piotr_pabijan / Shutterstock.com

Another Chance for Health Plan Changes

An unusual limited opportunity to switch to a new type of FEHBP coverage.

Except under certain defined circumstances, such as marriage or the birth of a child, you’re ordinarily not allowed to change your Federal Employee Health Benefits Program coverage outside of the annual open enrollment period. But this year, until the end of February, you may have such an opportunity.

It’s all because of the new self plus one option that became available in 2016. The Office of Personnel Management has created a window to allow federal employees who are participating in premium conversion (the pre-tax deduction of health premiums from their paychecks) to change enrollment from self and family coverage to self plus one. (Since federal retirees do not participate in premium conversion, they can downsize their FEHBP coverage from self and family to self plus one or from self plus one to self only at any time.)

Many employees already have made the switch to self plus one when they had the opportunity to do so during last fall’s open season. But if you missed out, it’s not too late. This is the first time in FEHBP history there has been an enrollment option other than self only or self and family.

The self plus one option was intended to provide savings for a family of two people. But for some FEHBP plans, there won’t be much difference in the cost of coverage -- and in a few cases, the new enrollment option actually is more expensive than self and family coverage. That might seem strange, but keep in mind that some FEHBP plans are more attractive to older retired couples who may have multiple chronic health problems and may also be filling expensive prescriptions on a monthly basis. Such expenses are factored in to the pricing of each option of every federal health plan. Plans that enroll those with significant health issues may have higher premiums than those that focus on preventative care or include more enrollees who are in good health.

The cost of a health plan is not necessarily a sign of its quality, but it could be an indication of the health of the enrollees who have chosen that plan. As the National Active and Retired Federal Employees Association recently reported:

As higher-cost options lose healthier enrollees and keep less healthy ones, higher claims for these plans cause premiums to rise. Such a system can precipitate “a race to the bottom,” or what economists call adverse selection, where workers and annuitants are limited to plans with less coverage and smaller provider networks. However, the “Fair Share” formula’s 75 percent cap on the government contribution toward any premium provides an important check against this race to the bottom. Absent the cap, the enrollee share of FEHBP premiums could be zero if enrollees select the lowest cost plans, giving enrollees a “premium-free” option.

Some federal employees may worry that moving from self and family to self plus one could end up costing them more out of pocket due to changes in deductibles and catastrophic protection limits. Savings in premiums don’t always result in overall savings once out of pocket health care expenses are factored in. But I haven’t found any differences yet in deductibles or catastrophic protection limits between self and family and self plus one plans.

For example, under the Blue Cross and Blue Shield Standard Option, the 2016 deductible is $350 per person. Under self plus one enrollment, both family members must meet the individual deductible. Under self and family, an individual can meet the deductible, or it can be satisfied when the total of family members’ deductibles reaches $700.

Check your individual plan brochure to see if this is the case for your FEHBP plan.

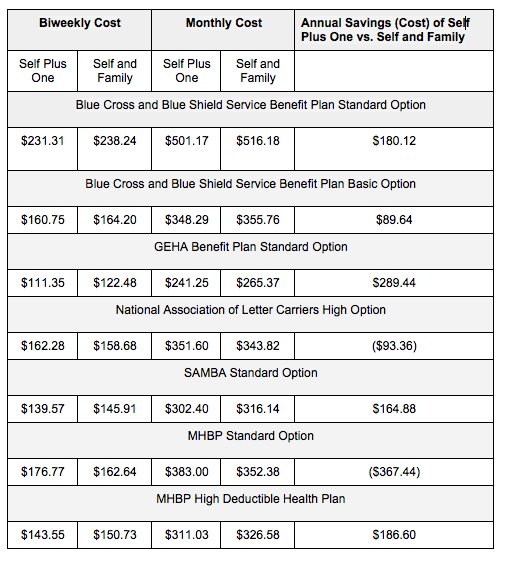

Here are a few examples of 2016 FEHBP plans, showing an overall comparison of self plus one and self and family coverage:

Until the end of February, all enrollment changes during the limited open enrollment period will be prospective to the first day of the first pay period following the one in which the change is requested. Contact your agency’s human resources office for more help and information if you’re interested in making the switch.

(Top image via piotr_pabijan / Shutterstock.com)