New Numbers Show Decline in IRS' Phone Service

Taxpayer advocate and commissioner fear impact on citizen compliance.

Fresh numbers tracking call volume at beleaguered Internal Revenue Service help centers appear to confirm warnings from the tax agency’s leaders and its main employee union that budget cuts are making life miserable for callers as well as staffers as the April 15 filing deadline approaches.

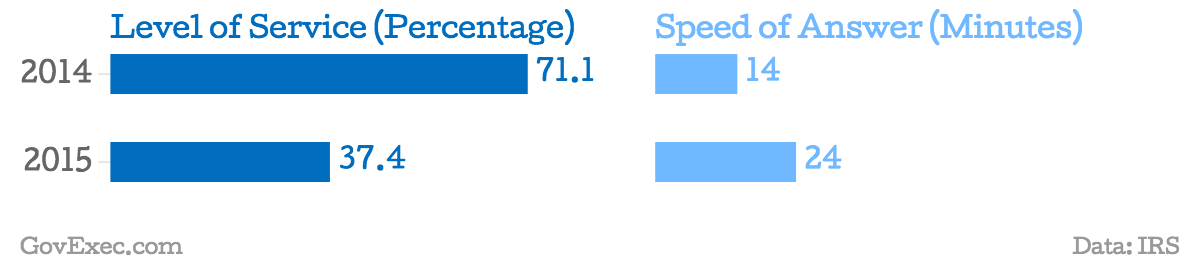

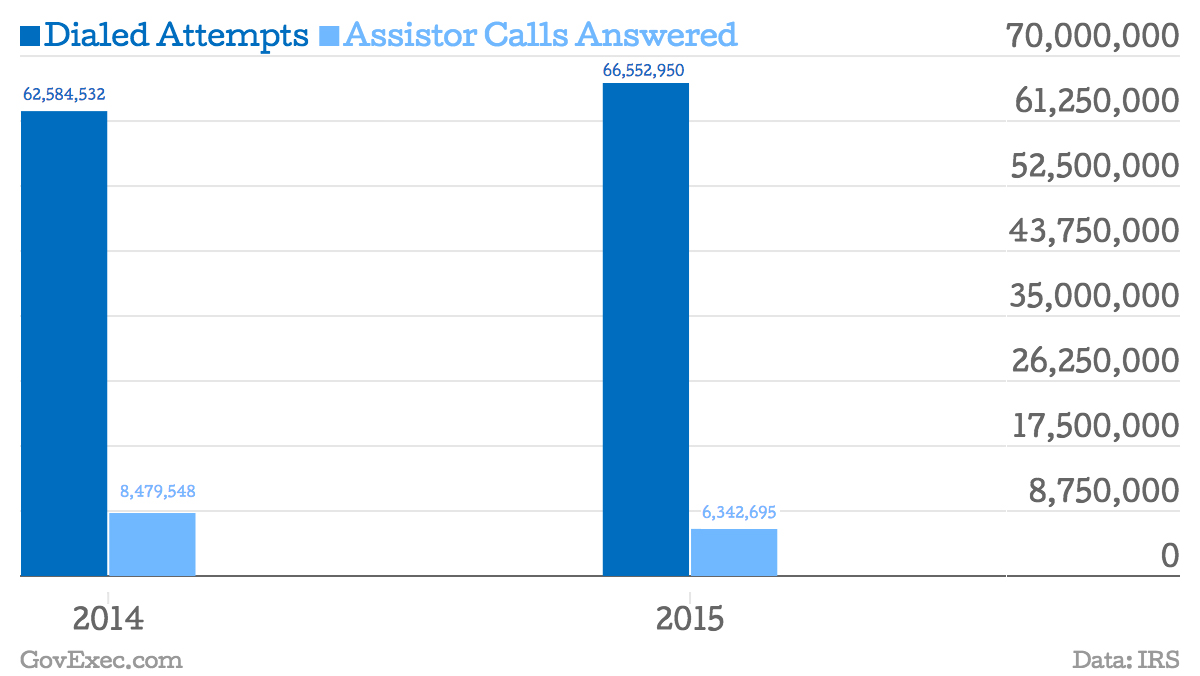

Internal IRS performance data released at the Urban-Brookings Tax Policy Center Wednesday by the National Taxpayer Advocate showed that as of April 6, attempts by taxpayers to dial call centers rose to 66.5 million—up 4 million over last year at the same time. About 6.3 million of those calls were answered. The agency computed a “level of service” of 37.4 percent, down 33.7 percent from last year. (The level of service looks at a smaller subset of several types of calls than the overall dials.) Average wait times rose 10 minutes.

Numbers released Thursday by the IRS itself showed that the service has processed 96.9 million returns as of April 4, about 1.2 million fewer than the 98.1 million at a comparable time last year. The number of visits to the IRS website—a practice the agency encourages—rose from 234.5 million in 2014 to 262 million so far in 2015, a rise of 11.7 percent.

“We’re a can-do agency, and will play the hand we’re dealt and do the best we can,” Internal Revenue Commissioner John Koskinen said at a panel discussion on how Congress’ five years of agency budget cuts have affected the IRS and taxpayers. “But I’m extremely concerned that cracks are beginning to show.” Call centers are operating with 3,000 fewer people, which puts the agency’s goal of 80 percent responsiveness to callers out of reach. “I’ve traveled to 37 offices and met with 13,000 employees,” Koskinen added. “None complain that they’re underpaid, but they complain that there are not enough people to answer the phones, and the reason they work is for the satisfaction of giving people answers.”

Nina Olson, the National Taxpayer Advocate, said, “In 40 years at this, I’ve never seen anything like this filing season on the phones, with only four of 10 calls being answered.” Only 25 percent of taxpayers who call for assistance are getting through to a live person, after a 22 minute wait, she reported. And the number of so-called “courtesy disconnects,” in which a caller is immediately told via a recording that they should try again later is seven times that of last year.

“These numbers mask the taxpayers’ real experience,“ Olson said, noting that many callers simply want to fix some switched digits in their Social Security number on their submitted form, report that they can’t file because they’re sick, or arrange to pay overdue taxes on an installment plan. While they can’t get through, however, “the IRS is automated and already attaching their wages,” she said. “These taxpayers can’t get through to say, ‘I can’t pay my basic living expenses, food and housing.’ That’s the power the IRS has, and to the taxpayer it looks illegitimate.”

Olson said as a tax administrator, she can see the “downstream consequences” of the fruitless calls, which create a need for an IRS agent and Taxpayer Advocate Service staffer later on to resolve the issue. “There is no answer to the phone problem but more human beings—it can’t be solved online,” she said.

The IRS is the “most powerful creditor in the country,” and many taxpayers only interact with its staff under negative circumstances, she said. As the agency moves away from the ability of taxpayers to “talk to it and for us to hear them, the more arbitrary and capricious it seems,” she said. The perceived “illegitimate use of power will drive compliance down as government sends a message that we’re busy and can’t talk to you,” she said. “It’s the biggest crisis in tax administration.”

The charts below show how IRS' level of service, call volume and wait times have changed: