Virginia Lawmakers Demand Answers on Long-Term Care Insurance Price Spike

Federal enrollees who do not change their coverage would end up paying $111 more per month on average for the insurance.

This story has been updated.

Some Virginia lawmakers want to know why premiums in the Federal Long-Term Care Insurance Program could skyrocket by as much as 126 percent beginning Nov. 1.

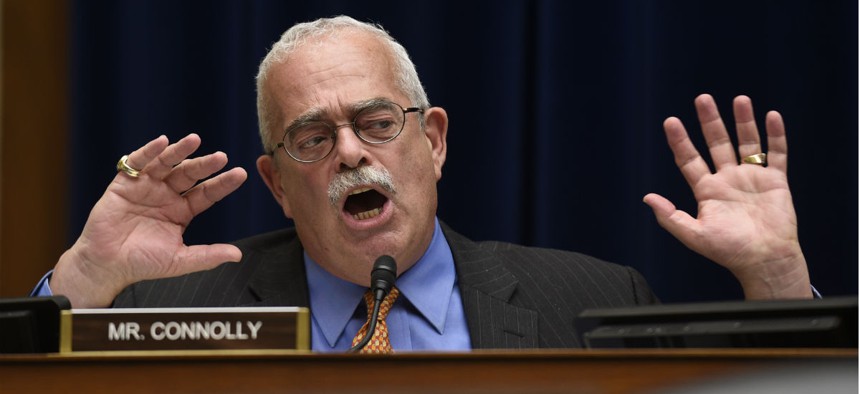

Democratic Reps. Don Beyer and Gerry Connolly – whose districts include many federal employees and retirees – are demanding answers from the Office of Personnel Management, which announced the upcoming significant increase last week. The rate increase, which will affect most enrollees, will vary widely between 0 percent and 126 percent, depending on an enrollee’s option under the Federal Long-Term Care Insurance Program. The average rate increase will be 83 percent, or $111 more per month, for enrollees who opt not to change their coverage.

“For those on a fixed or limited income, such an increase is simply unaffordable,” Beyer and Connolly wrote in a July 22 letter to acting OPM Director Beth Cobert. The lawmakers said that the significant jump in new premium rates, along with an average premium increase of 17 percent the last time the government awarded the FLTCIP contract in 2009, warranted “a reconsideration of how we structure FLTCIP so that price spikes at this extreme can be avoided.”

Feds and retirees with long-term care insurance have until Sept. 30 to make changes to their coverage, which Beyer and Connolly said was not enough time “for a purchasing population whose average age is 60. Medicare, by comparison, has a three-month enrollment period.”

OPM has notified enrollees about the new premiums through the mail, and feds can access the FLTCIP website to receive more information, view rates, and make coverage changes. But the Democratic lawmakers want to know what else OPM is doing to alert and educate enrollees, and seek information about how the premiums are calculated, and whether the agency and contractor plan to consider “graduated premiums without a dramatic decrease in coverage.”

The new, seven-year contract – announced in April -- retained John Hancock, which last received the contract in 2009. The insurance company was the only one to place a bid for the contract, which remained open for one year. OPM has to issue a new contract every seven years for the Federal Long-Term Care Insurance Program.

Critics of the sharp premium increases, including the National Active and Retired Federal Employees Association, said the change would force FLTCIP enrollees to make difficult choices: either pay significantly more for coverage, reduce their coverage, or drop it altogether. “I am stunned at the extent of the increase and angry that this type of financial pressure is being placed on federal employees and retirees,” said NARFE National President Richard G. Thissen, in a statement last week.

“It is of grave concern and urgency to our constituents to have answers before the decision period ends,” Beyer and Connolly told Cobert in the letter.

OPM said it had received the letter, and would respond to the lawmakers.

Of the approximately 274,000 current FLTCIP enrollees, about 10,000 will not be affected by the new premium increase. That group includes those who applied for coverage on or after new application rates went up on Aug. 1, 2015; enrollees who purchased FLTCI at age 80 or older; current enrollees in the FLTCIP’s alternative insurance program; and enrollees currently eligible for benefits or awaiting a decision on a pending claim.

NEXT STORY: OPM to Agencies: Let Feds Telework to Avoid Heat