sponsor content What's this?

Fargo’s revamped purchase program maximizes efficiency

Presented by

Mastercard

The City of Fargo, North Dakota is turning heads these days. It’s not just the centerpiece and namesake of a new critically-acclaimed television show; it also happens to be one of the fastest growing locales in the Midwest, and is increasingly recognized for its quality of living, culture, and vibrant downtown scene.1

Much of that growth can be attributed to developments in recent years to maximize the city’s spend efficiency. Along with growth is a need to maximize the efficiency of the Finance functions. Fargo chose to revamp its purchasing program to maximize the City disbursement efficiency and replace lost investment income due to falling interest rates.

By taking a hard look at its finances, advocating change from within, and sourcing the best private sector expertise, Fargo put in place an improved purchase card program that yielded significant benefits — higher rebates, larger savings, and greater accountability to name only a few. This is the story of how Fargo put itself back on the map.

Fargo signs on for P-card programs

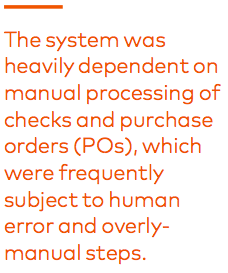

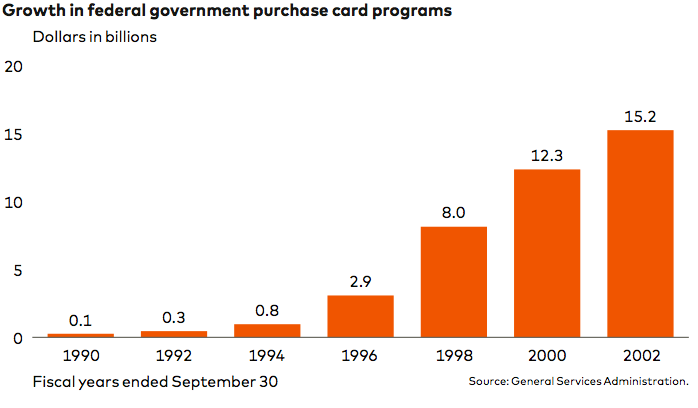

Fargo’s recent success finds its roots back in 2002, when it decided to supplement its traditional accounts payable system with a new purchase card (P-card) program with significantly expanded spending limits and Departmental authority. While P-card programs had been in effect since 1989, it wasn’t until the late 1990s that widespread adoption in government caught fire, spurred by a desire to give agencies a faster vehicle for acquiring goods and services directly from vendors.2

The government-issued cards were a welcome development over the previous model, which had required employees to issue checks and detailed purchase orders in a format many found tedious, inefficient, and time-consuming. Because P-cards preserved transactions electronically and consolidated purchasing in one reusable card, it was able to improve reporting integrity, internal controls, and remove much of the paperwork involved in drafting POs. As a result of these efficiencies, P-card programs were already responsible for $15.2 billion in government expenditures by 2002 when Fargo invested in its own program.3

The missing link

To be clear, Fargo did reap some of the benefits that were expected. Aside from less paperwork and streamlining of administration, the City saw higher-quality internal controls, improved reporting and data capture, and better pricing on goods from vendors. However, one of the primary benefits for switching over to the program did not take place as expected: from 2002 to 2012, Fargo failed to see a single dollar earned back in P-card rebates.

That’s because the program entailed a $3 million pay threshold to even meet the first-tier qualifier for a rebate. Since Fargo’s spend capped out at roughly $2.7 million, there was little motivation to even surpass the initial threshold. As Kent Costin, Finance Director for the City of Fargo, put it: “We thought P-cards were a great idea when we launched in 2002, however, it had a really high bar for rebates. We never felt the urgency to reach the rebate benchmark, because we thought it was fairly unattainable. The structure of the program prohibited us from being successful.”

To put this omission in perspective, just consider that the federal government received $3 billion back in refunds as a result of P-card purchase volumes during the same span of time.4 Granted, it’s not exactly fair to compare federal and local government expenditures, but it does show that Fargo hadn’t capitalized to the fullest degree.

Changing the playbook

Changing the playbook

The biggest challenge was obtaining buy-in from department leaders to move purchases to the P-card. In order to obtain buy-in, Costin’s team deployed some clever tactics. Since the Finance Department did the initial vendor calls to inquire about using a P-card, payments to those vendors on purchase orders and checks were intercepted and paid on P-cards by the Finance staff. During the transition period to grow P-card volume, non-compliant Departmental staff were called by the Finance staff requesting they use the P-card as the primary payment method. Using this direct method of communication changed payment methods quickly and reinforced program goals.

Another effective method was to issue P-cards to all staff involved in the purchasing process. Departments and individuals were issued cards with high spending limits and encouraged to use them for payments. By raising cardholder spend limits and revising policies to ensure payments met compliance, the Finance Committee and City Commission enacted the following measures:

-

Transferred reconciliation responsibility to individual employees, while providing department heads direct oversight and final approval of employee submissions.

-

All administrative decisions related to P-card purchases shifted to program analysts instead of Accounts Payable (AP) staff.

-

AP’s role as chief auditing division was revised to be lead processing.

The outcome

What came of these changes? For one, Fargo’s annual spend jumped from $2.7 million in 2012 to $16 million by 2015, a nearly 500% increase in value. It also added $426,000 in total rebates as a revenue source for the City’s General Fund, which is used to support such services as the police and fire department, and community development. It is telling that three years later, Fargo Mayor Timothy J. Mahoney pledged in his 2018 Preliminary Budget to continue investments in public services while seeking limited to no growth in the General Fund, a sign that the City is committed to dedicating financial support to citizen-specific needs.5

At least 375 cards have been issued to Fargo employees, covering nearly half of the City’s workforce. Consequently, check volumes are down by 30 percent, workload hours have reduced by nearly half of former levels, and streamlining of AP has dramatically sped up processing times and improved accountability.

Throughout the process, Costin never lost sight of the importance that cultural change and leadership plays in this effort. He says designating a champion to change behaviors is an essential catalyst for every organization looking to emulate Fargo’s example. “You’ve got to have a vision and a push to make it happen.”

Indeed, Fargo had a vision, they pushed to make it happen, and the rewards kept coming.

View a PDF version of this article here.

For more information or to request a demo on Mastercard SmartPay 3 solutions, please contact your Mastercard account representative.

This content is made possible by our sponsor. The editorial staff of Government Executive was not involved in its preparation.