sponsor content What's this?

Digital payments: what's ahead for agency leaders

Presented by

Mastercard

The SmartPay 3 (SP3) Master Contract provides the opportunity for agencies and organizations to incorporate value-added products and service offerings such as emerging technologies. As leaders evaluate digital payment options, Mastercard stands ready to discuss the innovations available to agencies and organizations with the SP3 Issuing Financial Institution.

Trends in digital payments:

Trends in digital payments:

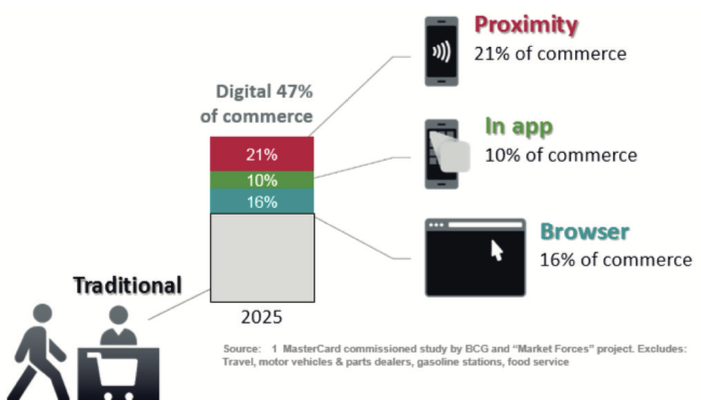

Through digital technologies, consumers, businesses, and governments are constantly connected — transforming the way they interact and transact. As connection among devices and entities grow, it is estimated that 47 percent of all payments could be digital by 2025 — giving consumers, businesses, and governments more possibilities when it comes to how they purchase goods and services

As such, Mastercard® is on the forefront of making payments more secure through our Mastercard Digital Enablement Services and more convenient through Masterpass™.

As more devices are becoming payment devices: mobile phones, tablets, watches, and even automobiles. The ubiquity of connected devices means that physical plastic cards are being replaced by connected mobile devices — which provide a more convenient and secure experience. It is estimated that the world’s five billion payment cards will be complemented by 20 billion payment tokens. This digital trend represents the biggest change in payments since the introduction of plastic, and agency leaders now have unprecedented opportunities to benefit.

While some agencies and organizations may have current internal policies that prevent the adoption of various new technologies, it is critical that agency leaders are familiar with and understand the options available in order to make the optimal decision for their organization. Through SP3, these innovations could be made available to an agency for adoption in the future.

Mastercard Digital Enablement Services

Mastercard is at the forefront of building a foundation for securing transactions made with devices through the Mastercard Digital Enablement Services (MDES). MDES allows for tokenization and digitization to create EMV-like security for digital payment transaction. Tokenization is the process of replacing a card’s primary account with a unique alternate card number, or “token.” Tokens can be used for mobile point-of-sale transactions, in-app purchases or online purchases. Tokenization helps reduce fraud related to digital payments by making transactions more secure by including a dynamic component with each transaction.

MDES supports both contactless payments from a mobile device at a physical point of sale and purchases made within a mobile app or online website. Transactions are secured using industry-standard EMV cryptography and take full advantage of the most secure payments technology in the world.

MasterpassTM Digital Wallet. Masterpass is a digital wallet that can enable cardholders to more securely store any of their payment cards and shipping addresses. With the Masterpass digital wallet, the individual could load multiple cards, such as an agency/organization’s GSA SmartPay 3 Purchase, Travel, Fleet and/or Integrated Card, and instantaneously choose the proper account for each transaction. Payments using Masterpass are now being made in the U.S. and more than 20 other countries. The Masterpass button is currently found on the websites and apps of more than 250,000 merchants worldwide, including those that would sell goods and services to your employees.

The value of digital payments

- Cardholders can access their Purchase, Travel, Fleet and/or Integrated Cards for point of sale, mobile application and online transactions through a single account.

- The use of tokenized credentials greatly reduces the risk of fraudulent transactions.

- Agencies receive the same detailed data for each transaction whether it is performed with a physical card or with a digital payment.

- The use of mobile apps and other secure card-not-present transactions help lower costs associated with post-fraud card re-issuance and replacement.

Digital payments in action

Digital payments in action

Contactless

Physical plastic cards can be complemented by existing mobile devices running iOS or Android and can be used to enable a more convenient experience.

Cardholders can tap their mobile devices on the merchant’s terminal to pay for goods and services. The transaction is more secure as the cardholder would also need to use a second authentication method such as a fingerprint or pin.

Merchants that currently accept contactless payments include global hotel companies, retail giants, major airlines, and many transit organizations.

In-App Payments

Cardholders can also choose to buy goods or services through a merchant’s mobile phone application.

They select a card from their digital wallet, check the transaction amount and enter the verification method associated with that card. The cardholder receives validation that the transaction was completed, and is more secure. The digital wallet then displays details of the completed transaction. Many popular merchants accept this payment method including leading network transportation companies and large office-supply retailers.

Mastercard, a leader in digital payments solutions.

As the digital revolution takes place, connected devices will become more prevalent over the next decade.

Mastercard is a leader in digital payments and can deliver its proven tokenization services for all major mobile payment and digital wallet solutions. The Mastercard Digital Enablement Service (MDES) powers transactions in thousands of mobile-pay-enabled merchant locations today.

View a PDF version of this article here.

For more information or to request a demo on Mastercard SmartPay 3 solutions, please contact your Mastercard account representative.

This content is made possible by our sponsor. The editorial staff of Government Executive was not involved in its preparation.