After Years of Cutting Funding, Republicans Seek to Privatize Part of the IRS

Advocates denounce the highway bill pay-for.

A new compromise package to fund the nation’s surface transportation projects would privatize a major function of the Internal Revenue Service, delighting Republican lawmakers looking to shrink the agency but rankling its advocates.

The highway funding bill crafted in the Senate by Majority Leader Mitch McConnell, R-Ky., and Sen. Barbara Boxer, D-Calif., is proposing to raise $2.4 billion by handing the task of tax collection over to private companies. The bill would require the Treasury Department and IRS to contract with private collection agencies as one of several pay-for provisions of the compromise highway bill.

Congress authorized the Treasury Department to contract out the task of recouping unpaid tax bills in 2006, but the agency phased out the program in 2009. The National Treasury Employees Union said on Wednesday the program proved unsuccessful, as the government was spending more on administrative fees and commissions to the companies than it took in.

“The use of PCAs to collect tax debts has repeatedly been shown to be a waste of taxpayer dollars,” NTEU President Colleen Kelley wrote in a letter to senators. “The Treasury secretary currently has the authority, but has chosen not to enter into such contracts.”

She added the commission-based payment incentive led to abuse of the system, and a disproportional focus on low-income taxpayers. The IRS, she said, has the unique ability to postpone, extend or suspend collection activities for limited periods of time; make available certain flexible payment schedules; and make certain compromise offers, including reducing the total amount owed by the delinquent taxpayer.

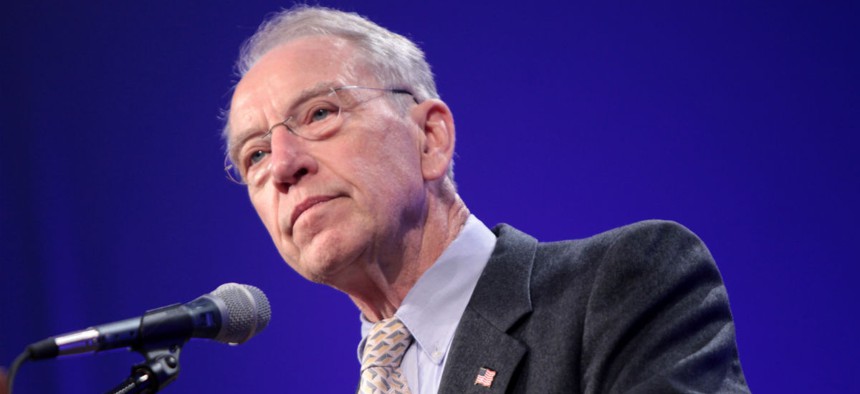

Sen. Chuck Grassley, R-Iowa, a longtime proponent of privatizing tax collection, said it was “hard to see the logic” of NTEU’s opposition.

“The IRS just had one of the worst filing seasons for customer service on record,” Grassley said, citing a recent report from the National Taxpayer Advocate. “The IRS hung up on callers because it couldn’t handle the calls. The private contractors would take on accounts involving taxes that are due and owed that are just sitting dormant right now.”

Nina Olson, the National Taxpayer Advocate, has said the IRS answered just four in 10 calls to the agency in the latest tax season, a ratio she had not seen in her 40 years in tax issues.

Olson, NTEU, IRS Commissioner John Koskinen and even President Obama, however, have cited the dramatic budget cuts at the agency as the impetus for the poor customer service. The agency’s annual spending has been slashed by $1.2 billion since 2010 and it is operating with 18,000 fewer employees. Call center staff alone has been cut by 26 percent. Olson has said the only solution to the “phone problem” was more employees.

The Treasury Inspector General for Tax Administration found in a 2013 report the revenue collected by the IRS from tax enforcement dipped 13 percent between 2010 and 2012. In that time, the IRS shed 5,000 front-line enforcement personnel.

“The real scandal around the IRS is that they have been so poorly funded that they cannot go after these folks who are deliberately avoiding tax payments,” Obama said in an appearance on The Daily Show with Jon Stewart Tuesday evening.

Grassley was less willing to cite the budget cuts as an excuse.

“The IRS isn’t even pursuing [tax debts],” Grassley said. “It seems unlikely to do so any time soon when it has trouble answering the phone from people who are trying to pay their taxes.”

Things are not likely to get better for the IRS; an appropriations bill approved by a Senate subcommittee Wednesday would cut spending at the agency in fiscal 2016 by $470 million compared to the current fiscal year, and by $1.8 billion -- or 15 percent -- compared to the agency's request. The House version of the bill goes even further, funding the agency at $838 million below the fiscal 2015 spending level and $2.8 billion below the White House’s budget.

House appropriators called the funding level a punishment for the “underperforming” agency.

The highway bill containing the privatization language hit a snag in the Senate on Tuesday, failing to reach a filibuster-proof majority. McConnell vowed on Wednesday to bring the measure back for another vote.

(Image via Flickr user Gage Skidmore)