Author Archive

Amelia Gruber

Managing Editor

Amelia Gruber covered management and contracting for Government Executive for three years before becoming an editor. She also has worked as an editor at Roll Call newspaper and as a research assistant at the Urban Institute. She holds a bachelor’s degree from Carleton College, with a major in economics, and a master’s degree from the Medill School of Journalism at Northwestern University.

Amelia Gruber covered management and contracting for Government Executive for three years before becoming an editor. She also has worked as an editor at Roll Call newspaper and as a research assistant at the Urban Institute. She holds a bachelor’s degree from Carleton College, with a major in economics, and a master’s degree from the Medill School of Journalism at Northwestern University.

Oversight

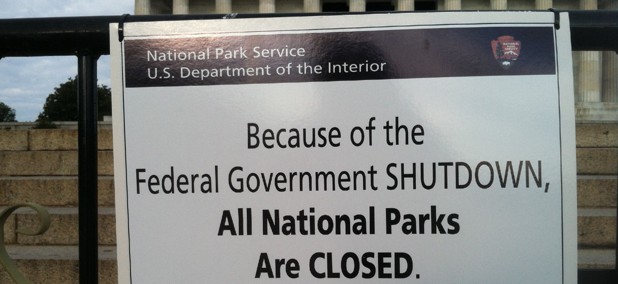

From shutdown prospects to anti-telework bills: 5 things to watch when Congress returns

Pending legislation could affect federal employees' work-life balance, civil service protections, TSP investment options and more.

- Amelia Gruber

Management

Proposed contractor climate change rule faces more questions from Republican lawmakers

House overseers demand a briefing from acquisition officials on the draft regulation requiring companies doing business with the federal government to report on their greenhouse gas emissions.

- Amelia Gruber

Workforce

House Republicans question the SEC’s hiring and pay practices

The chairman of the House Oversight and Accountability Committee wants to know more about the agency’s use of a program designed to bring on skilled hires for short-term rotations.

- Amelia Gruber

Management

New guidance will help agencies get underserved communities more involved in the regulatory process

The Biden administration is working to ensure that people who are affected have a chance to weigh in as rules are being developed.

- Amelia Gruber

Workforce

Homeland Security law enforcement officers would receive more mental health support, under a bill advancing in the House

Bipartisan legislation reported out of committee earlier this week comes in the wake of an uptick of suicides among border personnel.

- Amelia Gruber

Pay & Benefits

OPM establishes emergency leave transfer program to help feds affected by Typhoon Mawar

The typhoon devastated U.S. territories that are home to federal employees.

- Amelia Gruber

Management

House oversight panel votes to overturn Biden contracting policies and cut funding for unauthorized programs

Democrats object to measures targeting labor- and climate-friendly executive orders.

- Amelia Gruber

Workforce

It's Official: No More COVID Vaccine Mandate for Federal Workers and Contractors

The move comes just days before the end of the public health emergency for COVID, and had been expected.

- Amelia Gruber

Pay & Benefits

TSP Returns Stayed Mostly Positive for April

All but one of the five individual funds in the retirement savings program grew for the month, and all were in the black so far for the year.

- Amelia Gruber

Pay & Benefits

The TSP Wouldn’t Be Affected By McCarthy’s Plan to Raise the Debt Ceiling and Cut Spending

The House could vote on the plan later this week.

- Amelia Gruber

Workforce

How Would Your Agency Do Under Biden's 2024 Budget Request?

Only two Cabinet level departments would see decreases under the plan.

- Amelia Gruber and Ross Gianfortune

Pay & Benefits

How to Calculate Your 2023 Pay Raise, and More Pressure to Return to the Office

A weekly roundup of pay and benefits news.

- Amelia Gruber

Pay & Benefits

Almost Every TSP Fund Ended Last Month (and Year) Down

The government securities (G) fund was the only offering in the retirement savings program that gained ground in 2022.

- Amelia Gruber

Pay & Benefits

It Could Soon Get Even Easier for Feds to Qualify for Student Loan Forgiveness

The Education Department has proposed a package of regulatory reforms aimed at making loan forgiveness programs more accessible.

- Amelia Gruber

Pay & Benefits

More Help Is On the Way for Feds With TSP Transition Troubles, and Those Affected By Flooding

A weekly roundup of pay and benefits news.

- Amelia Gruber

Pay & Benefits

Some Federal Employee Retirement Funds Made Up a Little Ground in March

Three of the TSP’s five basic funds ended the month up and all of the lifecycle funds were in the black.

- Amelia Gruber

Management

Biden Wants to Give Nearly Every Agency a Big Budget Boost. How Much Would Your Agency Get?

All of the Cabinet level agencies would see an increase in discretionary funding under the president’s $5.8 trillion fiscal 2023 budget request.

- Ross Gianfortune and Amelia Gruber

Management

Two Years Later: How the Pandemic Has Changed the Jobs and Lives of Some Federal Workers

Readers share the challenges–and silver linings–of working and keeping themselves, their families and their colleagues safe during the COVID-19 pandemic.

- Courtney Bublé, Ross Gianfortune, Amelia Gruber, Eric Katz and Erich Wagner

Pay & Benefits

New Pay Tables Released: Calculate Your 2022 Raise

The average increase will be 2.7% for civilian employees, but the exact figure will vary based on where you live.

- Amelia Gruber

Pay & Benefits

What Federal Employees Should Know About Their Pay If There Is a Shutdown at the End of This Month

Unlike previous closures, furloughed workers would be guaranteed retroactive compensation once government reopens.

- Amelia Gruber