sponsor content What's this?

Mastercard® Provides the Next Generation of Payment Solutions for the Federal Government Smartpay 3 Program

Presented by

Mastercard

On September 5, 2017, The U.S. General Services Administration (GSA) announced that Citibank, N.A. and U.S. Bank were awarded contracts for GSA SmartPay® 3, the next generation of the largest government charge card and payment solutions program in the world.

While SmartPay 3 will not go into effect until November 2018, agency leaders will start to evaluate their options for SmartPay 3 as they select between the two Issuers and the supporting network. As explained in the video, Charge Up: Choosing Your Brand, by GSA (General Services Administration) posted June 28, 2017, on YouTube, not all networks offer the same value and agency leaders need to know what to look for when selecting a valued partner.

This article examines the important choice the agency/organizations will make in selecting a network for SmartPay 3. With the current differences between the networks, selecting the right network is as important as selecting the right issuer. Mastercard is offered by both Issuers.

GSA has suggested that agency/organization leaders consider at least the following six areas when choosing a network, and Mastercard excels in each of them:

- Data Mining – Mastercard is the exclusive offeror of Insights On Demand™ (IOD) a commercially proven solution with 14+ years in the market and over $2 trillion analyzed annually.

- Customer Support – Mastercard will support SmartPay 3 with resources from implementation all the way through the life of the contract.

- International Acceptance – Mastercard offers unsurpassed acceptance at over 43M locations worldwide.

- Innovative Solutions – Mastercard is an innovation leader. Given that SmartPay 3 is a 13-year contract, it is important to select a network the can offer products to meet needs that arise over the next decade.

- Insurance Offerings – Mastercard provides insurance for each card type including Purchase, Travel, Fleet and Integrated cards.

- Tax Reclamation — Mastercard has partnered exclusively with a third-party tax provider, Ryan LLC, one of the largest transaction tax practice in North America, to deliver tax reclamation services for SmartPay 3.

1. Data Mining

Proven data mining solution helps to proactively monitor and avert fraud, waste and misuse and provide key insights for the card program. Through an exclusive partnership with Oversight Systems, Inc., Mastercard is offering agency/organizations a commercially proven data mining solution, Insights On Demand™ (IOD). Oversight has been in operation for 14 years and has been in the Federal space for a decade. IOD is a web based solution available to agency/organizations that select Mastercard as their network for SmartPay 3.

IOD is intuitive and easy to use. It incorporates artificial intelligence and advanced statistical techniques to help identify transactions with a high probability of fraud, misuse and abuse. The tool scores 100 percent of transactions based on multiple identifiers which add or subtract to the fraud/misuse confidence score. IOD also includes a powerful dashboard to provide graphical summaries of the data mining results. IOD can accommodate multiple data feeds (HR, Concur, SAP, etc.) and is delivered in a hosted, supported and managed SaaS model.

|

Transaction Monitoring with IOD:

|

IOD scores the transactions based on confidence and priority. We recommend working high priority transactions first as they have the largest impact. IOD makes it easy to review the transactions, communicate with the cardholders and create an audit trail that cannot be modified by end user. In fact, most clients find that IOD helps to decrease their workload over a short period. In the commercial space, IOD has allowed companies to work all transactions with less resources than they needed previously to review only a sample of transactions. This allows you to focus your resources on other tasks including those that are core to your Mission

Mastercard offered several presentations of the IOD data mining tool during the SmartPay 3 Master Contract Kick Off Conference held in Washington D.C., on September 21. Agency representatives in attendance were impressed with the capabilities of the tool and its ability to meet their agency data mining needs.

2. Customer Support

Mastercard has assigned extensive resources to SmartPay 3 to bring the right technologies and platform and to deliver powerful solutions. Mastercard showed a strong presence at the recent SmartPay 3 Master Contract Kick Off Conference on September 21 from executive Linda Kirkpatrick Executive Vice President, U.S. Market Development North America to the many Mastercard subject matter experts that were available to interact with agency representatives at the Welcome Center. Mastercard will continue to show a strong force throughout the contract. Mastercard will work in cooperation with the selected SmartPay 3 Issuer and the agency’s SmartPay 3 implementation and operations teams. Mastercard is committed to bring an outstanding level of customer support from implementation through the life of the contract.

Mastercard has assigned extensive resources to SmartPay 3 to bring the right technologies and platform and to deliver powerful solutions. Mastercard showed a strong presence at the recent SmartPay 3 Master Contract Kick Off Conference on September 21 from executive Linda Kirkpatrick Executive Vice President, U.S. Market Development North America to the many Mastercard subject matter experts that were available to interact with agency representatives at the Welcome Center. Mastercard will continue to show a strong force throughout the contract. Mastercard will work in cooperation with the selected SmartPay 3 Issuer and the agency’s SmartPay 3 implementation and operations teams. Mastercard is committed to bring an outstanding level of customer support from implementation through the life of the contract.

Mastercard’s customer support encompasses several key areas, each of which will drive program success.

- Network Implementation. With years of experience converting, implementing and integrating both public and commercial card programs, Mastercard will fully support the SmartPay 3 network implementation in partnership with the selected Issuer. The assigned Mastercard transition project manager will serve as the single point-of-contact to monitor the implementation end-to-end and consult, lead and coordinate Mastercard resources.

- Data Mining Implementation and Training. Implementation of the IOD Data Mining Solution will be led by an implementation manager from Oversight Systems, Inc. Oversight Systems, Inc. has implemented IOD with hundreds of commercial and government clients over the past 14 years, and follows a customized process to affect a smooth and successful implementation. Agency/organization IOD training will be conducted by Mastercard and Oversight in coordination with the Issuer training for the Electronic Access System.

- Ongoing Contract Customer Support. After the go-live date the implementation team will transition off and the operations teams will handle the ongoing operations at Mastercard for network-related activities and at Oversight for the IOD data mining tool. IOD support includes the help desk support as issue/questions related to IOD arise and quarterly training. Mastercard is fully committed to supporting the agency/organizations that select Mastercard as the network for SmartPay 3.

3. International Acceptance

Mastercard offers unsurpassed acceptance at over 43 million locations across the world. In addition, Mastercard is offering agency/organization customers Enhanced Travel data which provides above Level 3 data from more than 21,000 participating merchants. Mastercard has greater Fleet acceptance than any other network. Mastercard Fleet has a 92% Level III data.

4. Innovative Solutions

Innovation is at the heart of Mastercard’s 50-year history. Through our technology lab, Mastercard creates leading edge payment solutions that provide the marketplace with payment solutions that are fast, secure, effective and meet client’s business objectives. Mastercard can bring these forward-thinking solutions to clients including agency/organizations that select Mastercard for SmartPay 3.

Selected Mastercard offerings for SmartPay 3 include:

- Electronic Accounts Payable

Mastercard can offer Mastercard In Control® for Commercial Payments (ICCP) as a virtual account solution. ICCP is an industry-leading solution built to help streamline and automate payments. Unique, dynamically generated virtual account numbers help make sending payments to suppliers flexible, easy and secure.

Agency/organizations can get the advantage, flexibility, security, visibility and traceability of a single-use virtual-card number. A new number is generated for each transaction, providing each transaction a unique identifier. Other virtual cards use a “store-and-rotate” process where a group of card numbers is reserved and rotated over time.

|

Through ICCP, Mastercard offers:

Benefits of the Mastercard virtual card solution:

|

- Other Innovative Solutions That Could Eventually be Available Under SmartPay 3

The SmartPay 3 Master Contract includes a number of innovative solutions that agency/organizations may select as Tier 2 options. These innovations would be priced separately and included as additional costs under the contract. Mastercard stands ready to discuss with the Issuer and agency/organizations the innovations available that may be appropriate now or in the future. Examples of such innovations include:

- Mastercard Digital Enablement Services creates EMV-like security for digital payment transactions. The ubiquity of connected devices means that physical plastic cards can be replaced by connected mobile devices like phones and tablets, enabling a more convenient and secure experiences. Mastercard is at the forefront of building a foundation for securing these transactions through the Mastercard Digital Enablement Services (MDES). MDES allows for tokenization and digitization to create EMV-like security for digital payment transaction. Tokenization is the process of replacing a card’s primary account with a unique alternate card number, or “token.” Tokens can be used for mobile point-of-sale transactions, in-app purchases or online purchases. Tokenization helps reduce fraud related to digital payments by making transactions more secure by including a dynamic component with each transaction.

- Masterpass™ Digital Wallet. Masterpass is a digital wallet that can enable Cardholders to carry multiple cards in one wallet including different types of cards. With the Masterpass digital wallet, the individual could load multiple cards, such as an agency/organization’s GSA SmartPay 3 Purchase, Travel, Fleet and/or Integrated Card, and instantaneously choose the proper account for each transaction. Payments using Masterpass are now being made in the U.S. and more than 20 other countries. The “Buy with Masterpass” button is currently found on the websites and apps of more than 250,000 Merchants worldwide.

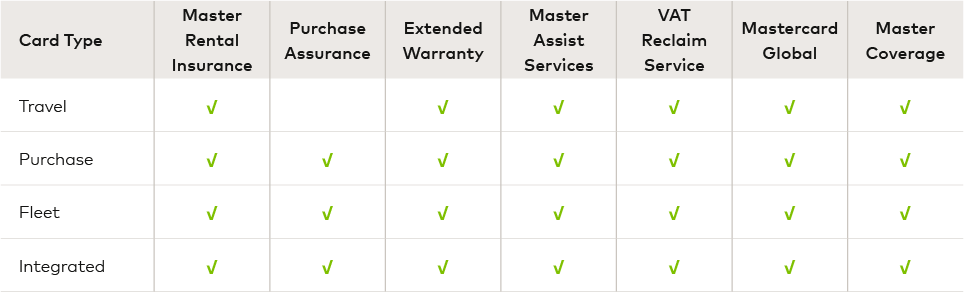

5. Insurance

Card Insurance protection extends to agencies

Mastercard sponsors insurance through the card Issuers that extends to the government agency/organization that authorizes each card and, where appropriate, to the cardholder. Insurance provided by Mastercard for each card type includes:

6. Tax Reclamation Services

Mastercard partners exclusively with Ryan LLC, one of North America’s largest transaction tax practice to deliver tax reclamation services for SmartPay 3. Mastercard has been providing tax reclamation services to the federal government for the past 18 years, recovering millions of dollars for various agencies.

Ryan has expertise in a full range of transaction taxes, including sales/use, hotel/motel, car rental, international value added and fuel excise taxes. Ryan also has extensive multi-state tax knowledge and leverages established working relationships with the individual States to facilitate the recovery of the agencies’ tax overpayments.

Mastercard's enhanced data, directly integrated into Ryan’s tax analysis system will streamline the tax reclamation processes, helping to enable a more timely payment to federal agencies while minimizing agency burden.

Mastercard: The Obvious Choice for GSA SmartPay 3

Mastercard is committed to supporting government agencies by bringing SmartPay 3 solutions that are built on decades of federal government expertise. Mastercard’s dedicated team of experts work with agencies on creating a payment strategy that works for the agency’s mission, connecting to an unsurpassed network of global suppliers and investing in technology that’s ready for the future — simple, safe and secure.

You have a choice in selecting your network and Mastercard would be honored to have your business.

View a PDF version of this article here.

For more information or to request a demo on Mastercard SmartPay 3 solutions, please contact your Mastercard account representative.

Mastercard and Mastercard In Control are registered trademarks, and Masterpass is a trademark, of Mastercard International Incorporated.

This content is made possible by our sponsor. The editorial staff of Government Executive was not involved in its preparation.