Flickr user Mount Rainier National Park

Shutdown Limbo, a Hearing on the Long-Term Care Premium Spike and More

A weekly roundup of pay and benefits news.

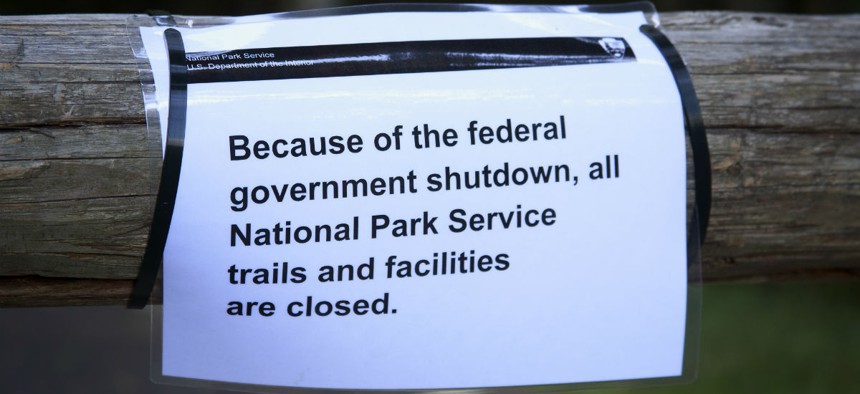

Federal employees are still waiting to find out whether the government will remain open after Oct. 1, and it looks like they will wait a bit longer. The Senate has been working on a deal for a short-term continuing resolution to fund agencies once the fiscal year ends and avoid a shutdown. But as of Wednesday afternoon, there was no final deal.

In better news, it appears that federal employees are slightly happier with their jobs this year than they were last year. The “global satisfaction index” based on results of the annual Federal Employee Viewpoint Survey increased 1 point, from 60 in 2015 to 61 this year, the Office of Personnel Management announced. Pay is one factor that goes into the index, along with feelings about individual jobs and the overall organization.

It’s safe to say many feds still are not happy with one aspect of their pay and benefits, however: a sharp spike in premiums for the Federal Long-Term Care Insurance Program. The rate increase -- which averages 83 percent, or $111 more per month, for enrollees who opt not to change their coverage – probably isn’t going to be reversed, unfortunately. But the silver lining is that it seems to have grabbed the attention of some lawmakers, and the House Oversight and Government Reform Committee tentatively plans to hold a hearing on the issue in November or December, during the lame duck session of Congress.

Federal employee advocates have also asked OPM to extend the Sept. 30 deadline for participants to decide whether they will endure the premium jumps or decrease their coverage levels. So far OPM has not announced any delay, so participants must still be prepared to make a decision soon. For those who might need help, Retirement Planning columnist Tammy Flanagan tackled the topic in August. Click here to read her column.

The federal Thrift Savings Plan is facing a challenge of its own. The 401(k)-style retirement plan is preparing for an influx of service members who will be auto-enrolled in the program starting in 2018, under a requirement in the fiscal 2016 National Defense Authorization Act.

The Federal Retirement Thrift Investment Board manages a program that has approximately 4.9 million participants, 730,000 of whom are service members, so it’s already big. Auto-enrolling service members could add between 260,000 and 270,000 new participants each year.

“This is a massive project,” said Tom Emswiler, senior adviser for the uniformed services in the agency’s Office of the Chief Operating Officer, during the board’s monthly meeting on Monday. “It might be the largest we’ve ever had before.”

So far, the blended retirement project is on track, said Emswiler during a presentation at the monthly meeting. The agency has issued a task order for a “capacity study” of its systems and business units to ensure they can absorb the additional participants and increased transactions without disruption. The board expects preliminary results from that study Nov. 1, and will perform whatever upgrades are necessary for a successful implementation based on that assessment.

Training for leaders on implementing the new blended retirement system for the military started June 1, with approximately 70,000 uniformed service members already trained, Emswiler said. Current service members who can opt into the system are scheduled to receive information and training in January 2017.

Finally, OPM has issued a memorandum to chief human capital officers and human resources directors on the Zika virus.

“As the Zika virus spreads into certain parts of the United States, we must remember that our federal workforce is our most valuable resource and take steps to minimize the impact of the Zika virus on our employees while continuing to ensure continuity of operations,” acting OPM Director Beth Cobert wrote in the memo. “Agencies are strongly encouraged to utilize all available human resources flexibilities, along with providing workplace accommodations, if appropriate, to support employees who have a significant risk of a severe outcome due to contracting the Zika virus—for example, female employees who are pregnant.”

More details on available workforce flexibilities can be found here.