Prasit Rodphan/Shutterstock.com

The Economic Case Against Majoring in Fun Things

The burden of student debt is fairly uniform, but the burden of repaying it varies across disciplines.

For many, the reality of student debt doesn’t hit home until you make your first payment. Though you may have read your paperwork and done the math on how much monthly debt repayment will cost, in practice, paying the piper can come as a shock. The impact is, unsurprisingly, more acute for new grads at the bottom of the pay scale.

Standard loan repayment lasts about 10 years, but the burden of these monthly dues eases considerably the longer you’re out of school, since wages tend to rise with professional progress. While starting salaries vary by major, total student-loan debt doesn’t vary that much at all, leaving creative-writing majors with about as much debt as someone who majored in something more lucrative, such as finance. In 2012, average student-loan debt amounted to about $26,500 , according to the Department of Education’s National Postsecondary Student Aid Study.

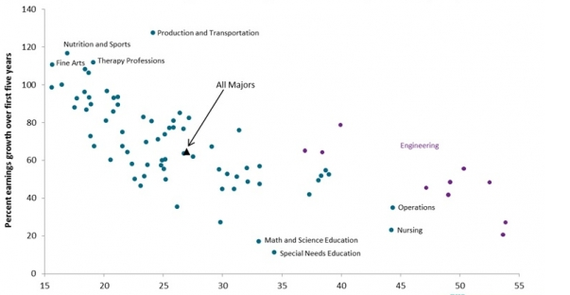

Earnings rise fairly rapidly within the first five years after college, increasing by about 65 percent across all majors, according to a new study by the Hamilton Project at the Brookings Institute. That’s good news, but for those who start on the lower-end of the pay scale, the relief that comes from increased pay isn’t fast enough.

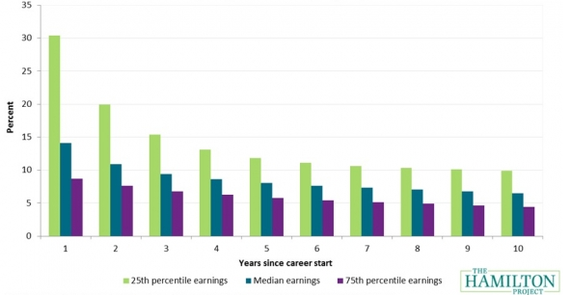

During the first year after graduation, a graduate with typical earnings, student debt and monthly loan repayments would put about 14.1 percent of their paycheck toward student loan debt, according to the report. But those figures vary largely by major.

Median Initial Earnings and Earnings Growth in Early Career, by Major

The Hamilton Project/American Community Surveys

Graduates with degrees in drama and theatre who have typical debt loads and earnings for the field spend nearly one-quarter of their first-year earnings on student loan repayment. Recent graduates who chose a field like energy-and-extraction engineering would spend only 7 percent of their paycheck on student-loan debt.

Percentage of Earnings Needed for Student-Loan Debt Payment, by Year Since Career Start

The Hamilton Project/American Community Surveys

The study points out a fundamental, but solvable, problem with the student-loan repayment system: timing mismatch. The study suggests that the more widespread use of fixed repayments, rather than payments that are income-based, can put significant strain on graduates in lower-earning fields during the beginning of their careers. "For borrowers with debt of $26,500—the typical or median amount—99 percent of graduates would qualify for the most generous income-based repayment plan in the first year of the career, 82 percent would in the fifth year, and 54 percent would in the tenth year," the study says.

Though they have a lower starting point for earnings, graduates in lower-paying fields also have a steeper increase in their earnings trajectory, with many seeing earnings that increase by 100 percent during the first five years after graduation.

( Image via Prasit Rodphan / Shutterstock.com )