sponsor content What's this?

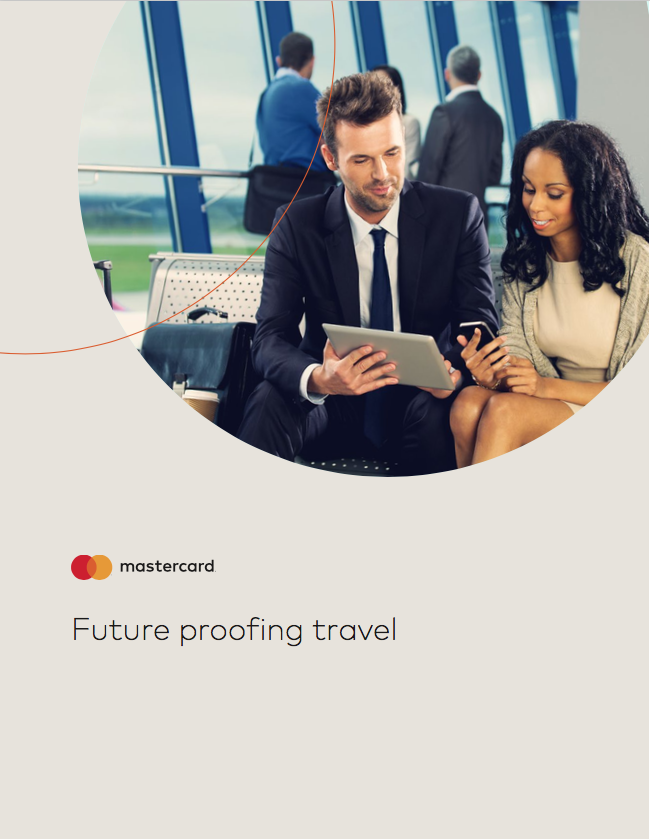

Future proofing travel

Presented by

Mastercard

Travel cards provide benefits to program coordinators and employees.

Over two million travel cards have been issued through the SmartPay 3 program and there were over 43 million transactions in 2016. Travel card programs provide efficiency, compliance and data to travel card managers. For employees, travel cards provide security, convenience and protection while they travel.

As agencies evaluate options for SmartPay 3, there are innovations on the horizon that benefit both travel card agency program coordinators and users. These benefits include new data mining tools, enhanced data, and digital payments – all of which are important capabilities to evaluate when selecting a network for a travel program.

New data mining tool helps to detect fraud, waste, and abuse.

New data mining tool helps to detect fraud, waste, and abuse.

Insights On Demand (IOD), exclusively for Mastercard, is an intuitive and easy-to-use data mining solution for SP3. It incorporates artificial intelligence and advanced statistical techniques to identify transactions with a high probability of fraud, misuse, and abuse. The tool scores 100 percent of transactions based on multiple identifiers, which add or subtract to the fraud and misuse confidence score. IOD also includes a powerful dashboard to provide graphical summaries of the data mining results. IOD can accommodate multiple data feeds (HR, Concur, SAP, etc.) and is delivered in a hosted, supported, and managed SaaS model.

|

Transaction Monitoring with IOD:

|

Enhanced data provides insights to drive efficiencies.

Mastercard’s Enhanced Data program is unparalleled in the payments industry. Our solution includes proprietary and patent pending components to deliver Level 3 or better data to an agency or organization’s travel card program. No other network provides an Enhanced Data program for travel to its customers to the same extent.

The Enhanced Data is transmitted into an agency or organization reporting and accounting system for expense reconciliation and management. The information helps an agency or organization understand all aspects of a purchase, driving compliance with policy and regulations. By selecting Mastercard as the network option for SmartPay 3, agencies and organizations will have access to the Enhanced Data capability for its travel program.

Using our solution, we capture and integrate details into Mastercard’s proprietary Global Data Repository from a wide range of third-party sources including:

- All major global distributions systems including Sabre, Travelport, Amadeus, and a host of independent airlines.

- More than 21,000 hotel properties including major hotel chains such as Hilton, Marriott (including Starwood), Hyatt, Carlson, Choice, InterContinental and Fairmont.

- Many travel agencies – Mastercard is constantly expanding our network of participating Travel Management Companies (TMCs).

With Mastercard Enhanced Data, agency and organization travel managers have a rich data set for each merchant type, providing the insights necessary to increase controls, reduce costs, and drive efficiencies.

Digital payments are providing new convenient and secure options.

Digital technologies are also changing the behavior of constantly connected consumers, businesses, and governments – transforming the way they interact and transact. As the digital evolution takes place, agencies should begin to prepare for new types of payments so they can continue to capture spend on cards. As more and more devices become connected, as much as 47 percent of all payments could be digital by 2025 – giving consumers, businesses, and government more possibilities when it comes to how they purchase goods and services. Through the new SP3 contract, agencies can have access to these innovative payment technologies and solutions. Examples of new payments opportunities already taking place in travel include:

Contactless.

Physical plastic cards can be complemented by existing mobile devices running iOS or Android OS, enabling a more convenient experience for the traveler. Using mobile devices for payments allows cardholders to tap their mobile devices on the merchant’s terminal to pay for goods and services. In New York City, for example, the transit system will begin to use this technology for travelers moving throughout the subway.

Merchants that currently accept contactless payments include major hotel chains, larger office retailers, airlines, restaurants, and many network (app-based) transportation companies.

In-App Payments.

Cardholders can also choose to buy goods or services through a merchant’s mobile phone application. Many popular apps already accept this payment method like network transportation companies.

They select a card from their digital wallet, check the transaction amount and enter the verification method associated with that card. The cardholder receives validation that the transaction was completed, and is more secure. The digital wallet then displays details of the completed transaction.

Mastercard is committed to providing safe and simplified travel experiences for your agency or organization through our travel cards, which are accepted at over 43 million locations worldwide. We provide secured convenience for the card user that also allows data to be captured – giving the organization visibility into spending, compliance and data for negotiations. Wherever you are heading, benefit from the innovation and resources that Mastercard provides you during your travels.

View a PDF version of this article here.

For more information or to request a demo on Mastercard SmartPay 3 solutions, please contact your Mastercard account representative.

This content is made possible by our sponsor. The editorial staff of Government Executive was not involved in its preparation.