Only 35% of Federal Employees Are Fully Prepared for Long Term Care Costs

With living expenses skyrocketing, many federal employees poised on the brink of retirement are less financially prepared than they would like to be. This is especially worrisome when placed in the context of long term care – while the majority of senior citizens will require some form of extended care, only 3 out of 10 federal employees have considered a plan for long term care; a quarter of people age 45 and over report being unequipped at present to handle the potential costs of care.

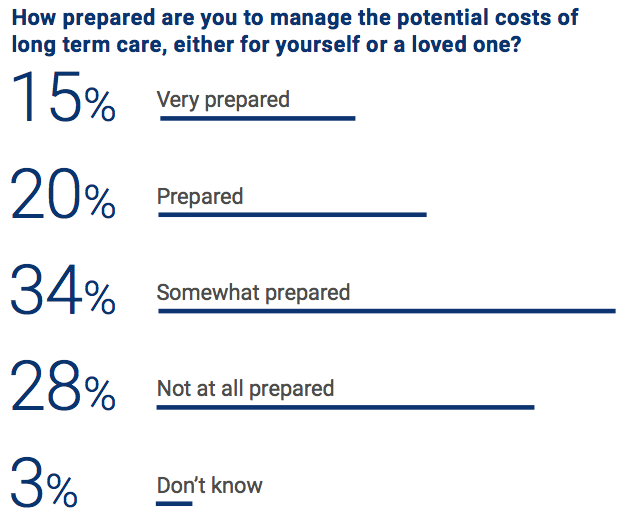

Continuing its series on federal attitudes toward long term care, Government Business Council sent out a flash poll on September 10 asking federal employees the following question:

190 employees representing more than 35 civilian and defense agencies responded to the poll. Only 35% of the respondents felt prepared or very prepared to manage the costs of long term care; 34% were somewhat prepared, and 28% were not at all prepared.

A successful long term care plan hinges on two steps: gauging the potential costs of care, and choosing a strategy for covering these costs. Calculating and planning for the financial impact of care requires careful consideration of the multitude of options available – formal care in an assisted-living facility, for instance, comes with a different set of expenses than informal home care. And while many assume that health insurance, Medicare, or Medicaid will pay for health requirements, none of these programs are specifically designed to cover the full set of possible expenses long term care might entail. To help mitigate these costs, federal employees can also opt to apply for the Federal Long Term Care Insurance Program, a government benefit that provides chronic care insurance for enrollees and their family members.

Regardless of how they broach the topic, it is becoming increasingly unaffordable for federal employees to delay planning for long term care. By taking the time now to examine and account for all future possibilities, they can focus their retirement on making the most out of this next phase of life.

This post is written by Government Business Council; it is not written by and does not necessarily reflect the views of Government Executive Media Group's editorial staff. Portions of this content are made possible by our sponsor, Federal Long Term Care Partners. For more information, see our advertising guidelines.