sponsor content What's this?

Electronic accounts payable: Increasing compliance, control and security

Presented by

Mastercard

As the federal government approaches the digital transformation, Mastercard stands ready to discuss with agencies and organizations innovations available that may be applicable now or in the future to help you achieve card program growth objectives. Mastercard’s electronic accounts payable solution, In Control for Commercial Payments, provides the most robust controls helping you to gain efficiencies, ensure security, and increase refunds.

Electronic Accounts Payable (EAP)

Purchase cards have come a long way; they have helped streamline purchase-to-pay processes in most organizations in North America.1.

- Saved over $40 billion in transaction costs

- Improved order to receipt cycle time by 70 percent

- Created a new revenue stream with incentive rebates

- Provided better visibility into spending patterns

- Enabled higher supplier discounts

And now the use of EAP is growing fast, increasing by 33 percent between 2014 and 20152 as organizations leverage EAP solutions to automate, streamline, and make their payment processes more secure.

By leveraging their Enterprise Resource Planning (ERP) investments, leading best practice organizations have captured larger dollar accounts payable transactions by implementing EAP solutions, which has fueled their card payment program growth.

EAP growth projections indicate that accounts payable spending could eventually equal or surpass the amount of spending on plastic cards. This upward spend is likely to be most prominent in the areas of operating goods and supplies, inventory, computers, and software.3

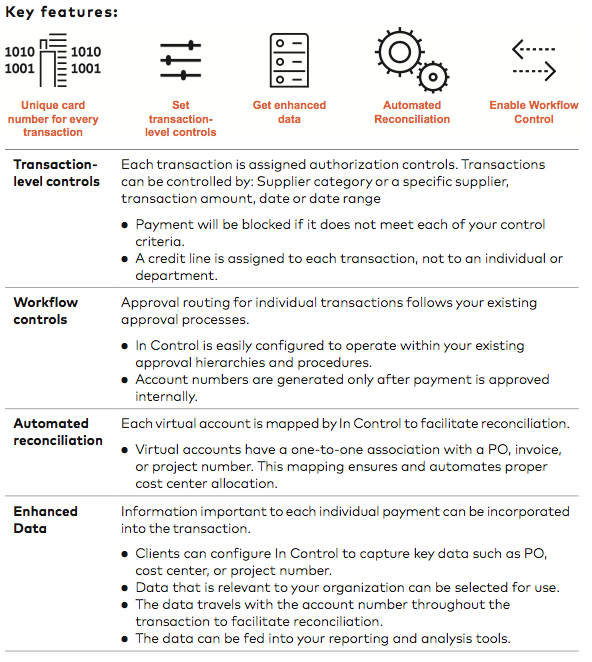

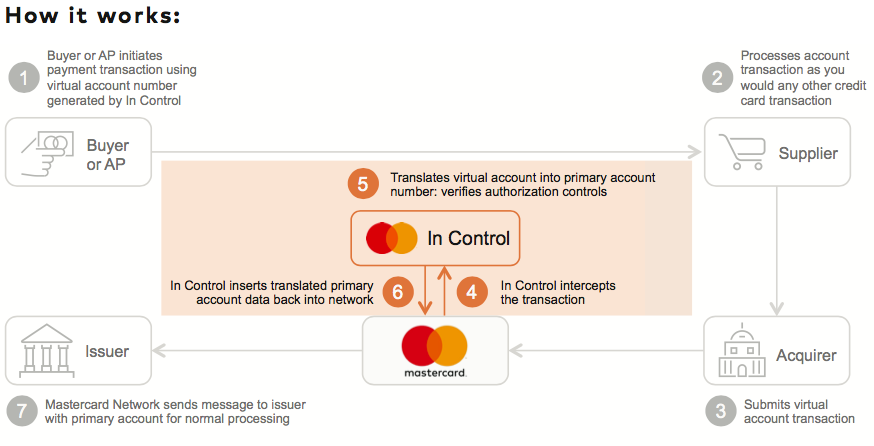

Mastercard Solution: Mastercard offers Mastercard In Control® for Commercial Payments (ICCP) as a virtual account solution. ICCP is an industry-leading solution that creates unique, dynamically generated virtual account numbers. ICCP helps make sending payments to suppliers flexible, easy, and secure.

Mastercard Solution: Mastercard offers Mastercard In Control® for Commercial Payments (ICCP) as a virtual account solution. ICCP is an industry-leading solution that creates unique, dynamically generated virtual account numbers. ICCP helps make sending payments to suppliers flexible, easy, and secure.

Government agencies and organizations can get the advantage, flexibility, security, visibility, and traceability of a single-use virtual-card number. A new number is generated for each transaction, providing each transaction a unique identifier. Other virtual card providers use a “store-and-rotate” process where a group of card numbers is reserved and rotated over time.

-

Truly virtual— there is no plastic card issued for these accounts.

-

Valid for a single use.

-

Only generated when needed and after proper approval is obtained.

-

Securely transmitted to the specific supplier at the proper time of payment.

-

Accepted and processed at any supplier around the world that accepts Mastercard.

-

Mapped to the appropriate primary billing account number for processing and accounting. (Suppliers never see the “real” primary account number.)

Benefits:

Improved control, compliance, and security enabling agencies to enhance efficiencies in strategic purchases and larger payments

- Ensures pre-purchase compliance with agency policy.

- Reduces exposure to fraud, misuse of funds, and non-compliant employee spending.

Simpler reconciliation and reporting, reducing the cost, time, and effort of reconciling payments and providing better analytics for supplier management and negotiation.

- Data capture and the association of a unique account number to a unique payment improve reconciliation and data analysis.

- Virtual accounts have a one-to-one association with a PO, billing event, or project number.

- Data capture reduces the reliance on suppliers to add data.

Increased accounts payable efficiency greatly reduces payment processing time and labor.

- Provides virtual accounts on demand. Electronic payments replace inefficient alternatives.

- Reduces paper-based accounts payable processes, which are labor and time intensive.

- Builds an e-payables program to reduce transaction processing workload for the client organization.

Improves suppliers’ Days Sales Outstanding and may increase refunds incentives.

- Gives agencies a tool to accelerate payments to suppliers and expands the benefits of your purchase card program.

- Suppliers get paid promptly, yet client financial settlement is on their purchase card schedule.

- Migration of payments to electronic cards may maximize incentive revenue.

EAP in action:

Payment of approved invoices:

A single-use virtual account number is generated upon invoice approval and is associated with the invoice number and securely transmitted to the supplier. The supplier processes the transaction as a normal card transaction, but never sees the actual funding account number.

High-dollar payment:

Expansion of card program into higher payment amounts can be done safely with virtual accounts and transaction-specific spending controls. And single-use accounts are assigned a credit line for the specific transaction amount, so they don’t tie up a larger portion of the organization’s credit line.

Vendor management systems orders:

Transactions such as temporary worker orders can be assigned a virtual account for each pre-approved resource request. The account number is mapped to the requisition number, individual worker, and cost center. It can be made valid only for the approved time period and is transmitted to the agency with the approved requisition.

Ad hoc payments:

A single use account number can be generated for ad hoc needs of employees who are not authorized for purchase cards. A record of the vendor is now electronic and can be used in card program data analysis.

The right partner for agency payments.

Mastercard’s In Control EAP solution simplifies your agency’s payments with increased efficiencies, enhanced controls, more security and better data. Our dedicated team is ready to make a difference for your agency

View a PDF version of this article here.

For more information or to request a demo on Mastercard SmartPay 3 solutions, please contact your Mastercard account representative.

Sources

1. RPMG 2017 Purchasing Card Benchmark Survey Results

2. RPMG Survey, EAP Study, 2015

3. RPMG 2015 EAP Study

This content is made possible by our sponsor. The editorial staff of Government Executive was not involved in its preparation.