integrity released the results of a six-month study that concluded, “the tea party scandal, combined with Congress systematically stripping the IRS of resources and clout over decades, has led to an exempt organizations division that has all but quit regulating politically active nonprofits in any consistent, demonstrable way.”

Growing Workload, Shrinking Staff

The division “bled 14 percent of its staff positions during the past two decades while the number of nonprofits it regulates has grown by more than 40 percent,” the reporters’ group found. Staff scaled back inquiries and the number of nonprofit group tax returns investigated recently fell by 10 percent, from 11,699 in 2011 to 10,575 last year. Overall, the study found, “EO reduced the number of denials for exempt status for social welfare nonprofits from nearly 4 percent during the early 1980s to less than a quarter-percent in 2013.”

Finally, the division has yet to weigh in on the application for “social welfare” status from one of the most controversial nonprofit groups, Crossroads GPS, affiliated with Republican political strategist Karl Rove. On May 6, the pro-campaign finance regulation group Democracy 21, joined by the Campaign Legal Center, urged the IRS to deny the application, calling Crossroads GPS “a campaign operation formed to hide the donors who are financing the campaign expenditures the group makes.” (The IRS does not speak publicly on individual pending applications.)

Notions that the IRS has been intimidated don’t wash with conservatives who’ve seized on the political targeting scandal. A spokesman for the House Oversight and Government Reform Committee told Government Executive that interviews with IRS staff show that the Exempt Organizations division was not addressing a real problem but instead was silencing critics of the administration. “If there is a slowdown, it’s the result of IRS mismanagement and wrongful attempts to silence people,” he said.

Cleta Mitchell, a Washington attorney and conservative activist who represents Tea Party groups attacking the IRS, said she laughed at the suggestion that the IRS is intimidated. “The powers that be in the D.C. office of the IRS took a perfectly well functioning system and broke it,” she said. Mitchell added that she advises her clients now to not bother applying for social welfare group status—under section 501(c)(4) of the tax code—saying it appears that the IRS “has decided on its own to stop processing new applications until an applicant has been in existence for a lengthy period. Applying is not required and subjects an applicant to needless harassment and unnecessary expense.”

Asked for comment, the IRS produced several documents on the Exempt Organizations division’s progress in expediting processing for the backlog of 60,000 of all types of tax-exempt applications that were delayed for months or even years, as reported in a May 2013 report by the Treasury Inspector General for Tax Administration. “Ninety-seven percent of applications for tax-exempt status under Sections (c)(3), (c)(4) and other categories in open inventory [that were] over a year old at the beginning of the fiscal year have been closed, and we are on pace to close almost all by the end of the calendar year,” the agency said.

Streamlining Operations

The IRS receives about 70,000 applications for tax-exempt status annually. Its data show the number of disapprovals for all categories of tax-exempt status has declined significantly, from 517 in fiscal 2010 to 91 in 2013.

As for the backlog of under 150 applications from groups claiming to be social welfare organizations, data updated monthly show that as of Aug. 18, 132 cases (91 percent) have been closed, including 31 denials.

To respond to critics and to act on a recommendation by the Treasury inspector general, the IRS since June has been working to streamline the applications processing , in part by allowing some organizations to “self-certify” as social welfare groups.

On July 1, Commissioner John Koskinen announced a new, shorter application form to help small charities apply for tax-exempt status—section 501(c)(3) in the tax code—more easily. The three-page Form 1023-EZ is expected to expedite processing and free the IRS up to focus on larger groups, Koskinen said.

But critics see the streamlining as a retreat from tough enforcement. National Taxpayer Advocate Nina Olson, in her June mid-year report, said, the IRS’ ability to monitor compliance once an organization obtains tax-exempt status is limited because groups with receipts of less than $50,000 have minimal reporting obligations. “The taxpaying public will have little or no ability to determine whether an organization is conforming with the purpose for which it was granted tax exemption,” she wrote.

For others, the issue is less whether the IRS is intimidated when processing tax-exempt applications but whether it lays out clear rules for deterring future political activity by exempt groups. A joint IRS-Treasury Department proposal for determining the proper balance between social welfare and political activity released last November drew a record 150,000 comments from the left and the right. In response to the comments, officials are now reworking the rules.

Longtime campaign finance reform advocate Fred Wertheimer, president of Democracy 21, told Government Executive there is “no question that the focus on IRS dealings with conservative groups took up a lot of attention and energy and, in our view, diverted a focus away from the fact that large groups were misusing the tax laws to hide their donors. But the key issue is what they do on issuing new regulations on eligibility,” he said.

“In the end, the test of whether we will be able to stop hundreds of millions of dollars in secret contributions from flowing into our elections rests with what IRS does on the current rulemaking procedures. I do not believe they have been intimidated so far on that rule making,” Wertheimer said. “The IRS can put an end to dark money in federal election, I’m not writing off that as a possibility for next year.”

( Image via Flickr user Howard Lake )

NEXT STORY: To RIF or Not to RIF