Flickr user Mount Rainier National Park

Government Shutdown Could Have Helped Former HUD Employee Commit Fraud

A new audit of the department’s purchase card program reveals one of the ripple effects of furloughs.

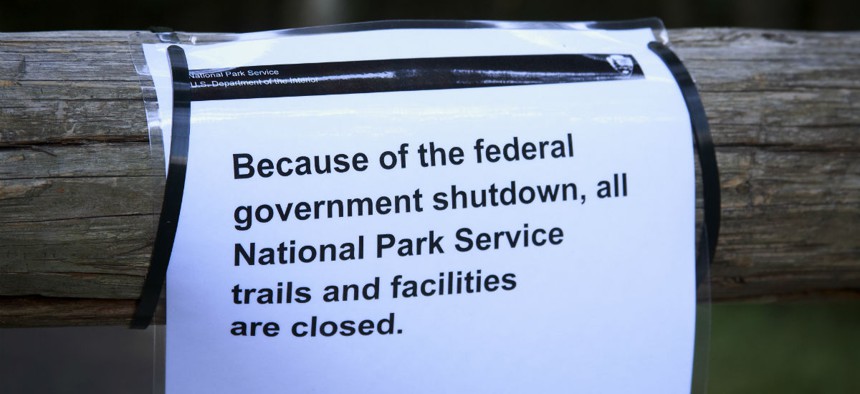

A new report from the Housing and Urban Development Department’s watchdog indicates that the 2013 government shutdown helped a former employee who misused his government charge card fly under the radar for a while because no one was around to notice red flags.

The former GS-12 support services specialist, who made nearly $12,000 in fraudulent purchases on his government charge card in 2013, was subsequently placed on administrative leave and the department’s inspector general recommended an indictment to the U.S. attorney for the Northern District of Georgia in 2014. HUD spokesman Jereon Brown said on Monday that the employee who made the unauthorized charges “is no longer with the department.” His last day in HUD’s Atlanta regional office was April 2, 2014.

But the incident, which is discussed as part of an overall audit of HUD’s government purchase card program, revealed what can happen when the government closes and few are left minding the store.

“The only violation identified was a single cardholder who was able to circumvent the controls by reporting his card being stolen and at least some of the transactions [were] occurring during the government shutdown when no HUD personnel were present to detect the violations,” said Keith Surber, HUD’s acting chief procurement officer, in a June 22 response to the July inspector general audit.

The IG concluded that the department’s purchase card program was well-managed overall, and that the reviewed transactions were properly documented and supported. The watchdog looked at 10,182 purchase card transactions totaling more than $3.3 million between April 1, 2013, and March 31, 2014.

But the watchdog also took HUD to task for failing to properly evaluate and report the fraudulent purchases which totaled $11,938 between August and October 2013. The illegal purchases included $7,357 spent at grocery stores and supermarkets; $1,280 spent at drug stores and pharmacies; and $488 for cable, satellite, and other pay television and radio services.

“HUD should not have waited for the results of the OIG investigation to determine whether the purchase card misuse constituted a significant weakness or not to report the violation,” the audit concluded. “Reporting violations as soon as HUD completes its evaluation would provide better transparency to OMB regarding weaknesses in HUD’s purchase card program.” Because of that decision, the violation and any other illegal charges that may have occurred during the reporting period were not included in two 2014 reports (semiannual joint purchase and integrated card violation reports) that HUD submitted to OMB, the watchdog found.

The watchdog recommended that HUD improve existing policies to “evaluate violations to determine whether they constitute a significant weakness in the design or operation of the purchase card program” as well as develop “specific criteria to determine which violations will be reported.”

The department agreed to the recommendation but disputed the IG’s view that it failed to take appropriate action regarding the 2013 fraudulent charges.

HUD said it reported the alleged violation to OMB in a January 31, 2014, quarterly report, and it “immediately” took actions to strengthen oversight, including blocking hundreds more merchant costs associated with hotels, Amazon.com and other vendors, reducing the number of purchase cardholders within the department, and issuing guidance to supervisors emphasizing their role in monitoring purchase card transactions.

Essentially, HUD and the IG disagreed over whether the agency or the watchdog can confirm alleged violations. “HUD has the authority and responsibility to independently determine whether a reportable violation occurred,” the audit stated. “It should work with OIG in cases that are referred and accepted to ensure that reporting will not interfere in an investigation.”

The General Services Administration oversees the purchase card program governmentwide through its SmartPay system, negotiating major contracts with national banks. The 2012 Charge Card Abuse Prevention Act aimed to strengthen oversight of agency purchasing cards.