Vlue/Shutterstock.com

When Do Most Americans Think They'll Actually Retire?

Workers would like to retire by 65, but only those making $100,000 or more expect that they'll do so.

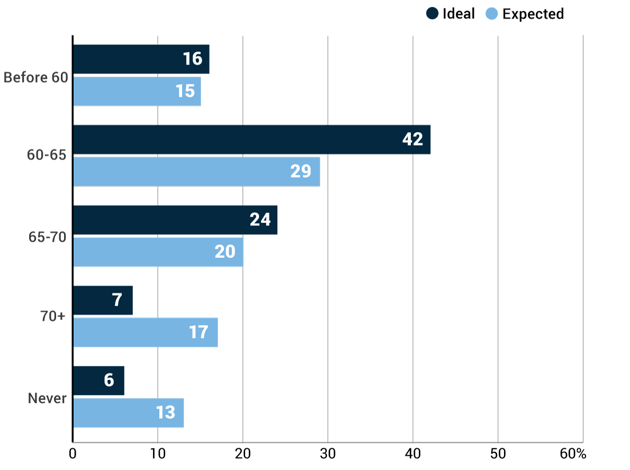

The ideal age to retire falls somewhere between the ages of 60 to 65, according to a new Allstate/National Journal Heartland Monitor Poll. Retiring then works best, poll respondents say, because it’s the sweet spot for both age and finances. People are young, healthy, and financially secure enough to enjoy their time.

“You’ve got at least 20 good years after that to pursue whatever else would make you happy,” says Barbara Arganbright, 60, of Parma, New York, who plans to retire within the next five years.

But poll respondents split on the question of whether they’ll be able to get to a secure retirement. Only 29 percent of those surveyed expect to retire within that ideal 60-65 age range, and those differing expectations fall mostly along class lines, especially when it comes to education and income. Half of those who describe themselves as middle class and two-thirds of those in the upper class expect to retire at their ideal retirement age. About a third of those who identify in the lower or lower-middle class expect the same.

Retirement Age: Ideal vs. Expected

National Journal/Allstate Heartland Monitor Poll XXIII

Respondents making at least $100,000 a year were the biggest group who expected to retire in that 60-65 age range, while those making $30,000 or less were most likely to say that they might never retire. Similarly, 22 percent of those who describe themselves as lower class don’t expect to retire, a six- to 12-point gap among those who identified themselves in higher class groups.

More than half of college graduates between the ages of 18-39 expect to be able to retire on time, followed by college graduates aged 40-64 (49 percent) and those aged 18-39 without a college degree (45 percent).

There are also clear divisions within age brackets. Between 45 percent and 53 percent of those under the age of 50 feel optimistic that they’ll be able to retire between the ages of 60 and 65. Between the ages of 50-59, the expectation to retire when they hoped drops to 41 percent and to 29 percent for those who are at least 65 and not yet retired. “I haven’t saved enough, that’s why I predict my retirement will be far in the future,” says George Herson, 50, now a student for a master’s degree in computer science in Connecticut. “It’s good to be able to retire but if you don’t have the money, you can’t, it’s as simple as that.”

Overall, Millennials are much more optimistic than their Baby Boomer predecessors now nearing retirement. That’s partly because Millennials are under no illusions that they’ll be able to rely on any of the Social Security benefits they have paid into, but believe that they still have time to save up on their own. “I’m not going to rely on [Social Security],” says Elizabeth Childress, 25, of Richmond, Virginia. “I think there’s a lot of uncertainty and negativity around whether it will be available. It’s just not something I’m willing to put in the hands of someone else.”

Student-loan debt is one of the major clouds lingering over expectations on retirement. Of all respondents with student-loan debt, 46 percent agree that the 60-65 year window is ideal for retirement. But only 31 percent say they think that’s a realistic target for themselves.

“Every loan payment I make is money that’s not going toward retirement or any short-term savings either,” says Childress, who will be taking out loans for law school. “For my generation, so much of it is dependent on student loans and at what age people are able to move past paying off student loans and getting to saving for retirement. Most of my friends aren’t even thinking about retirement because their student-loan payments are so big that the idea of saving for something 45 years down the road just seems crazy to do at this point.”

(Image via Vlue/Shutterstock.com)