Shutterstock

Nearly 8 in 10 Feds Have Had Experience with Long Term Care

Approximately 10,000 baby boomers are reaching retirement age per day - a social shift that holds wide-ranging implications for the aging federal workforce. The subject of long term care is a key part of this increasingly salient conversation on health and retirement: according to the U.S. Department of Health and Human Services (HHS), about 70% of people turning age 65 will need long term care services at some point in their lives. However, long term care is by no means solely applicable to the elderly: nearly 41% of care is provided to people under the age of 65 whose ability to care for themselves is limited by illness, injury, chronic disability, and other complications.

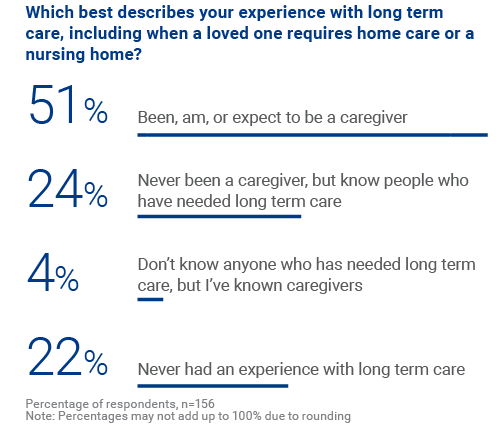

In an effort to learn more about federal employees' perspectives on long term care, Government Business Council conducted a flash poll on September 3 asking the following question:

GBC received responses from 156 federal employees representing more than 35 civilian and defense agencies. Over half of the respondents stated that they had been, were, or expected to be caregivers. Of the respondents who did not expect to personally provide care, 28% still reported knowing either caregivers or people who have required care. Only 22% of federal employees stated that they had never had an experience with long term care.

Respondents reporting involvement in care provision are at least as impacted by the realities of long term care as are care recipients. Long term care, which is most commonly performed at home by loved ones rather than by nursing homes and other professional facilities, often entails around-the-clock, hands-on assistance in daily tasks. Moreover, it can be an enormous and increasingly unsustainable strain on people who lack formal training for providing such care. The chronic physical and mental stress attached to caregiving has led policymakers and the Centers for Disease Control and Prevention (CDC) to regard it as a major public health issue, with focus increasingly turning toward expanding caregiver support and resources.

As supported by the results of this GBC poll, long term care should be a serious consideration for many federal employees, with government benefit programs like the Federal Long Term Care Insurance Program (FLTCIP) forming a potentially integral part of their retirement planning. Health insurance, Medicare, and Medicaid will rarely cover the full scope of long term care services, and investing in insurance is one way of accounting for their financial future. GBC will revisit this topic in future research posts.

This post is written by Government Business Council; it is not written by and does not necessarily reflect the views of Government Executive Media Group's editorial staff. Portions of this content are made possible by our sponsor, Federal Long Term Care Partners. For more information, see our advertising guidelines.